Philippine power reserves thin in 2023; but no red alert just yet

LET THERE BE LIGHT San Carlos Sun Power Inc., Aboitiz Power’s first solar power plant venturein San Carlos City, Negros Occidental. —ABOITIZ POWER

As early as last year, the government has warned that the Philippines will experience power supply woes this 2023, especially during the summer. One can assume that Filipino consumers are used to this scenario, which the media have extensively and repeatedly reported on in previous years. We can summarize the news reports in three sentences: The population is increasing. Electricity demand is rising. But the country still has the same power plants to deliver its ever-increasing energy needs.

During the summer season (from April to June), people consume electricity the most just to beat the scorching heat. Electric fans and air conditioners run at full blast for several hours to keep cool in hot weather. Historically, overall rates are usually highest during this period as the electricity demand is high.

If this has been the case, what makes 2023 different? The government and the private sector seem to agree this will be the most challenging year for the Philippine energy sector. Circling back to the scenario pictured earlier, there isn’t any new major power plant that has come online at the onset of the coronavirus pandemic to meet the unabated rise in electricity consumption.

Even though no power interruption looms on the horizon, the Department of Energy (DOE) itself is expecting a difficult power situation due to the thin power supply for most of 2023.

Energy Undersecretary Rowena Cristina Guevara says the agency does not expect any declaration of red alert in the Philippines, particularly in Luzon, which accounts for the largest share of the total electricity consumption. Guevara, however, flags the possible issuance of 12 yellow alerts as early as March to as late as November.

A red alert refers to supply deficiency that can lead to power interruptions. On the other hand, a yellow alert signifies insufficient power reserves or ancillary services. Ancillary services are designed to ensure the uninterrupted transmission of electricity from power plants to electricity end-users.

Guevara says their simulations show yellow alerts are expected to be raised once in March, twice in April, the entire month of May, twice in June, one in September, one in October, and one in November. These might occur during the following periods: March 12 to 18; March 26 to April 1; April 23 to 29; the entire month of May; June 1 to 10; Aug. 27 to Sept. 2; Oct. 15 to Oct. 21 and Nov. 19 to Nov. 25.

Projections already include the scheduled outage of certain power plants with a combined capacity of 500 to 600 megawatts (MW).

The energy official warns if at least one power plant were to suddenly bog down, a red alert might be declared in the Luzon grid. “Hopefully there won’t be any unscheduled outage because, let’s say, one power plant goes offline, red alert might be raised,” she adds.

According to the agency, the occurrence of yellow alerts may be reduced if diesel-fired power plants with a capacity of 420 MW are operated. But imported fuel in the global market remains expensive, which may still result in steep power rates.

Outside Luzon

The DOE paints a better supply scenario in the Visayas and Mindanao. The DOE rules out the possibility of red alerts but hints at the likelihood of five yellow alerts occurring in the evening toward the second semester of 2023. Only Mindanao is assured of sufficient power reserves for the entire year.

Tycoon Isidro Consunji says the year 2023 would be the “most challenging” in the country’s power supply. Although he expects no brownouts this year, power rates “might be expensive,” adding the highest price is recorded in June and July based on historical data.

“[I believe] 2023 is the most challenging, more than 2024 because in 2023, the LNG [facility] is not ready. We are ready by 2024. There will be no brownouts but electricity rates may be more expensive,” says Consunji, chair and president of listed DMCI Holdings Inc.

Emmanuel Rubio, president and CEO of listed Aboitiz Power Corp., says they “remain optimistic” this year amid the gloomy power supply scenario.

“As the country will need more power to bounce back postpandemic, the energy sector must work together to deliver stable and reliable electricity, especially during the summer months when demand is highest. To do this, the Philippines will require all forms of energy, including new and more advanced power generation technologies to reap the benefits of a thriving economy,” says Rubio in an email to the Inquirer.

