Moody’s upgrades PNB credit rating

MANILA, Philippines — Tycoon Lucio Tan-led Philippine National Bank (PNB) bagged a credit rating upgrade from Moody’s Ratings for its improved profitability and healthy buffers.

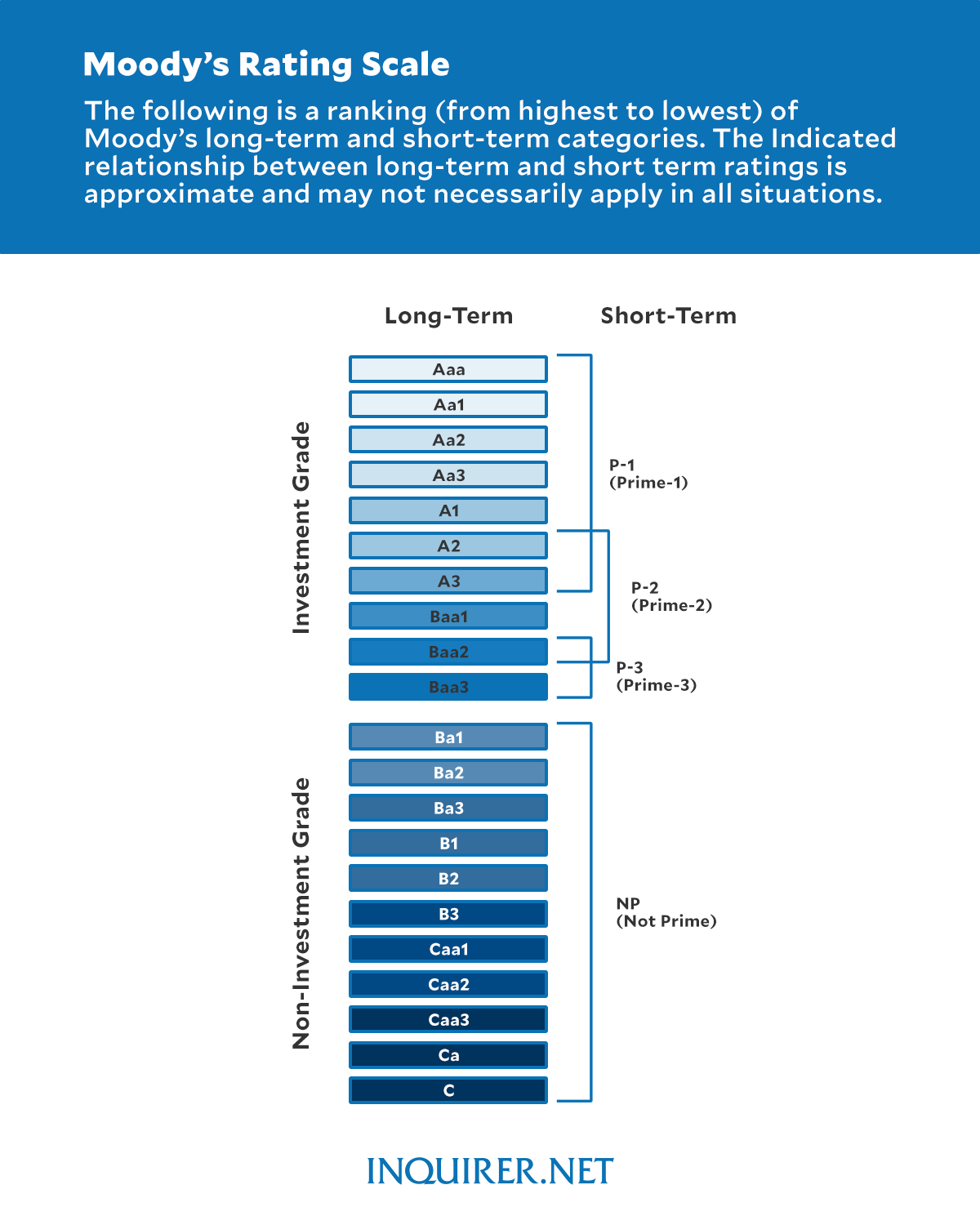

Moody’s raised its investment-grade rating on PNB by a notch from “Baa3” to “Baa2.”

This improved creditworthiness of the bank comes at a time when financial conditions are still somewhat tight amid a slow interest rate-cutting cycle at home and abroad.

PNB has just entered a new era with the recent appointment of veteran banker Edwin Bautista as new CEO.

Accordingly, Moody’s changed its outlook on PNB from “positive” to “stable.” This means the bank’s current rating—already at the same level as the Baa2 score of the Philippine government—is unlikely to change within the next 12 to 24 months.

The debt watcher said PNB managed to sustain the improvements in its core profitability while keeping “robust capital and solid liquidity.”

Excluding one-offs, the credit rating agency said PNB’s profitability, as measured by return on assets, had improved significantly to 1.7 percent in 2024 against the five-year average of 0.9 percent.

The bank was able to widen in net interest margin partly due to growth in higher yielding, albeit riskier, retail and small and medium enterprise segments. Still, Moody’s said PNB was able to reduce credit costs, thereby supporting the bank’s profits.

But the bank looks ready to face potential stress, thanks to its robust capital strength. Moody’s said the ratio of PNB’s common equity relative to the riskiness of its assets was at 20.8 percent as of 2024, the highest among its rated-peers in the country.

“These strengths balance the bank’s modest asset quality, which deteriorated over the pandemic due to large, concentrated exposures,” the debt watcher said.

Security Bank faces risks

READ: After banner year, Security Bank sees sustained momentum

But it’s a different story for Security Bank.

While it kept the bank’s Baa2 rating due to its “average solvency and liquidity metrics,” Moody’s downwardly revised its outlook on Security Bank from stable to “negative.”

A negative outlook means there’s a higher probability of a rating downgrade within one to two years.

Moody’s said Security Bank’s common equity, as a percentage of risk weighted assets, had declined to 13.7 percent in 2024, from 17 percent a year earlier, as the lender handed out more loans. INQ

Moody’s Rating Scale