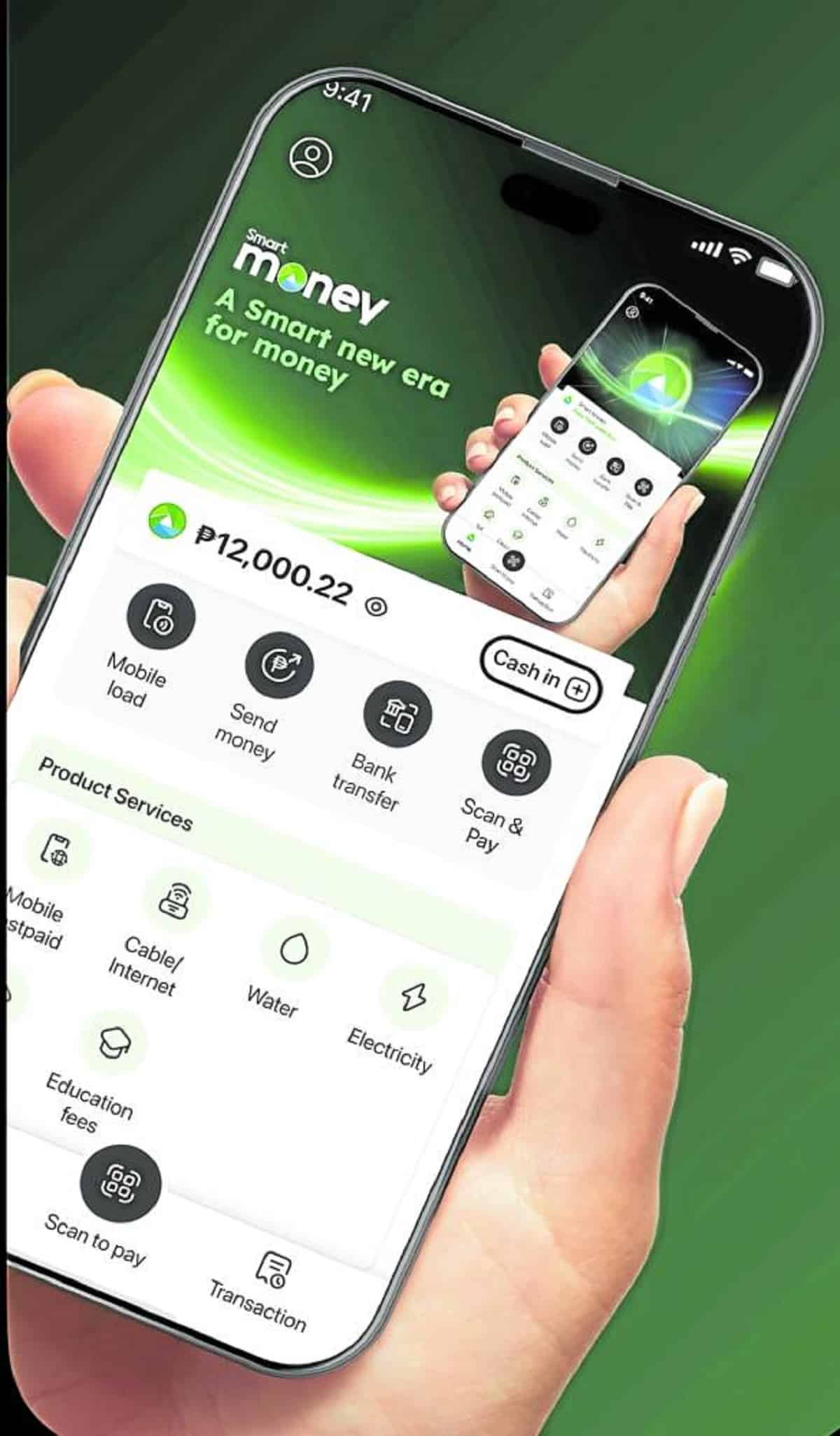

Next unicorn? Coming soon: Smart Money 2.0

LAS VEGAS, Nevada—PLDT Group is targeting to restart the services of once-popular Smart Money this 2025 to provide Filipinos another e-money option with potentially cheaper transaction fees and challenge the market currently dominated by Ayala-led GCash.

Dheeraj Kumar, chief artificial intelligence advisor of PLDT’s wireless unit Smart Communications Inc., says the group applied for an e-money issuer and remittance licenses with the Bangko Sentral ng Pilipinas (BSP) about three months ago.

The Smart official, on the sidelines of Adobe Summit here, says they are hoping to receive the approval soon so the company can launch the “next big unicorn for the country.”

“Within this year, we will be live,” Kumar says.

READ: BIZ BUZZ: Surprise! MVP revives Smart Money

Kumar says the e-wallet would “disrupt” the market by providing “seamless pricing,” pointing out that current players are charging fees at a level that might burden the users.

The official of the Pangilinan-led group says they aim to offer cheaper fees for the usual transactions like cashing in and sending money.

“My chairman’s (Manuel Pangilinan) vision is a seamless frictionless payments in Philippines and that will revolutionize digital payment and digital adoption in the country,” he says.

PLDT is reentering a market that has gone accustomed to using GCash, which has about 94 million users.

But Kumar says the company is still optimistic in carving out a sizable market share by pitching cheaper convenience fees.

Smart Money is under pilot testing by the Pangilinan-led group employees, who also include those working at Metro Pacific Investment Corp., Metro Pacific Tollways Corp. and Manila Electric Co., among others.

The plan to revive this e-money platform—the first of its kind—came following the return of Anastacio Martirez as Smart’s chief operating officer (COO) last year.

READ: BIZ BUZZ: The ‘boy’ is back

Since December last year, the Smart Money app has been available for download via App store and Google Play.

Dubbed as Smart Padala, it was one of the groundbreaking products offered by Smart about two decades ago.

He earlier said they want to regain their previous market share, estimated to have hit as much as 75 percent.

“Smart Padala was clear market winner. And we think people miss Smart Padala,” Kumar says.