Lopez-led clean and renewable energy (RE) firm First Gen Corp. agrees with DOE’s findings that 2023 is also expected to have tight supply during the summer months.

The DOE expects demand to increase from 2022 levels, possibly reaching a high of 13,125 MW. In addition, available capacity in the grid during the summer months from March to May is estimated to be at 14,730 to 15,800 MW, which leaves around 1,802 to 3,019 MW as operating reserves during the summer months.

“Note that the required operating reserve is already at around 1,800 MW. Simultaneous forced outages of baseload plants can put the grid at risk,” First Gen vice president and head of corporate communication Ricky Carandang says.

“But we are happy to note that the government is working on programs and policies to resolve these issues,” he adds.

The First Gen official points out that in response to Malampaya’s impending depletion, policies are being set in place to accelerate the development of a new natural gas infrastructure, which will supplement the country’s natural gas supplies.

“Support policies, particularly government issuances that will help set markets and contracts for liquefied natural gas (LNG) projects, are needed because they are vital for the industry’s success and further development. Efforts to explore and develop new indigenous sources of natural gas are also welcome in view of the continued decline of Malampaya’s output,” Carandang says.

“Needless to say, power plant outages have to be addressed to ensure stable supply of electricity.”

DOE statistics reveal that over 50 percent of installed capacity in the Philippines comes from power plants that are 20 years or older. First Gen believes that the old plants can help avert unplanned outages, provided they are well-maintained and given sufficient time to conduct maintenance outages.

The power plant outages, especially among old coal-fired power plants, likewise highlight the need for energy diversification, it says. Citing DOE figures, First Gen notes that 58 percent of the country’s electricity comes from power plants running on coal; 22 percent from renewable energy (RE); 17 percent from natural gas, and 1 percent from oil.

“To achieve a balanced, optimal, and efficient energy mix, a central energy planner needs to coordinate long-term energy industry planning,” Carandang says.

Transmission imperative

The outages also bring to focus the need for further development of the country’s transmission system to support more RE projects, Carandang says. Along this line, he notes that the DOE has launched the Grid Planning and Competitive Renewable Energy Zones (CREZ) program, which, however, has yet to be fully implemented.

Both the DOE’s Philippine Energy Plan (PEP) and the Transmission Development Plan (TDP) of the National Grid Corporation of the Philippines (NGCP) have identified the islands of Cebu, Negros, and Panay as the main sites for capacity additions to the grid from the Visayas.

Thus, NGCP is implementing the Cebu-Negros-Panay 230-kilovolt backbone. The first of the three-stage project (the additional submarine cable between Negros and Panay) was energized in October 2016. The second and third stages (Negros-Cebu transmission line improvements) are still to be fully executed.

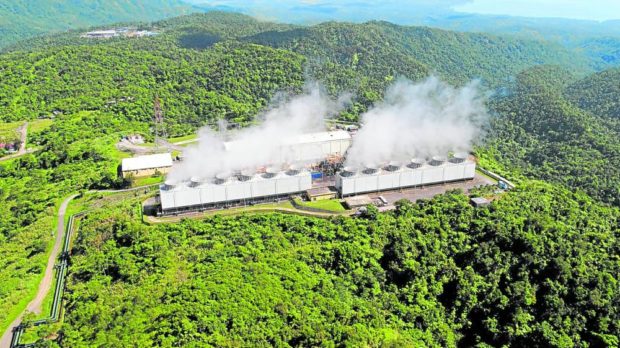

BacMan geothermal power plant of Energy Development Corp., First Gen’s RE arm, in Bicol. —CONTRIBUTED PHOTOS

“Until then, transfer capacity will be insufficient, given the entry of RE and other committed plants,” Carandang says.

NGCP is also implementing a project to interconnect the Visayas and Mindanao grids, which will help distribute energy supply more efficiently and, at the same time, encourage the development of new power facilities. We eagerly await the completion of this long-delayed project.

