Trailblazing CEO takes GCash to new heights

Written by: Tina Arceo-Dumlao

Taking over the helm of a multi-billion-peso company is challenging enough in the best of times, certainly even more so at the beginning of a raging pandemic that would cause an unprecedented public health and economic crises.

Such a prospect would have daunted other candidates from immediately embracing their new role of chief executive officer amid massive disruptions caused by the COVID-19 outbreak, but not Martha Sazon, who was appointed to the top post of Globe Fintech Innovations Inc. or Mynt, operator of fintech leader GCash, in April last year.

Mynt CEO Martha Sazon is acknowledged as trailblazer in her field

On the contrary, the telecommunications and marketing veteran with a Business Administration and Accounting degree from the University of the Philippines, eagerly took on her new responsibilities.

“It was like being handed a modern spaceship, with all the buttons waiting to be pressed,” said Sazon, who was promoted to President and CEO of Mynt after 12 years in Globe, where she led various businesses such as postpaid mobile, small and medium businesses and broadband. “I got excited with the host of opportunities and possibilities this presented!”, added Sazon.

Article continues after this advertisement

Sazon is eager to travel with her family as soon as the pandemic is over

Sazon was encouraged by the belief that GCash had great potential to make a profound difference in the lives of all Filipinos, especially those who had long been excluded from the banking and financial system.

Article continues after this advertisement

The lockdown has turned Sazon into a certified plantita

It took the COVID-19 pandemic to fully unleash that potential as the resulting lockdowns and mobility restrictions forced Filipinos, who have always preferred to use cash for their transactions, to migrate to financial technology tools such as GCash.

And once they got the taste of it, and realized that it was the easier and more practical option rather than going to the bank or paying their bills in physical branches, there was no going back to just using cold cash.

Evidence of that mindset shift was seen starting May last year when GCash recorded a 700-percent surge in transactions as demand for digital finance soared amid strict quarantine restrictions imposed to stem the spread of COVID-19.

By the end of 2020, GCash exceeded its own targets and hit a transaction value of over P1 trillion, with daily gross transaction value peaking at P7.5 billion and over six million transactions a day including cash-ins, payments and money transfers, making GCash the country’s top finance app.

Sazon told the Inquirer that conditions were set for GCash to break out. There was the pandemic that forced massive adoption and then the internal strength of the organization that had been preparing for the surge in GCash use for years.

“I came into a team that was very hardworking, doing anything and everything they can to increase adoption. The commitment and the grit were there. It is a fantastic team that is digitally savvy and dynamic. What I just added was the deep knowledge of the Filipino consumer, the rigor of a telco. Imagine that combination,” said Sazon.

Indeed, that enviable combination prepared GCash to absorb the surge in transactions and the demand to expand its portfolio of services to include investments, savings and online shopping, all while the team is operating under a hybrid setup that combines working from home and taking turns going to the office.

The unique circumstances, however, suited Sazon’s management style that she described as “transformational”, one that inspires the team to aim for greater accomplishments beyond their normal comfort zone and consistently raise the bar for achievements.

It’s agile, growth focused and entrepreneurial so that innovation and creative thinking can come out and not boxed in by routine.

“This stems from my purpose. My main ‘why’ is unlocking the potential in everyone. My personal focus is allowing people to realize their full potential going beyond their limits, especially for the people who matter to me,” Sazon stressed.

“The leaders are empowered to run their own units. I am really there more to just check and give guidance and offer help where needed. We also have weekly cadence meetings basically where we check the major issues and updates,” she added, “My expectation is for people to think. I tell them that I did not hire you to become a robot. You’re here to be a living human being. That is my main principle.”

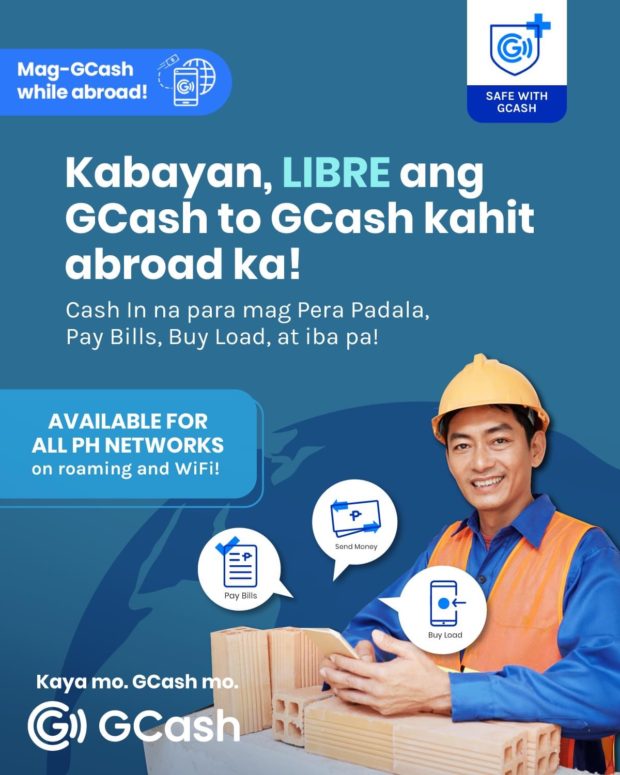

GCash continues to innovate by launching everyday solutions for Filipinos here and abroad

Her ability to stretch people’s abilities helped GCash make the migration to a more robust platform that could take in exponentially more transactions in the middle of a pandemic and executed entirely online and roll out new features such as GCash International, which allows Filipinos abroad to send money and pay bills using GCash as long as they have a Philippine SIM, and GLife to accommodate the digital lifestyle.

Sazon shares that she does not approach management from a single perspective. There are those who perform better when they are left alone but then there are those who need a bit more handholding. She can easily adjust her style depending on what will work best to meet a common objective.

“It’s important to figure out what their strengths are and leverage on that, rather than pound on their weaknesses,” she said.

“I try to provide opportunities to give people an equal shot at success or achieving their dreams and surprise even themselves (so that they can say “kaya ko pala gawin to”),” she said, “That’s why moving to fintech was an easy choice because I am given the opportunity to do the same for the Filipinos — helping them unlock their potential and achieve greater things beyond what they can imagine.”

Sazon recognizes that these are not the easiest times to work at full speed, given the mobility restrictions and lack of face-to-face interactions that instantly tune in people to what the others are feeling or thinking based on body language. Mental stress is at an all-time high and people can feel isolated.

Enabling the Mynt organization to cope with the pain of the pandemic is the knowledge that they are in a space where they can of real help to people.

“That sense of purpose is very strong in GCash, the vision of financial inclusion, of making people’s everyday lives better, no matter how small the difference is. That is inculcated in our hearts and minds,” she said, “At the end of the day, it’s all about value adding features to better empower our customers. That’s how simple it is for us.”

Read more Business stories:

Sun, sea and sands: Welcome to the hottest investment opportunity in Manila

Investing in the health of the Philippines

Family Farm Schools online benefit concert feat. Maestro Ryan Cayabyab and RC Singers