PH expected to outperform regional rivals

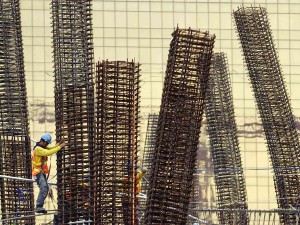

A construction worker wires together steel frames for the foundation of a building still under construction in Parañaque City. American banking giant Citigroup sees the Philippines outperforming neighbors in the region this year in the face of the tapering of the US Federal Reserve’s easy money policy and a slowdown in China. RAFFY LERMA

MANILA, Philippines—American banking giant Citigroup sees the Philippines outperforming neighbors in the region and better withstanding external shocks arising from the tapering of the US Federal Reserve’s easy money policy and a slowdown in China.

The Philippines can attain an above-trend gross domestic product (GDP) growth rate of 7 percent this year and 6.8 percent for next year, said Johanna Chua, the managing director and head of Asia-Pacific economic and market analysis at Citi.

The Hong Kong-based Filipino economist said the Philippines was beating global growth forecast trends and that the stage was set for an investment-led recovery in the country.

Chua said growth in the country was “very resilient,” supported by ample fiscal space for government spending alongside high business confidence levels.

Economic growth in the second quarter would likely be slower than the first quarter, when the domestic economy grew by 7.8 percent year on year, but the growth rate would still be “quite elevated,” she said. In the last decade, Philippine trend growth rate was at less than 5 percent.

Article continues after this advertisementThe economist said emerging markets in the region continued to face two major external risks: the tapering of the US Federal Reserve’s $85 billion in monthly bond purchases and a structural slowdown of the Chinese economy. Citi sees the tapering of easy money starting by September this year and going down to zero by the middle of next year.

Article continues after this advertisement“If we look at and combine both risks, the Philippines stands out as the country most insulated to both, with macroeconomic and financial stability intact,” she said.

“The sudden reversal of capital flows may hurt the domestic growth of some markets but the Philippines is in better shape,” she added.