Deadline on use of new receipts extended

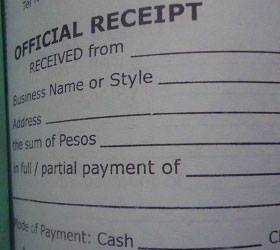

The BIR says enterprises can use their old set of receipts until Oct. 31, instead of Aug. 30 as earlier ordered. Last week the Tax Management Association of the Philippines submitted a letter to the BIR asking for an extension of the validity of old receipts due to the failure of printers to service printing requests on time. PHOTO COURTESY OF T.M.A.P.

The Bureau of Internal Revenue has given leeway to some enterprises as far as the directive on the use of new receipts is concerned.

In its latest memorandum circular, the BIR said enterprises could use their old set of receipts until Oct. 31, instead of Aug. 30 as earlier ordered, under two conditions.

The first is that the printing of the old receipts should be covered by an authority to print (ATP) issued by the BIR on or after Jan. 1, 2011. This means receipts covered by ATPs older than Jan. 1, 2011, will no longer be valid starting Aug. 31.

The second condition is that enterprises should already have an authority to print new receipts from the BIR on or before Aug. 30.

The BIR said enterprises would be able to get their ATPs on time had they applied for these on time. The BIR said the applications for ATPs should have been filed on or before April 30.

BIR circular 52-2013, which was released to the public Wednesday, also stated that enterprises that could not meet the two conditions would be required to use a new set of receipts starting Aug. 31.

The leeway embodied in the circular was issued following complaints that BIR-accredited printers were not able to service printing requests on time.

The delays have been blamed on the enormous printing requests that had piled up, with the bulk of businesses having requested printing services only during the past month or two.

The Tax Management Association of the Philippines, a group of tax practitioners in the country, last week submitted a letter to the BIR asking for an extension of the validity of old receipts. The group cited the failure of printers to service printing requests on time.

In response, the BIR said the leeway was being given but only to those that could not issue new receipts starting Aug. 31 only because of service delays by printers. The BIR said it would impose monetary fines on enterprises that fail to issue new receipts starting that date because of their late filing of requests for ATPs.

The BIR said businesses that would still use old receipts even after Aug. 30 (for some companies) and Oct. 30 (for other firms) would be slapped with the same penalties imposed on those that would not issue receipts to customers.

The BIR added that old receipts used after Aug. 30 and Oct. 31 for other firms would not be honored by the BIR for purposes of tax deductions, Internal Revenue Commissioner Kim Henares said in the circular.

The BIR said the directive on the use of new receipts was meant to address the problem on the rampant use of fake receipts by tax cheats and smugglers. It is also meant to address complaints that some BIR personnel force taxpayers to have their receipts done by printing companies owned by relatives of the BIR personnel.