Optimism still reigns in PH

Two years after the Duterte administration’s rise to power, the centerpiece “Build, Build, Build” program is taking root, certainly not without hitches, but enough to maintain optimism that the Philippines could finally be on its way to a golden age of infrastructure.

Another key Duterte legacy seen to benefit generations to come is an overhaul of the country’s taxation system, designed to put in place a more equitable and progressive system that will ultimately help the poor.

But because the first phase of the tax reform program took effect when global commodity prices were on the rise, this structural reform took some of the blame for the faster-than-expected surge in the prices of basic commodities.

This, in turn, has gnawed on Mr. Duterte’s popularity in a way that loud criticisms of the bloody all-out war against drugs did not.

Nonetheless, businessmen and economists are looking forward to Mr. Duterte’s use of his massive political capital to pursue in his next four years in office more structural changes, particularly the liberalization of foreign investments and the further overhaul of what is described as an antiquated tax system.

His ardent desire to shift to a federal form of government, however, is one bone of fierce contention, a proposed reform that most Filipinos currently don’t believe is necessary.

There are other proposed reforms seen deserving of more attention, to cash in on the country’s enviable macroeconomic indicators.

For many years, the Philippines has been in the so-called sweet spot, with economic growth trending higher amid benign inflation rates and against a backdrop of a young and growing workforce.

Mr. Duterte also inherited a sovereign investment grade rating, which lowers the cost of borrowings for both the government and the private sector.

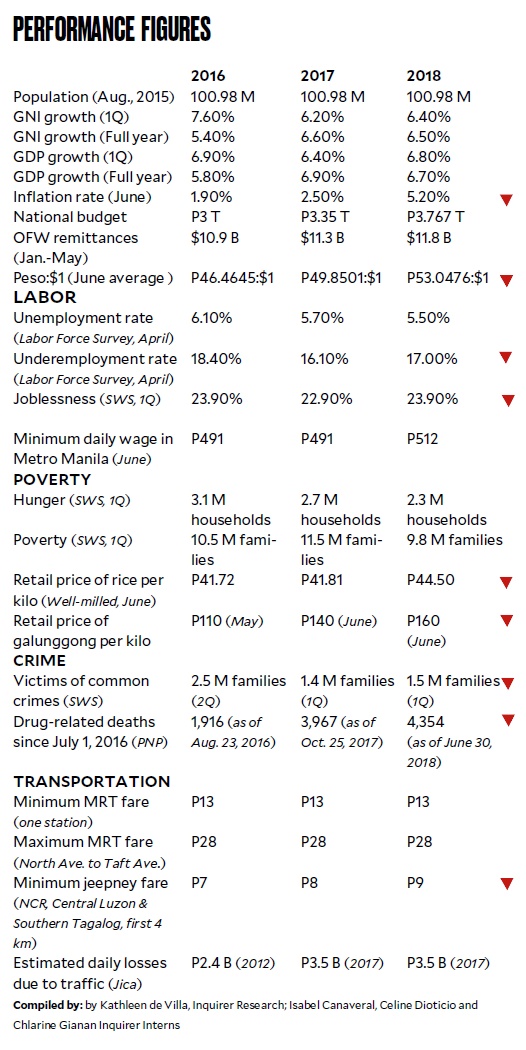

This year, however, inflation has gone beyond the 2-4 percent range targeted by the central bank. The peso is at multiyear lows against the US dollar and the local stock market has turned bearish.

Inflation, which measures the pace of increase in goods used by a typical household, hit a five-year high of 5.2 percent in June.

“Obviously it’s a bit rough sailing right now. Inflation is much higher, but we look forward to (government) taking measures, controlling expectations to bring inflation back to the 2-4 percent level,” said Patrick Cheng, chief financial officer at China Banking Corp.

Despite nagging concerns over inflation, experts believe the Philippines will continue to ride on a higher growth trend.

At the most recent pace of 6.7-6.8 percent a year under the Duterte administration, this is already a marked improvement over the trend growth rates delivered by previous administrations.

To recall, gross domestic product (GDP) growth averaged 6.1 percent during the term of former President Benigno Aquino and 4.8 percent during the nine-year term of Gloria Macapagal-Arroyo.

A fast-growing economy, however, requires easing structural bottlenecks. This was why infrastructure building was immediately identified as a key priority early in the Duterte administration.

Under the ambitious “Build, Build, Build” program, the government plans to flesh out 75 “game-changing” projects—half of which are targeted to be finished within Mr. Duterte’s term—to be supported by around P9 trillion worth of spending on hard and modern infrastructure until 2022.

These are seen enough to sustain a growth rate of over 7 percent for the Philippines.

“If the administration can continue to focus on their “Build, Build, Build” program, then that will declog the metropolis and give access to other parts of the country. If you improve roads and ports, that really contributes to the rest of the country so it’s not just Metro Manila. So the country can reach its potential,” Cheng said.

Gaining ground

For economist Bernardo Villegas of the University of Asia and the Pacific (UA&P), things are looking up for the country despite recent uncertainties caused by rising commodity prices and political noise over extrajudicial killings, the ouster of Chief Justice Maria Lourdes Sereno and the debate over the proposed shift to a federal form of government.

He cited gains on governance, noting that the Ombudsman had been handing down more indictments against allegedly corrupt government officials.

