Moody’s upgrades Greece credit rating, outlook stable

After a prolonged debt crisis, Greece is now out of “junk” territory.—CONTRIBUTED PHOTO

SAN FRANCISCO, United States — Ratings agency Moody’s on Friday upgraded Greece’s credit rating, pulling the country out of junk territory after its years of struggling to recover from a debt crisis.

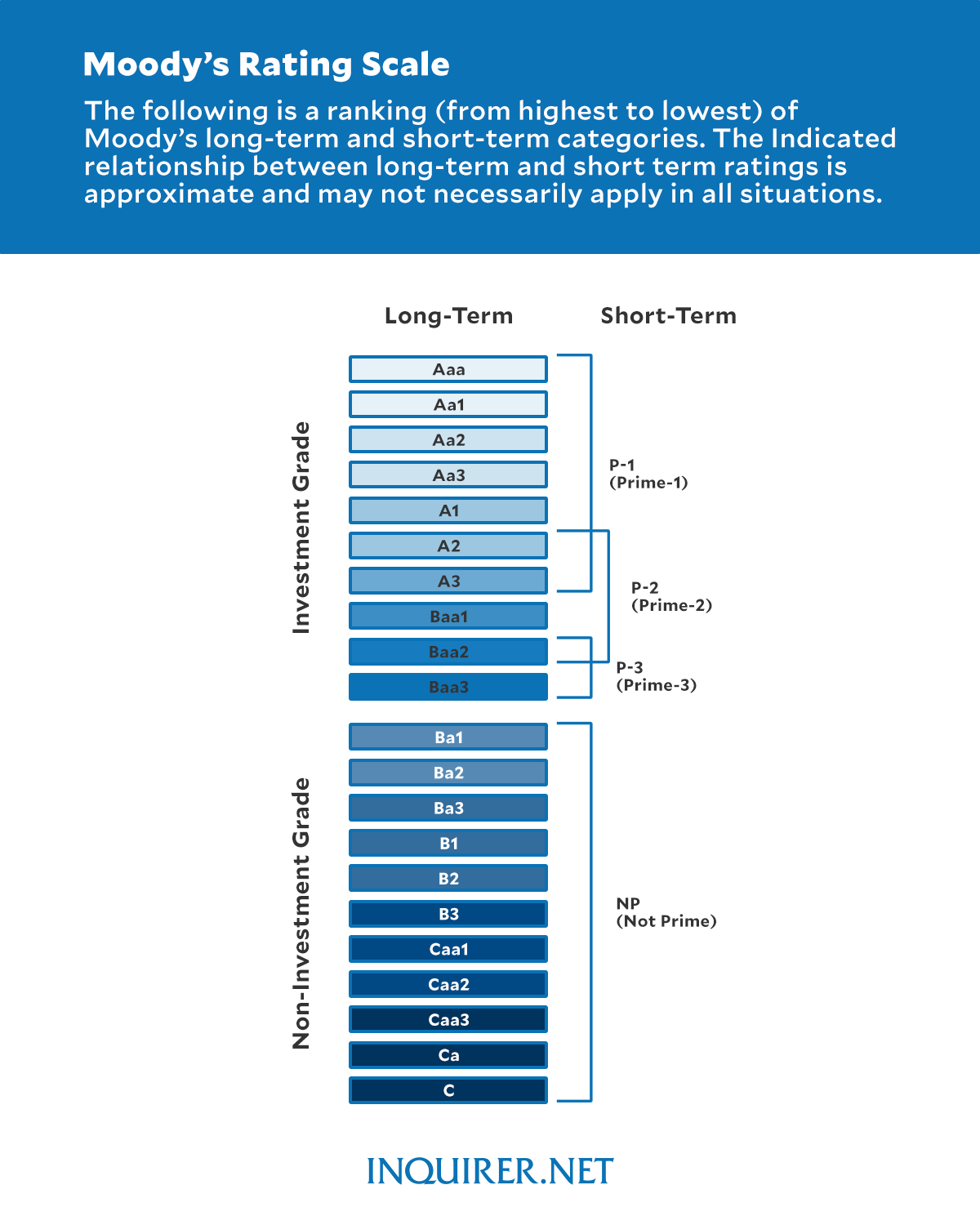

Along with the ratings elevation from Ba1 to Baa3, Moody’s changed its outlook for Greece from positive to stable.

The other two major ratings agencies, S&P and Fitch, elevated Greece out of junk territory last year, for the first time since 2010 and the country’s financial crisis.

“The upgrade reflects our view that Greece’s sovereign credit profile now has greater resilience to potential future shocks. The public finances have improved more quickly than we had expected,” Moody’s Ratings said in a statement.

“Based on the government’s policy stance, institutional improvements that are bearing fruit, and a stable political environment, we expect Greece to continue to run substantial primary surpluses which will steadily decrease its high debt burden.”

Moody’s also noted that the health of the European nation’s banking sector “continues to improve.”

The outlook was stable, not positive, because the agency said “economic structural reforms will take time” and also that “Greece’s main credit challenges will be slow to improve.”

Greece has registered improved economic growth in recent years (5.6 percent in 2022, 2 percent in 2023, and 2.3 percent in 2024) and is expecting 2.5 percent GDP growth this year, according to the country’s central bank.

READ: Greek economy on rebound but many still struggling

High food prices

But Greeks are still contending with high food prices and low salaries.

During a decade of economic crisis (2008-2018) when the public debt and deficit exploded, interest rates soared, leading the ratings agencies to progressively downgrade Greece’s credit rating.

With Athens on the brink of default, the Greek government got bailout cash of 289 billion euros from the European Union, World Bank and International Monetary Fund, to keep it from crashing out of the eurozone.

In exchange, the so-called “troika” demanded across-the-board reforms.

These included deep state spending and salary cuts, tax hikes, privatizations and other sweeping measures aimed at righting public finances.

READ: Greece to exit EU’s ‘enhanced surveillance’ framework after 12 years

The economy contracted by more than a quarter, unemployment spiked to almost 28 percent and skilled professionals emigrated in droves.

Greece emerged from the crisis in August 2018, after first seeing economic growth a year before.

Moody’s Rating Scale