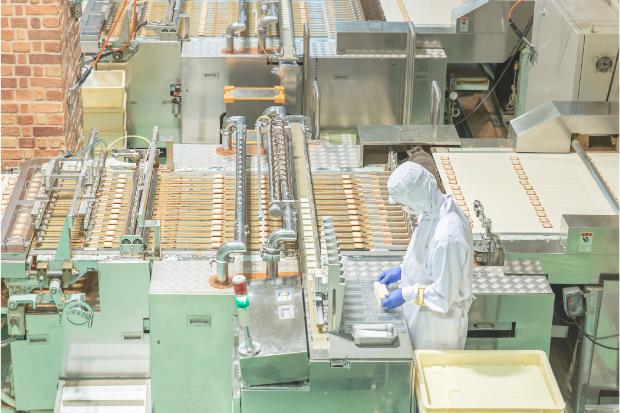

PH manufacturing sustains growth despite higher production costs

Manufacturing output in the Philippines sustained robust growth in April amid economic reopening, but high production costs posed a risk, global intelligence firm S&P Global said on Monday (May 2).

The Philippines’ manufacturing purchasing managers’ index (PMI) further rose to 54.3 last April — the highest since November 2017. It marked the third-straight month of growth—or PMI above 50—which S&P Global’s report said reflected “a solid improvement in overall operating conditions.”

“Looser pandemic restrictions led to a stronger improvement in operating conditions across the manufacturing sector in the Philippines at the start of the second quarter,” S&P Global economist Maryam Baluch said in a statement.

S&P Global said both consumer demand and production schedules benefitted when lockdowns were dismantled and most of the country were placed under the lowest alert level 1 restrictions. As of April, about four-fifths of the economy was under alert level 1.

“As client demand strengthened, both output and new orders expanded at rates not seen for over three years. Furthermore, upbeat forecasts have resulted in a solid increase in stocks of inputs, with the sector moving towards recovery,” Baluch added.

However, S&P Global flagged the continuing escalation of production costs despite a mild easing from March levels. “Although output growth picked up in April, global headwinds, notably from the Russia-Ukraine war and lockdowns in China, led to further pressure on supply chains,” Baluch said.

“Furthermore, the rate of input cost inflation eased only slightly from the record-high seen in March, leading to another sharp increase in selling prices,” Baluch added.

S&P Global reported that demand for Philippine-made goods overseas declined for the second-consecutive month last April as “Russia’s invasion of Ukraine, higher shipping costs and limitations due to the pandemic had reportedly hampered new export orders.”

For Baluch, “while strengthening client demand has been able to support the recovery so far, it will be important to see how growth momentum is sustained amid ongoing supply chain disruption and sharply rising costs.”

Last week, the Philippine Statistics Authority (PSA) reported that the producer price index (PPI) for total manufacturing further rose to 5 percent year-on-year in March from 4.2 percent in February. Month-on-month, production costs last March were 0.7-percent higher than last February, and increased at a faster pace than the 0.6-percent hike last April.

Out of the 22 industries covered by the PSA’s monthly PPI report, 18 sectors posted higher production costs year-on-year, while 16 jacked up manufacturing prices month-on-month.

TSB

RELATED STORIES:

PH manufacturing rebounds strongly after Omicron surge