Benchmarking Asean export drivers: How is PH faring?

Export is a vital cog of development. The country needs foreign exchange to fund imports from food to machinery to raw materials to oil. It has to pay foreign debt and finance Filipino travelers.

How did the Asean fare in foreign exchange generation in the past decade? Where is the Philippines in the race?

There are three criteria: goods exports, services exports and personal remittances.

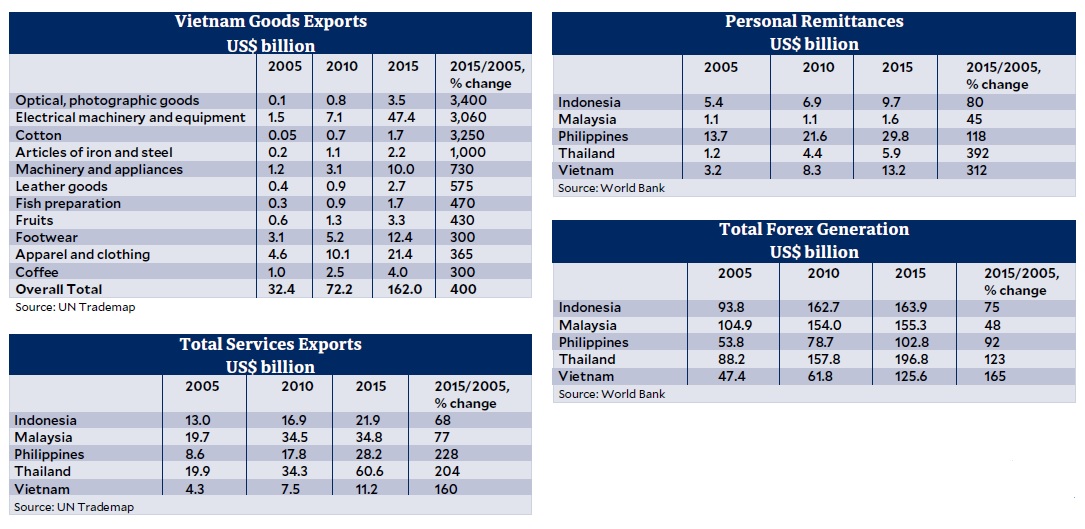

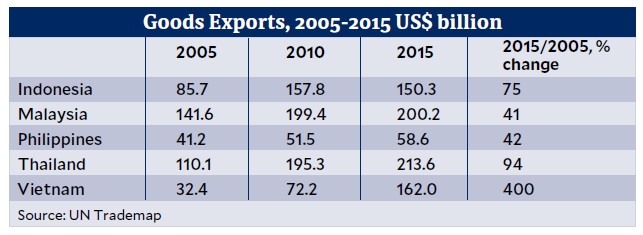

Goods exports

The Philippines lags in goods exports. In 2015, exports totaled only $58.6 billion, about 40 percent that of Indonesia’s and Vietnam’s, and barely 30 percent that of Malaysia’s and Thailand’s.

In terms of 10-year expansion, the Philippines posted the slowest advance alongside Malaysia. Both countries are behind Indonesia and Thailand. All Asean-4 trails Vietnam. The latter multiplied its exports five-fold, a monumental achievement barring none.

Article continues after this advertisementVietnam’s rapid advance was recently flagged by noted economist Cielito Habito in his column. The country’s export gains appeared broad-based. Electronics is big league. The growth leaders were optical and photographic goods, electrical machinery and equipment (electronics), cotton, articles of iron and steel, machinery and appliances, leather goods, fish preparation, and fruits.

Services exports

These comprise business services, travel, transport, financial and construction services. The Philippines ranked third behind Thailand and Malaysia in earnings in 2015.

The Philippines’ main export was business services (mainly business process outsourcing or BPO) while those of Thailand, Malaysia, Indonesia and Vietnam were travel services (tourism). This was evidenced by the number of tourist arrivals by country in 2015: Thailand with 29.9 million; Malaysia with 25.7 million; Indonesia, 9.7 million; Vietnam, 7.9 million, and the Philippines, 5.4 million.

By growth rate, the Philippines was ahead, followed closely by Thailand.

Personal remittances

These are mainly overseas workers’ remittances. The Philippines led by a mile in absolute amount at $29.8 billion versus $13.7 billion for Vietnam and $9.7 billion for Indonesia. However, Thailand and Vietnam posted very high growth, albeit at a low base.

The sum

The three forex earners were combined together with goods exports adjusted for domestic value-added shares in 2011, as estimated by the Organization of Economic Cooperation and Development (OECD).

These are: Indonesia, 88 percent; Philippines, 76.4 percent; Malaysia, 59.4 percent; Vietnam, 63.7 percent; and Thailand, 61 percent. (https://data.oecd.org/trade/domestic-value-added-in-gross-exports.htm)

In absolute terms, Thailand had a total forex earning of $197 billion in 2015, Indonesia with $164 billion, and Malaysia with $155 billion. Vietnam, with $126 billion, was ahead of fifth placer Philippines, which had $103 billion.

Comparing growth rates, Vietnam and Thailand posted the fastest expansion, with the Philippines in the third spot.

Where do we go from here?

By contrast, the Philippines has much catching up to do in terms of goods exports. In 2015, industrial and mineral exports were only $53.8 billion as compared to $117.2 billion for Indonesia, $138.3 billion for Vietnam, $167.1 billion for Malaysia, and $177.3 billion for Thailand.

The country’s agri-food export base is even weaker. In 2015, its agri-food export was only $4.8 billion as compared to $23.7 billion for Vietnam, $25 billion for Malaysia, $33.1 billion for Indonesia and $36.3 billion for Thailand (UN Trademap).

Philippine farm productivity, diversification and agri-food processing also trail their Asean peers. Low productivity and limited diversification impact on the raw materials supply of processing industries.

The Duterte administration has a lot on its plate. If it wants to reduce poverty from 21.6 percent in 2015 to 14 percent in 2022, export is one key driver.