Stock market falters after 6-day run-up

MANILA, Philippines—The local stock market ended a six-day run-up on Wednesday as investors weighed the risks of a US debt default as a result of the political stalemate that has held up passage of the US federal budget alongside concerns about weaker global economic prospects cited by the International Monetary Fund.

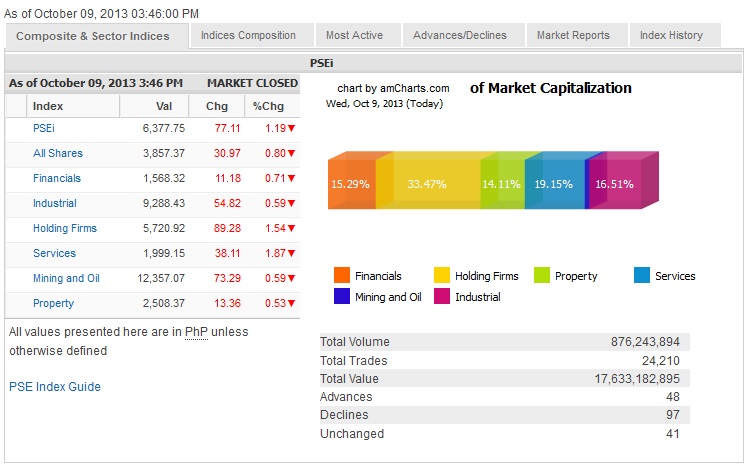

The main-share Philippine Stock Exchange index lost 77.11 points or 1.19 percent to close at 6,377.75, tracking the overnight slump on Wall Street. The battle over the US budget and debt ceiling is seen potentially leading to a default by the US government, which is now in the second week of a shutdown of some federal operations due to the failure of the US Congress to pass the budget.

All counters ended in the red but the biggest decline was posted by the holding firm (-1.54 percent) and services (-1.84 percent) counters.

There were 97 decliners against 48 advancers while 41 stocks were unchanged.

Turnover was heavy at P17.63 billion due to the cross of P12-billion shares in URC sold by the JG Summit group at P115 per share. This was part of its fund-raising to pay for the purchase of a 27-percent stake in Manila Electric Co. that was bought from SMC.

Article continues after this advertisementThere was net foreign selling worth P2.68 billion at the market.

Article continues after this advertisementThe day’s biggest index lagger was DMCI (-3.18 percent) which expects flat earnings for this year versus 2012, while AEV, AGI, SM Prime, Bloomberry and PLDT all declined by over 2 percent. MWC, SMIC, BDO and MPI also tumbled by over 1 percent.

Among the few PSEi gainers were Megaworld (+3.8 percent), RLC (+3.55 percent), JGS (+1.07 percent) and EDC (+0.87 percent).

Outside of PSEi stocks, Emperador (+4.33 percent) continued to gain in heavy volume.