Never too young to invest for the future

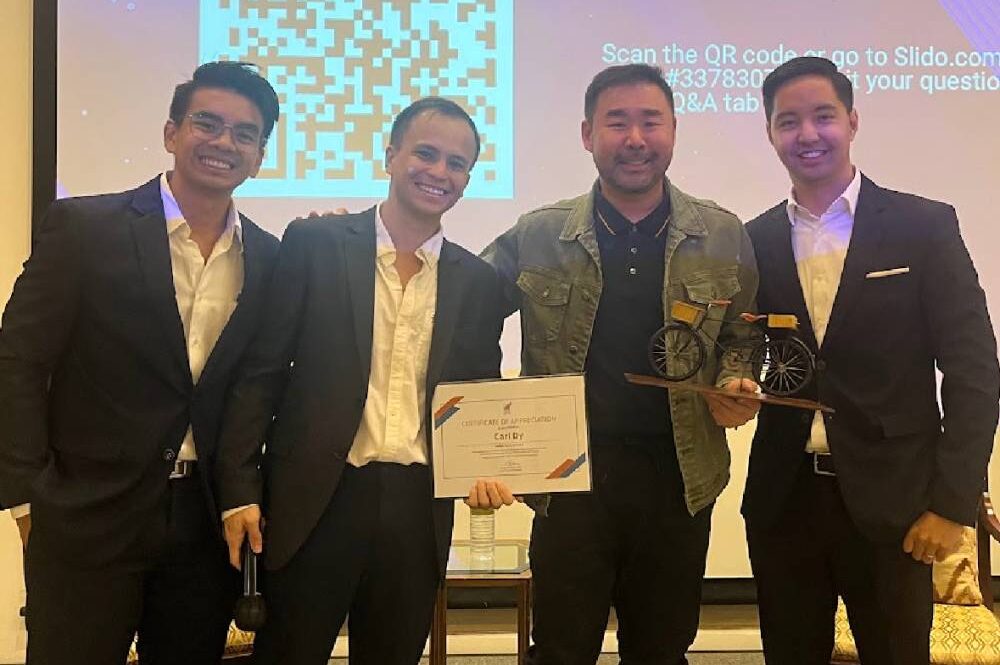

YOUNG GUNS Joshua Llanto (left) and Pietro Sarmiento, IFE associate financial architects; Carl Dy, Spectrum Investments president; and Enrique Fausto, IFE chief financial architect —CONTRIBUTED PHOTOS

If you have money that you want to grow for your retirement or other future plans, do not wait to buy property. Instead, buy property and wait for your investment to grow in value without having to put in a lot of hard work.

This was the advice given by Carl Dy, property investor and president of Spectrum Investments, a property management company.

Dy, a real estate management graduate of Harvard Business School who has had 20 years of experience in the property business working with the Ayala Group, says real property will always be an asset and will continue to appreciate.

“Unlike [having a] business, property is easier to manage and profit from rental of a property is easier to compute,” he points out.

Dy was the resource person at the recent seminar on “Generating Passive Income through Stocks, Bonds and Property.”

Article continues after this advertisementOrganized by IFE (Investing for Everyone) Management, the seminar sought to respond to Filipinos’ need to find out how best to invest their hard-earned money to achieve their goals, particularly for comfort and financial security when they retire.

Article continues after this advertisementDiscussed, among other things, were the pros and cons of investing in stocks and bonds compared to real estate, as well as the best way to take advantage of both in a diversified portfolio.

IFE seminar participants

Make money work for you

Participants, mainly young professionals and corporate employees, received practical advice to help them navigate their financial journey safely and smoothly. They gained insights into current market conditions and how to optimize investment opportunities in stocks, bonds and property to generate passive income.

Dy, who is himself building up his portfolio with the goal of living on passive income from property, says passive income is a better and more dependable source of funds.

“You make your money work for you, instead of working for money,” he stresses.

As for young people who think they should wait before putting their money in real estate, Dy tells them, “You are never too young to start investing in property.”

He adds, “Don’t wait to buy real estate; buy real estate and wait.”

Prospective real estate buyers should look for opportunities to put their money in places that are being developed, he says. If new roads are being built in a place, chances are commercial and business establishments will open and property value will rise.

As for choosing between investing in land or buying a condominium unit, he points out that land always grows in value. Income from a condo unit meant to be rented out, will depend on demand.

“In today’s market, [buy a piece of] land,” Dy says. He adds that prices of condo units are likely to continue to rise because construction cost is also rising.

Enrique Fausto, IFE Management chief financial architect, paints a positive outlook for 2024, as he talks about other investment options. Despite geopolitical risks, including continuing armed conflicts, inflation is cooling and interest rates are falling. While growth is slowing, the economy remains resilient.

Philippine bonds are potentially good investments when inflation and interest rates are dropping. The country’s stocks are cheaper than those in other nations, including neighboring countries, he adds.

As risks still remain, he suggests, “Choose paths to passive investment.” —CONTRIBUTED