Start strong, finish stronger

(First of two parts)

The Philippine property market is starting to recover after reeling from the debilitating impacts of COVID-19 in 2020 and 2021. Rebound still varies across submarkets, but Colliers is optimistic that sustained macroeconomic growth as well as implementation of sound economic policies are likely to support the sector’s faster pace of recovery beyond 2024.

Office landlords should look at specific sub-locations that present development opportunities, including second and third tier cities, while focusing on occupants’ sustainability thrust. Residential developers should further explore the viability of launching resort-themed projects outside Metro Manila while mall operators should continue renovating and redeveloping spaces while curating activity center events. Hotel operators meanwhile should remain aggressive in launching homegrown or foreign brands whereas industrial locators should seize the demand from emerging industrial locators such as electric vehicles (EV).

Bolstered infrastructure to support property recovery

In our view, the completion of crucial public projects conceptualized and started during the Duterte administration is likely to further raise the competitiveness of the Philippine property landscape.

In Metro Manila and nearby cities in central and southern Luzon, among the projects likely to raise land and property values include the MRT-7, the New Manila International Airport, the Metro Manila Subway, and the North-South Commuter Railway.

The completion of transportation projects in key cities in Visayas and Mindanao such as Iloilo, Cebu, Bacolod, Davao, and Cagayan de Oro should entice more developers to landbank and launch more projects here. New residential, office, retail, leisure, and industrial projects outside Metro Manila should make the Philippine property landscape more interesting and competitive.

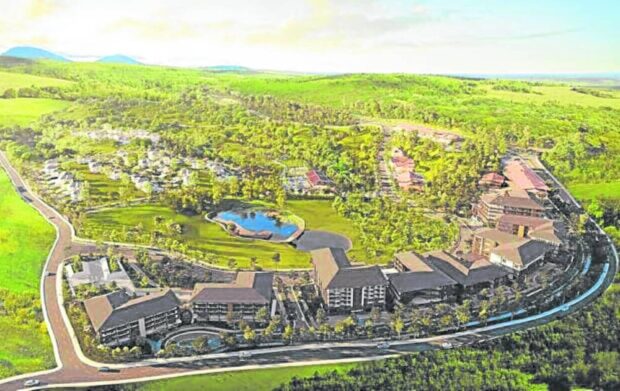

One trend that Colliers has seen over the past few years has been the development of more masterplanned communities and resort-themed projects in northern and southern Luzon.

Colliers attributes the attractiveness of these projects to the improvement of road networks from Metro Manila to property hubs in Luzon including Bulacan, Pampanga, Cavite, Laguna, and Batangas. These provinces no longer serve as mere suburban support to Metro Manila. In fact, developers have already carved out their own residential enclaves and business districts in key cities such as Angeles, San Fernando, and Porac in Pampanga; Marilao in Bulacan; as well as Kawit and Imus in Cavite.

RESIDENTIAL

Shift to horizontal from vertical

Colliers has observed steady demand for house-and-lot (H&L) and lot-only projects in key areas outside of Metro Manila. We believe that developers will continue to venture into horizontal residential projects outside the capital region where demand primarily comes from end-users.

Colliers has also been seeing the expansion of resort or leisure-themed projects outside Metro Manila, and we project the launch of similar projects as property firms cater to a rising demand from a discerning and affluent market. These projects were already popular before, but the pandemic only highlighted the need for such developments. Among the developers that have leisure-centric properties outside Metro Manila (Cebu, Davao, Bohol, Palawan and Batangas) include Rockwell Land, Megaworld, Ayala Land, Robinsons Land, Damosa Land and Cebu Landmasters.

More flexible payment terms

Colliers has observed that payment terms in the pre-selling market became flexible especially at the height of the pandemic in 2020 and 2021.

Mall operators and retailers should closely coordinate in curat- ing events that are usually held in malls’ activity centers.

With the onset of recovery in 2022, Colliers sees the continued implementation of attractive and flexible payment options to entice investors and end-users. Developers should continue offering affordable amortization and extended payment terms as well as innovative payment schemes, including discounts for spot cash buyers. Given the substantial completion in the market, property firms should continue offering rent-to-own (RTO) schemes especially for projects that are nearing turnover. We see RTO schemes becoming more prevalent in 2024.

Return of expats, but not Chinese

Colliers has seen a recovery of the leasing market in 2022. We partly attribute this to the easing of pandemic restrictions.

