Icasa, the growth area

The hypothesis then was that these countries were interlinked and represented the rise of emerging markets.

In 2015, Goldman Sachs closed its BRICS investment fund that marked what Bloomberg called “the end of an era.” India and China performed, but Brazil, Russia and South Africa, all heavy natural-resource exporters, lost steam.

And then, in 2017 came Icasa.

McKinsey, a consultancy, sees a new growth dynamics, with the mental model of BRIC (Brazil, Russia, India, and China) countries giving way to a regional emphasis on Icasa (India, China, Africa, and Southeast Asia).

McKinsey reported that in the three geographic entities—India, China and Africa—urbanization is empowering populations that exceed one billion people, and a fourth entity, Southeast Asia, with more than half a billion. Icasa markets hold a huge potential for significant sustained economic expansion.

Article continues after this advertisementHow large are these economies?

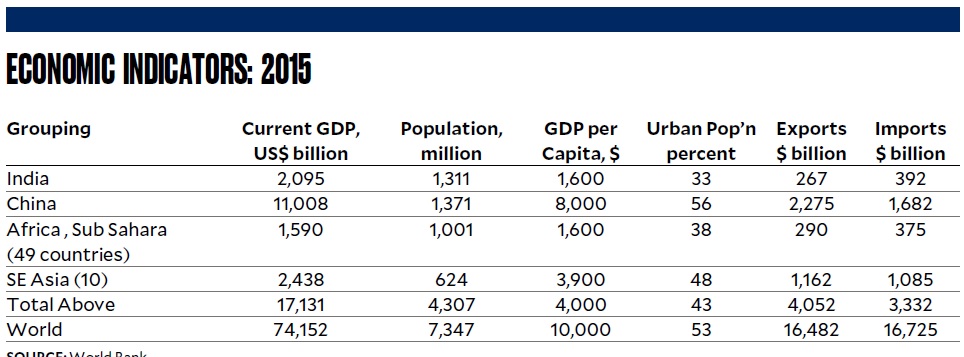

Article continues after this advertisementIcasa had a population of 4.3 billion in 2015, or nearly 60 percent of the world population. Its urban population of 1.85 billion was nearly half of the world urban population. The area’s population is growing faster (Africa, 2.7 percent, India and SE Asia 1.2 percent) versus the 0.6 percent of the club of developed countries, the Organization for Economic Cooperation and Development (OECD).

The current gross domestic product (GDP) reached $17 trillion, heavily dominated by China at $11 trillion. Total trade reached $7.4 trillion. But GDP per capita remains low at $4,000, or 60 percent below world average. The potential for growth is large, given their growing and young population, except China. The middle class could even grow faster.

Global forces

In an article titled “The global forces inspiring a new narrative of progress,” written by Ezra Greenberg, Martin Hirt, and Sven Smit in the McKinsey Quarterly April 2017, the following was noted:

India (Population: 1.31 billion): The “challenges include transitioning to more sustainable urbanization; building a manufacturing base in India; substantially increasing women’s participation in the general economy; and fully exploiting the country’s technical brainpower to move up the value chain.”

China (Population: 1.37 billion): China’s growth rate has begun to taper, and despite substantial institutional changes over the past decade, the country needs to do more to complete its transition from an investment-led growth model to a productivity-led one. The demographic headwinds China will soon be facing amplify the need for this transition.

Africa (Population: 1 billion): The “working-age population is projected to top that of China and India before 2040, which has the most unfilled potential. It also faces the greatest challenges: mobilizing its domestic resources, aggressively diversifying individual state economies, increasing sustainable urbanization, accelerating cross-border infrastructure development, and deepening regional integration. Failing to achieve any one of these could stall growth.”

Southeast Asia (Population: 624 million): The region’s “impressive past growth has been driven by an expanding labor force and a shift of workers from agriculture to manufacturing. To continue growing as these factors fade, the region needs substantial investment in infrastructure that supports digitization and urbanization.”

How long will Icasa survive as a development acronym need not be answered here.

However, the grouping contains the large and growing markets of the world.

Today, three countries in Asia are experiencing a “demographic sweet spot and dividend.” They are: India, Indonesia and the Philippines. This is the period when a large portion of the population is of working age. The young consumers will drive consumption, move investments, and thus fuel economic growth.

In a related development, another acronym, VIP, was invented by UA&P economist Bernardo Villegas.

VIP represents three Asean countries with large populations and similar levels of development: Vietnam, Indonesia and the Philippines. Altogether, they have a total population of 450 million, nearly three-quarters of Asean population. They are expected to grow by five to seven percent a year in the coming decades.

Expect more investments to flow into Icasa.