T-bond rates mixed ahead of BSP meet

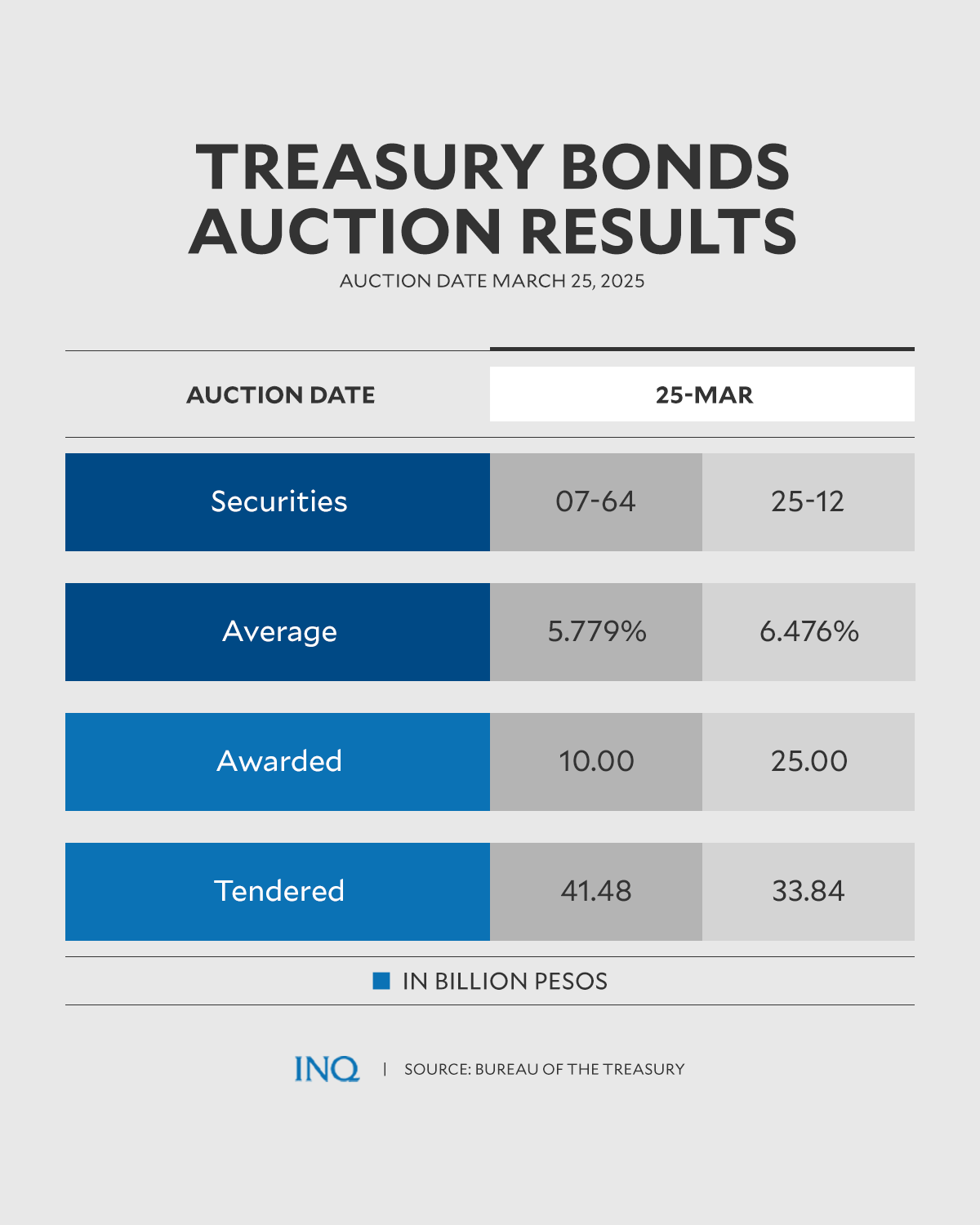

Results of the Treasury Bonds auction on Tuesday, March 25, 2025.

MANILA, Philippines – Yields on long-dated local debts of the government were mixed on Tuesday, but that did not stop the Marcos administration from borrowing its planned amount of Treasury bonds.

Auction results on Tuesday showed the BTr had raised a total of $10 billion via T-bonds, which had a remaining life of three years and 26 days.

The offering attracted P41.48 billion in total bids, exceeding the original size of the issuance by over four times.

READ: T-bond rates rise amid German fallout

The BTr later decided to accept P400 million in excess demand via its tap facility window, bringing the total proceeds from the T-bond sale to P10.4 billion.

The BTr said the T-bonds fetched an average rate of 5.779 percent, cheaper than the 5.894 percent seen during the last auction of 3-year debt paper nearly two months ago.

It was also lower than the 5.827 percent quoted for the comparable tenor in the secondary market.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said yields for the 3-year T-bonds went down after BSP Governor Eli Remolona Jr. dropped clearer hints of a quarter-point policy rate cut in April.

25-year paper

The Treasury also sold P25 billion in 25-year T-bonds yesterday, as planned.

Total tenders for the longer-dated debt paper amounted to P33.84 billion, bigger than the initial size of the issuance by 1.4 times.

But the government accepted much higher borrowing costs.

The average yield for the 25-year debt note stood at 6.476 percent, more expensive than the 6.334 percent seen during the previous auction of the same tenor last Jan. 28.

It was also higher than the 6.304 percent quoted for 25-year bonds in the secondary market.

“Shorter-dated tenors are more attractive for many investors compared to the longest tenors such as the 25-year due to higher market risks involved when holding [bonds with] much longer number of years and yields similar to the shorter-dated tenors,” RCBC’s Ricafort explained.

For this year, the Marcos administration plans to borrow P2.55 trillion from creditors at home and abroad to plug a projected budget hole amounting to P1.54 trillion, or equivalent to 5.3 percent of the country’s gross domestic product.

By sources of financing, the government will borrow P507.41 billion from foreign investors in 2025. The remaining P2.04 trillion is targeted to be raised domestically, of which P60 billion will be via short-dated Treasury bills and P1.98 trillion via T-bonds.