Sin tax revenue earmarking set Monday

MANILA, Philippines—Only the earmarking of the revenues from the sin tax bill is left to be discussed in the bicameral conference after its members concluded deliberations on tax rates Thursday night.

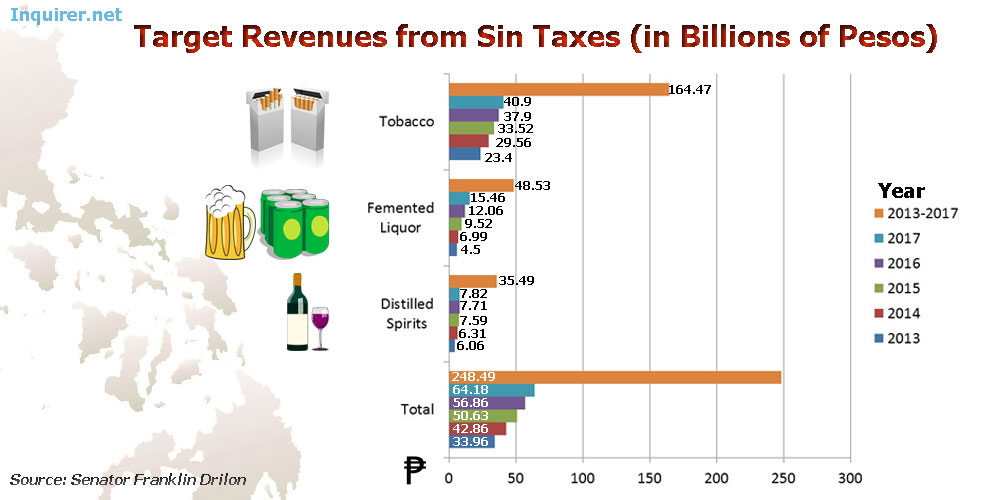

Senator Franklin Drilon told reporters Friday that they have agreed on a target of P248.49 billion in additional taxes on tobacco and alcohol products from 2013 to 2017.

He said the deliberations on the rates took them seven hours “of hard negotiations”, which prompted them to postpone discussing the earmarking of the revenues to another bicameral conference committee meeting set on Monday.

For tobacco products, the committee agreed to a collection target of P23.4 billion in 2013, P29.56 billion in 2014, P33.52 billion in 2015, P37.09 in 2016, P40.9 billion in 2017.

A total of P164.47 billion will be collected from tobacco products over the five-year period, Drilon said.

Meanwhile, for fermented liquor or beers, P4.5 billion will be collected in 2013, P6.99 billion in 2014, P9.52 billion in 2015, P12.06 billion in 2016, and P15.46 billion in 2017.

By the end of the five-year period, a total of P48.53 billion will have been collected from fermented liquors, Drilon said.

And finally, on distilled spirits, P6.06 billion will be collected in 2013, P6.31 billion in 2014, P7.59 billion in 2015, P7.71 billion in 2016, and P7.82 billion in 2017.

According to Drilon, P35.49 billion will be collected from distilled spirits throughout the five-year period.

“We are hopeful that we would be able to finish everything by Monday and submit the committee report sometime next week,” Drilon said.

Unfair burden sharing

Senator Ferdinand Marcos Jr., however, said in a statement that there was an unfair burden sharing in the discussed rates during the committee meeting.

“What happened is they will maintain the [tax rates] on alcohol for the next five years but on tobacco it will keep on increasing. The burden sharing becomes heavier on tobacco [products],” Marcos said.

The Senate had previously agreed to a 60-40 burden sharing between tobacco and alcohol respectively. Marcos however said that it would be 70-30 in 2013, the first year of implementation of additional taxes should the bill be passed into law.

“It reached 70-30 on 2013 but as it goes on, every year the burden increases on tobacco while remaining steady on alcohol,” Marcos said.

“I don’t agree at all. But they don’t care. And the fact of the matter is that [with] burden sharing like that, and with prices like that, they will kill the industry. They will put 2.5 million people out of work,” he said. “I don’t know if that is their intention but that will be the effect.”

Drilon however, maintained that the tobacco industry will not be killed. He also stressed that what the committee came up with was a result of negotiations and deliberations between the Senate and House of Representatives panels.

“We cannot impose everything on the other panel,” Drilon said.