Philippines stocks reach 4,500 level, near record high

MANILA, Philippines—Most local stocks extended their winning streak for a fifth session on Thursday, lifting the main stock barometer past the 4,500-level and closer to its all-time high record.

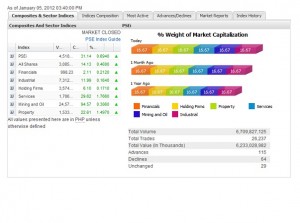

The main-share Philippine Stock Exchange gained another 31.14 points, or 0.69 percent, to finish at 4,518.91.

Local equities benefited from the so-called “January” effect, referring to the seasonally robust investor appetite at the start of every year.

The local index closed at its best level at around 4,550 on Aug. 1, 2011, although it hit an intra-day high of 4,563.65 the following day.

On Thursday, all counters were up but the day’s upswing boosted the property and services sub-indices the most, as they respectively surged by 1.5 percent and 1.77 percent.

Value turnover was higher at P6.23 billion compared with the previous day’s P5.83 billion, suggesting a growing conviction in the market. But the run-up in the last five days has also sent some blue chips to “overbought” levels, making them ripe for profit-taking.

Manny Cruz, chief strategist at stock brokerage AsiaSec Equities, said the uptrend was supported by improved foreign investor appetite as well as anticipation of better corporate earnings this 2012 and of a potential upgrade in Philippine sovereign credit rating. The warm market reception to the government’s fresh global bond offering, Cruz said, was another proof of such favorable investor sentiment.

But in the near term, Cruz said investors would likely try to lock in gains at the 4,550 to 4,580 index range.

“We’re at overbought levels, so we’re expecting a retracement to 4,400,” Cruz said. “Then we believe that there’s another upswing, which should push the market above the 4,600 within the month. I think people will be anticipating better prospects ahead of the Chinese New Year holiday (January 23),” he said.

There were 115 advancers that overshadowed 64 decliners while 29 stocks were unchanged on Thursday.

Investors continued to load up on selective blue chips while pocketing gains from others, resulting in a mixed trade. The index stocks that contributed to the day’s gains were DMCI, PLDT, ALI, AC, Metrobank, AP, Megaworld, URC and ICTSI. FLI also traded higher.

On the other hand, the PSEi’s rise for the day was tempered by the decline of BDO, MPI, AGI, SMIC, Meralco and EDC. Security Bank and Lepanto A (open only to local investors) also traded in the red.

Overnight, the Dow Jones Industrial Index was up by 21.04 points or 0.17 percent to 12,428.42.