“DOF (Department of Finance), DBM (Department of Budget and Management) and DPWH (Department of Public Works and Highways) have been doing their job,” Villegas said, particularly citing Public Works Secretary Mark Villar’s infrastructure initiatives.

“I travel a lot and I can see that we are addressing the problem of the countryside,” he added.

At the same time, he noted that the Department of Education was getting more funding to improve the quality of education, adding that the country was beginning to reap the benefits from the shift to the K-12 system.

“We are graduating from a low middle-income economy to a high middle-income economy in the next five years,” Villegas said.

Jose Mari Lacson, research head at fund management firm ATR Asset Management, said the Duterte administration had scored partial gains by obtaining funding for major infrastructure projects such as the proposed railway between Clark and Subic, two major industrial hubs outside the metropolis. This P50-billion project will be funded by China.

Lacson said success was “partial because the Chinese have yet to give a go.”

“Too many issues are unresolved on the infrastructure front (apart from funding) that projects are at risk of severe delay,” Lacson said.

“I think if Duterte fails to get Chinese funding by the third quarter, he must be prepared to throttle down on infra spending to keep inflation and the exchange rate manageable,” he said.

Lacson hopes Mr. Duterte will clarify in his upcoming State of the Nation Address his stance on key infrastructure issues such as airports and railways and the third telecommunications player, to pave the way for execution in 2019.

Outside of big-ticket projects, Lacson said the government should also aim for small but relevant successes such as improved maintenance of MRT trains and the swift processing of vehicle license plate applications.

He said these were items that could benefit from swifter decision making.

Further liberalization

Liberalizing foreign investments was among the economic measures often mentioned by Mr. Duterte during his presidential campaign.

The business community is eagerly looking forward to the fulfillment of this promise.

Lacson said his Sona wish list would include a policy statement affirming plans to remove, reduce and amend restrictions on foreign investments to help facilitate growth of foreign direct investments.

The latest draft of the Consultative Committee (Con-com) tasked by President Rodrigo Duterte to review the 1987 Constitution—primarily to pave the way for a shift to federalism —still prescribed a 40-percent foreign ownership cap in key segments like public utilities, real estate, exploitation of natural resources and education. The draft also stated that mass media, use of marine wealth and practice of all professions (except in cases provided by federal law and international agreements) would be limited to Filipinos.

For Villegas, what he wants most is to hear from Mr. Duterte that he would ask for a revision of the Con-com draft, which he described as “so Filipino first” in mentality.

“(US President) Trump really learned America first from us. The Filipino-first (mentality) was the one that destroyed the Philippine economy. I would like to see President Duterte telling Congress to focus on removing all those unreasonable restrictions against foreign investments,” Villegas said.

The economist noted that neighboring countries like Vietnam had been able to attract much more foreign investments because of their more liberal environment. Foreigners, for example, have better access to land in Vietnam.

“Some people exaggerate and say—they will allow foreigners to own land, the Chinese will buy all our 7,000 islands. But the law can stipulate how foreigners can own land…to prevent speculation…so that you don’t always have threats of other countries taking over. But definitely, I think it is unfair not to let a foreigner who builds a factory benefit also from the appreciation of the land,” Villegas said.

Villegas also hopes to hear during the Sona more initiatives to finally make the Philippine agribusiness sector as productive as that of Thailand, Vietnam and Malaysia.

Awaiting TRAINs

The private sector is likewise looking forward to the completion of the other stages of the wide-ranging tax reform program.

“I think the biggest legacy of President Duterte here in the Philippines would be his fiscal stimulus. And it’s not just about spend-spend-spend or build-build-build, it’s really about updating the income tax structure in the country. Personally, I benefited from reduced salary taxes. Another thing that makes me excited about the prospects of the stock market is really the reduction in the corporate income tax,” said Cristina Ulang, vice president and head of research at First Metro Investments Corp.

“It’s like the United States. We’ve seen how the US stock market reacted to President Trump’s initiative to lower corporate income taxes. That’s going to be very supportive of our growth and reinvestment of capital by key corporations in the country now that interest rates are beginning to rise. So if the tax structure favors reinvestment, lowers the rate, it’s an enabler as far as capital reinvestment is concerned,” Ulang added.

The first phase of Tax Reform for Acceleration and Inclusion (TRAIN), which took effect this year, lowered and simplified personal income taxes and simplified estate and donor taxes. But to compensate for foregone revenues, it also expanded the value-added tax (VAT) base, adjusted oil and automobile taxes and introduced excise taxes on sugared beverages.

TRAIN 2 proposes to gradually lower the corporate income tax rate from 30 percent to 25 percent while streamlining incentives for companies to make these “performance-based, time-bound and transparent.”

TRAIN 3 seeks to rationalize taxes on real property while TRAIN 4 involves an overhaul of capital market taxation.

Lacson hopes Mr. Duterte would endorse in his Sona at least one of the three remaining tax reform packages as priority legislation.

He also hopes the President will push all agencies to resolve within a year lingering issues on TRAIN Package 1 such as taxes on regional office headquarters of multinational corporations, real estate investment trusts, and VAT.

Businessmen are closely monitoring other upcoming TRAIN packages.

For the banking industry, for instance, various organizations are preparing to participate in the consultations for TRAIN 4, which will cover capital income taxation.

“TRAIN 4 is something the banking industry has a big stake in. We obviously want to simplify tax rates and tax administration so there will not be too many rates and too many rules which can complicate things,” China Bank’s Cheng said.