RCBC unveils financial inclusion ‘super app’

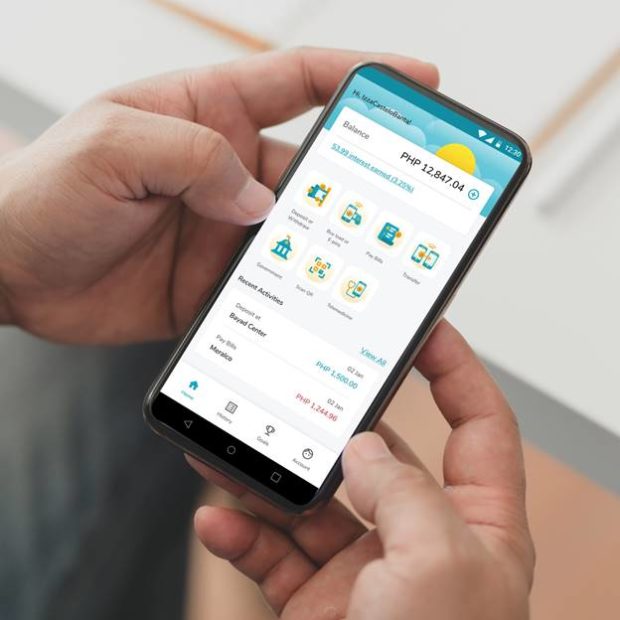

Yuchengco-led Rizal Commercial Banking Corp. (RCBC) has entered the mobile banking race with the launch of “DiskarTech,” touted as a financial inclusion “super app” that offers in sachet format vital services needed by “unserved” and “underserved” consumers.

“The change brought about by this new normal has challenged us to be even more relevant as we move forward in this new way of banking. DiskarTech will be our legacy to the young and tech-savvy Filipinos,” RCBC chair Helen Yuchengco-Dee said during the virtual launch of the digital banking platform on Wednesday.

Apart from deposit-taking, the app facilitates cardless automated teller machine (ATM) withdrawals as well as cash-out from thousands of agent partners nationwide, fund transfers, bills payments, purchase of airtime load and gaming pins, quick response (QR) code transfers and even telemedicine, or offsite medical consultation.

More services are expected to be introduced, including microinsurance and a marketplace for enterprising Filipinos.

“We accelerated the addition of features as they prove to be more necessary today. More responsive and more relevant than ever, finally, DiskarTech is here for every unbanked and underserved Filipino,” said Eugene Acevedo, RCBC president and chief executive officer.

DiskarTech allows users to quickly create their own basic deposit accounts through one-time registration via an electronic know-your-customer (eKYC) digital process. It does not require an initial amount or maintaining balance.

The interest rate on the deposit account is offered at 3.25 percent per annum.

A goal-oriented digital savings feature also allows users to set their life goals, reminding them when to top up their savings to meet such goals, like saving for a motorcycle downpayment, or a laptop or mobile phone purchase.

“Our aim has always been to scale consumer adoption by making DiskarTech simple. It talks to every ordinary consumer using Taglish, a language that is easy to understand and almost everyone uses comfortably,” said Lito Villanueva, RCBC executive vice president and chief innovation and inclusion officer.

Targeting the working class from the C, D and E income segments, Villanueva said in a press briefing that this would mark RCBC’s first initiative for a cloud-based core banking functionality.

The new app uses the backroom of parent bank RCBC itself but the bank is set to apply with the Bangko Sentral ng Pilipinas (BSP) for a rural bank license for a digital-centric banking business model, under which Diskartech will be folded into, Villanueva said.

“DiskarTech is an app that exemplifies innovation and collaboration. Our digital finance ecosystem must be inclusive to ensure that no one is left behind. We must leverage on this momentum to drive technology-driven financial inclusion not only by promoting use of digital financial services but also increasing consumer trust and confidence. And this is what, I believe, DiskarTech, can do,” Bangko Sentral ng Pilipinas Governor Benjamin Diokno said in his keynote address during the launch.

Diokno noted that at least half of retail payment transactions would shift to digital channels in three years. He aims to see 70 percent of adult Filipinos having and using a transaction account by the end of his term in 2023.

“The DTI (Department of Trade and Industry) fully supports DiskarTech as a pioneering app as it is fully aligned with President Rodrigo Duterte’s 10-point socio-economic agenda by helping more than 1.3 million sari-sari stores and market vendors in over 42,000 barangays nationwide,” said Trade Secretary Ramon Lopez.

“DiskarTech’s complete suite of digital financial services will benefit our micro, small and medium enterprises. DTI will promote DiskarTech through training programs across DTI’s more than 1,000 Negosyo Centers nationwide,” said Lopez.