“Energy security can be enhanced further by expanding reserve capacity to support the goal of getting more energy supply from variable RE and address the increasing outages. There are now proposals to introduce competitive market structures for reserve capacity, such as the Reserve Market and the Ancillary Service Competitive Selection Process (ASCSP). The reserve market, which will be cooptimized with the Wholesale Electricity Spot Market, will allow spot trading of reserve capacity and at the same time provide price signals to investments. ASCSP, on the other hand, will ensure competitiveness in the contracting of reserves. We hope these competitive market structures, which are designed also to encourage generators to invest in reserve capacity, will soon be put in place,” he says.

To help assure power stability, the government likewise implements a number of demand-side programs. These include rules and regulations to promote energy efficiency (such as the Energy Efficiency and Conservation Act); to reduce end-user demand (such as net metering, distributed power generation, the Interruptible Load Program and demand-side bidding); and even to encourage more RE use (such as the Green Energy Auction Program). First Gen welcomes all these.

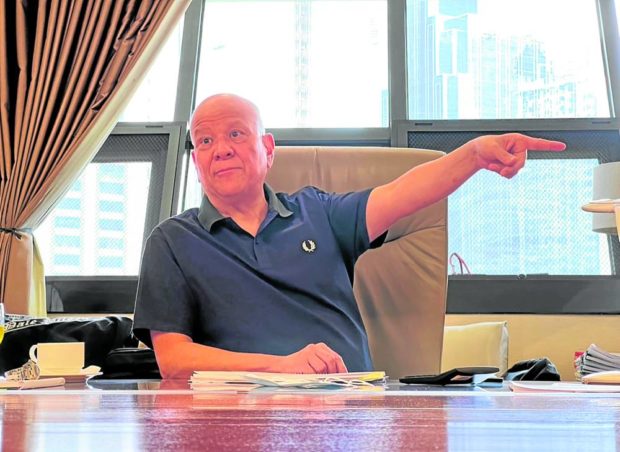

San Miguel Corp. president Ramon S. Ang

Committed projects

“In much the same way that economic activity and people’s lives are returning to normal, system demand also continues to recover and revert back to its historical growth of 5 to 7 percent prior to the COVID-19 pandemic. At the same time, the power facilities that account for much of the net reliable and baseload capacities in Luzon continue to age beyond their cost-effective, useful lives,” says Ramon Ang, president of San Miguel Corp., whose power generation arm, SMC Global Power Holdings Corp., is among the country’s largest.

“With demand fast catching up to, and quite possibly outpacing system capacity, coupled with the unreliability and inefficiency of existing power plants, there could be rotating power outages beginning the summer months. It is, therefore, important that both government and industry players work together to achieve optimum efficiency in terms of power generation,” Ang says.

Over the long-term, Ang says the government needs to ensure construction of new power facilities that will provide additional 6,000 MW of reliable baseload capacity, to replace the portion of Luzon’s net dependable power generation that are sourced from power plants over 20 years old.

“Government should also continue pushing for the integration of more RE sources into the Philippine grid to help us transition to a clean energy future, but with the provision of sufficient ancillary services for frequency control,” Ang says.

“But the fastest way we can keep supply in sync with demand is to come up with programs that will promote an energy conservation mindset among power consumers,” he adds.

Guevara cites data from the DOE in saying there are several committed power projects with a combined capacity of 1,074 MW. Of these, 250 MW are coal fired power plants, 11 MW oil power plants, 46 MW geothermal, 7.4 mW biomass, 31.36 MW hyrdro, 480.5 MW solar and 110 MW wind.

This possibility could have been avoided if the RE plants in the pipeling were completed on time.

“If not for the pandemic, our renewable energy sources are online now. But upon checking with the renewable energy generators, the development of RE projects really slowed down. The situation would have been okay by now. We will be able to catch up with the construction of RE plants in another two years,” says Guevarra.