Demand for green bonds set to soar in Asia

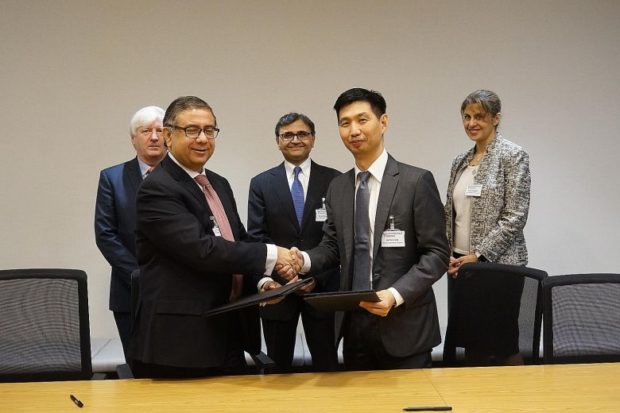

Mr Vivek Pathak, IFC’s director for East Asia and the Pacific, and Mr Ng Yao Loong, MAS’ assistant managing director, development and international group, at the signing of a memorandum of understanding, which will see both parties working together to spur green bond issuances by financiers in Asia.PHOTO: MAS

Private capital has a huge opportunity to help meet the region’s soaring demand for “green” investment over the next decade or so, said a Monetary Authority of Singapore (MAS) executive yesterday.

Mr Ng Yao Loong told the Green Bonds Asia Conference here that an estimated US$200 billion (S$266 billion) of investment will be needed between 2016 and 2030 – a five-fold increase from current levels.

But while the demand is evident, more clarity is needed in the standards of debt instruments – called green bonds – to boost investor confidence, added Mr Ng, MAS’ assistant managing director, development and international group.

He noted: “Investors need clarity on and confidence in the standards that green bond issuers are adopting.”

Singapore’s existing green bond grant scheme applies international standards, while the Asean Green Bond Standards have been aligned with the principles of the International Capital Market Association.

Article continues after this advertisementMr Ng said: “Doing so provides a single Asean standard to promote the development of a regional green bond market, while mitigating the risk of diverging from the standards to which international issuers and investors are accustomed.”

Article continues after this advertisementHe added that if the share of private financing in Asean is assumed to increase from the current 25 per cent level to more than 50 per cent of total green financing needs, the amount has to increase by more than 10 times today’s level.

This means private-sector players, including investors, underwriters or issuers, must build up expertise in order for the green finance market to grow, said Mr Ng.

The green bond market started a decade ago and reached US$156 billion last year. Asia contributes about a quarter of global green bond issuances annually, driven by the hive of activity out of China.

It was only recently dethroned as the world’s largest green bond issuer by the United States, reflecting the impact from a US$25 billion mortgage-backed green securities issue by Fanny Mae, an S&P report earlier this year showed.

There have been signs of institutional demand for such an asset class in Singapore.

Mr Ng cited the 19.5 billion rupee (S$387 million) bond deal issued by the Indian Renewable Energy Development Agency that was listed on the Singapore Exchange (SGX).

Last November, Manulife Financial Corp issued and listed a $500 million green bond on the SGX, and in April this year, Indonesia’s Star Energy Geothermal issued and listed a US$580 million amortizing green project bond.

The MAS and the International Finance Corporation (IFC), a sister organization of the World Bank and organizer of yesterday’s conference, will collaborate on spurring green bond issuances by financiers in Asia.

A memorandum of understanding outlining the issue was signed yesterday. The two agencies plan to promote internationally recognized green bond standards and raise awareness among finance professionals on green finance issues.

Mr Vivek Pathak, IFC’s director for East Asia and the Pacific, said: “Addressing climate change will require innovative, high-impact financial solutions that mobilise the private sector.”