In our view, the return of more expatriates and local employees has been fueling the demand for condominium units for rent across Metro Manila. Colliers has seen Fort Bonifacio as one of the most preferred locations among expats due to the condominiums’ proximity to schools, hospitals, and retail establishments. Other popular options include Makati central business district, Ortigas Center, and Rockwell Center. To attract more expats, unit owners should consider renovating their condominium units, and highlight good brand and property management to attract discerning tenants.

New highs in luxury pricing

Colliers sees more luxury residential units being launched in the pre-selling market. We attribute this to rising land values, incorporation of upscale amenities, and surge in the prices of construction materials.

Colliers believes that more luxury projects are likely to be launched in the future. Recent launches are already at P670,000 to P760,000 per sqm. More partnerships with foreign brands are also likely to raise prices further. Colliers thus expects residential developers to provide upscale amenities and high-quality concierge services to potential investors.

OFWs to drive demand for affordable to lower mid-income units

Colliers recommends that developers closely monitor key residential markets including overseas Filipino workers (OFWs). This market has partly driven the demand particularly for affordable to lower mid-income condominium units (P2.5 million to P7 million per unit) within and outside Metro Manila as well as horizontal residential projects.

Developers should thus remain proactive in offering these units to households receiving remittances from their relatives working abroad. Latest data from the Bangko Sentral ng Pilipinas showed that the percentage of OFW households planning to allocate a portion of their remittances for the purchase of a property rose to 11.7 percent in the second quarter of 2023 from 8.1 percent a year ago. The deployment of more Filipinos for overseas employment and sustained rise in remittances should continue supporting residential demand across the country.

Joint ventures to thrive

Colliers sees the upscale to luxury segments (P12 million and above) likely remaining resilient despite rising interest and mortgage rates. In the first nine months of 2023, these segments accounted for 17 percent of total condominium take-up in Metro Manila, up from only 10 percent a year ago.

With the prevailing scarcity of developable land in Metro Manila coupled by the demand for luxury projects, Colliers sees more joint ventures between local property firms and foreign developers, including Japanese firms. In our view, these joint ventures should help local players differentiate their projects in the market.

Developers should also emphasize the JV projects’ upscale amenities, integrated development features, topnotch concierge services, and strong potential for capital appreciation, which are important considerations for discerning buyers.

RETAIL

Reactivation of activity centers to entice mallgoers

In our view, mall operators should maximize the consumers’ willingness to visit brick-and-mortar mall spaces and participate in various activities held in malls’ activity centers. Events such as wedding fairs, concerts, bazaars, and even housing summits can entice more consumers to visit malls, stay longer, and even spend more. Mall operators and retailers should closely coordinate in curating events that are usually held in malls’ activity centers.

Greater interest from foreign retailers

Colliers sees an improving demand for physical space from foreign retailers. We attribute this to improving consumer demand on the back of sustained macroeconomic expansion as well as enactment of measures that further relax the country’s retail regulatory environment. Mall operators should seize demand from foreign retailers planning to enter the country by taking into account their size and fit-out requirements.

Mall vacancy to rise in 2024

In the third quarter of 2023, vacancy across Metro Manila malls rose to 14.4 percent from 14 percent in the first quarter due to additional supply. Meanwhile, major developers have reported that revenues from malls grew between 30 percent and 40 percent year-on-year as of the first nine months of 2023 due to higher occupancy and rental charges. In 2024, Colliers expects vacancy to rise to about 17 percent as we project the delivery of about 385,900 sqm of new retail space.

Renovate or dissipate

Developers should use their renovation or expansion projects as an opportunity to expand food and beverage (F&B) tenants and upgrade other retail features such as cinemas and activity centers. Colliers recommends that developers use pockets of vacancies in their malls to house more lifestyle-oriented retailers to attract more consumers and balance the rising popularity of online shopping in the country.

Colliers observed steady de- mand for house-and-lot (H&L) and lot-only projects in key areas outside of Metro Manila.

In our view, redesigning of physical mall spaces should be complemented by the improvement of retailers’ online shopping platforms. We see a continued reconfiguration of physical mall spaces and we see this trend even after holiday-induced spending in the fourth quarter of 2023. (To be continued) Colliers sees more luxury residential units being launched in the pre-selling market. Mall operators and retailers should closely coordinate in curating events that are usually held in malls’ activity centers. Colliers has been seeing the expansion of resort or leisure- themed projects outside Metro Manila. Colliers observed steady demand for house-and-lot (H&L) and lot-only projects in key areas outside of Metro Manila. Colliers believes that more luxury projects are likely to be launched in the future.