Court: There’s no reason to stop Jeane Napoles tax evasion trial

Jeane Catherine Napoles. INQUIRER FILE

Action taken by the Bureau of Internal Revenue (BIR) concerning a Los Angeles City property is not enough basis to stop the tax evasion trial of the daughter of alleged pork barrel scam mastermind Janet Lim Napoles.

That is according to the Court of Tax Appeals that is hearing the case against Jeane Catherine Napoles for alleged failure to pay taxes on her Ritz Carlton condo unit in Los Angeles.

Thus, in a June 29 resolution released only this week, the CTA Third Division denied the motion of Jeane to quash criminal charges O-452 and O-453 filed against her for alleged tax evasion on the property.

Jeane argued the corpus delicti (facts and circumstances constituting a breach of law) of the case was extinguished after the BIR issued on Nov. 29, 2016, a preliminary assessment notice (PAN) imposing a tax on her controversial mother for the Ritz condo.

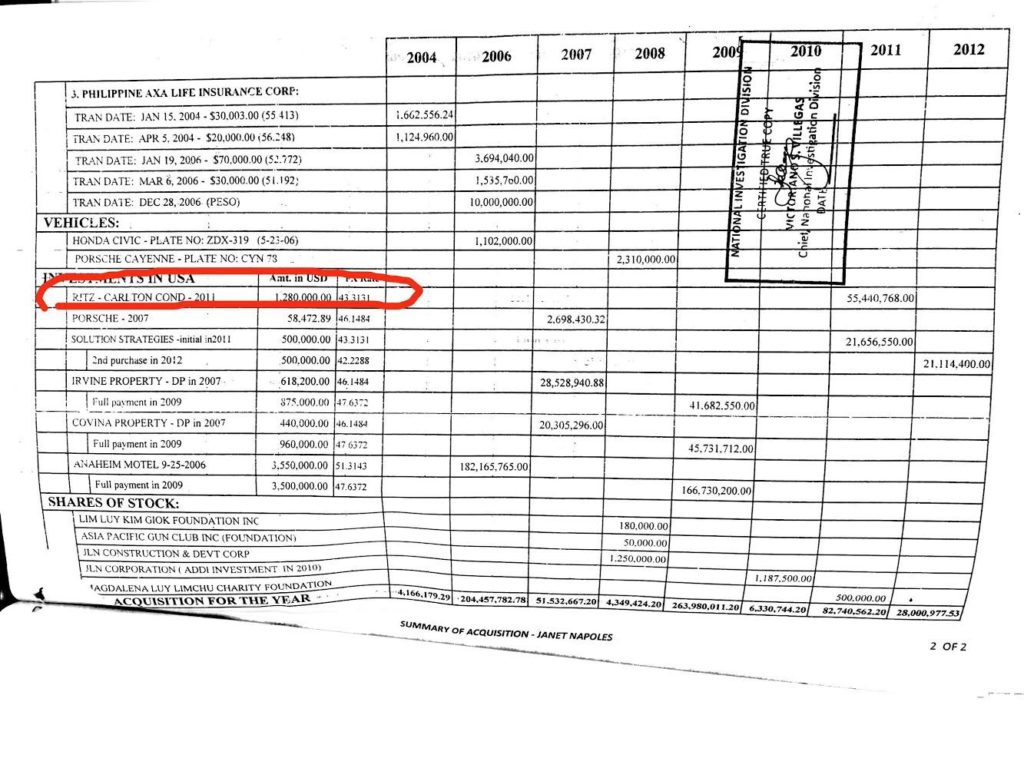

Jeane Catherine Napoles tried to invoke the Bureau of Internal Revenue’s Nov. 29, 2016, preliminary assessment notice, which counted her posh $1.2-million Ritz Carlton unit as a taxable property of her mother, Janet Lim-Napoles. The document was obtained by the Inquirer.

According to her, this jibed with her claim that she was just a student who had no taxable income and who only received the property as a gift from her parents.

The tax court acknowledged that the Ritz Carlton indeed fell under Investments in the USA section of Janet’s PAN. But, it said this sole argument was not a basis to stop her ongoing trial for tax evasion.

“The Court finds no justifiable reason to dismiss the case based merely on the PAN received by Janet Lim-Napoles,” read the three-page resolution.

“This does not go into whether accused failed to pay or paid less than the amount of taxes legally due; and whether the facts charged constitute an offense,” it explained.

While Jeane argued that the PAN signed by BIR Commissioner Caesar Dulay meant the ownership of the condo was being charged against her mother, the CTA said the prosecution’s allegations against her continue to be supported by documents.

“As provided in the Grant Deed… dated July 20, 2011, and the Property Profile, the Ritz Carlton condominium unit is under the name of accused,” the resolution read.

Associate Justice Lovell R. Bautista penned the resolution with the concurrence of Associate Justice Ma. Belen M. Ringpis-Liban. A check with the CTA division showed a motion for reconsideration has yet to be filed as of press time.

The June 2 motion to quash was not the first time Jeane tried to secure a favorable ruling by invoking the moves of the Duterte administration, which has floated the possibility of using her mother as a state witness to target politicians “overlooked” by the Aquino administration in the pork barrel scam.

Jeane had separately filed a petition for review questioning the BIR’s P40.03-million income tax assessment for the years 2011 and 2012 that served as basis for the tax evasion charges.

That civil case, numbered 9354, was dismissed by the CTA Second Division, after her lawyer Ian Encarnacion missed the Feb. 16 pretrial hearing.

Jeane sought the reopening of the civil case for a new trial partly by invoking the PAN issued by Dulay. The Second Division on June 21 denied the said motion, saying that since the case did not even reach the trial stage, it could not entertain the new piece of evidence.

Napoles was cast into the limelight after her lavish lifestyle was publicized during the height of the controversy faced by her mother, who allegedly facilitated the misuse of lawmakers’ Priority Development Assistance Fund allocations through bogus non-government organizations. CBB