Millennial power, activate

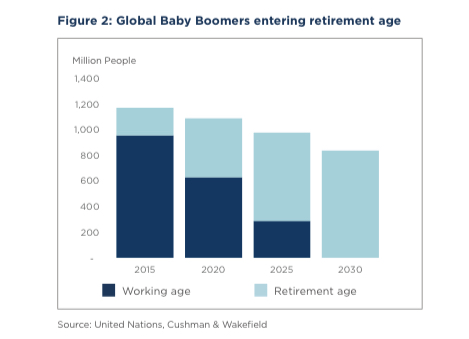

In the next 10 years, millennials will be dominating the workforce globally; Generation Z will comprise 26 percent of the world’s population, and most Baby Boomers will be facing retirement. Such “seismic demographic shifts,” says an international real estate services firm, are bound to affect the evolution of the world’s cities, which will need to adapt to ensure they attract the businesses and talent that they need.

According to Cushman & Wakefield, in its recent report “Demographic Shifts: The World in 2030,” the following changes should be expected by countries across the globe in the next decade:

• Around two-thirds of Boomers (born between 1946 to 1964) will reach the age of 65 by 2025; by 2030, all of them will have reached this milestone;

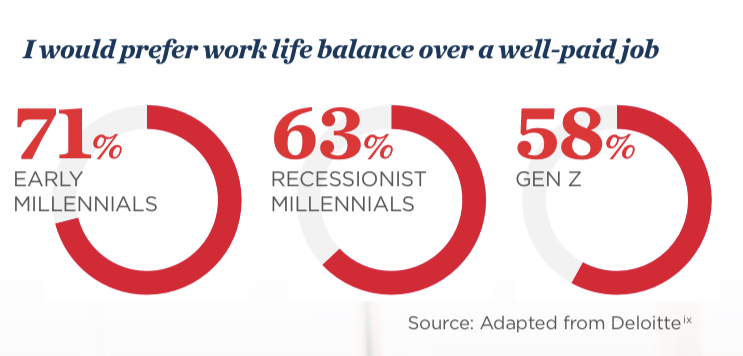

• Millennials (1981-1996) will represent 40 percent of the global working age population. By 2030, the oldest of this bunch will turn 50 (it’s time to stop using the term to refer to young people);

• Gen Z (1997-2012), the digital natives, will be joining the workforce. Citing a survey by employer branding specialist Universum, this cohort, compared to millennials, are more interested in becoming professionals rather than entrepreneurs. Additionally, Gen Zs seem to be more financially driven, with plans of earning high salaries, buying their own home, and starting a family.

Such shifts are expected to affect certain industries, the report adds. Take the Boomers’ retirement: Because this is a generation that’s “ready to spend,” leisure travel is one industry that will benefit greatly from this group’s activities. Traditional retail will also likely see a resurgence, since Boomers still prefer to shop in-store. Health care, in particular, largely benefit from this aging generation—according to the report, global health care expenditures are expected to increase by 5 percent per year until 2022, and reach over $10 trillion.

Millennials, the most talked about (read: criticized) generation, are expected to have the fastest growth in net wealth in the next decade, the report says. They are still “perennial renters,” but the report indicates that members of this are already looking to purchase their own homes. “As the trailing end of millennials enter family-formation age, this could be the catalyst for change,” the report reads.

Talking about property ownership, the report also notes that for millennials, the most important factor isn’t the usual location, location, location—what they want is to be close to high-amenity areas. Low-cost residential areas with strong civic centers, transportation services, and lifestyle service providers (i.e. gyms, childcare facilities, restaurants) are, therefore, attractive to this bunch.

As for the digitally native Gen Z (the report notably skips Gen X, or the “sandwich” generation), it comes as no surprise that the report says they expect the technology that they use to offer experiences that are nothing short of seamless. “Experiential” retail and e-commerce are two industries that are seen to benefit most from Gen Zs. However, being extremely tech-capable also has a downside: the report says Gen Zs may need help developing their emotional and social skills.

Taking all these into consideration, the report focuses on what cities can do to cope with such demographic shifts. First, it states that placemaking, or “a multifaceted approach to the planning, design and management of public spaces,” is critical to these cities. According to Cushman & Wakefield, factors that need to be considered in placemaking are livability, talent attraction, business attraction, sustainability, connectivity, and diversity and inclusion.

The report helps cities determine what they should work on in terms of placemaking by classifying cities into four categories, based on the correlation of labor force growth and rate of real gross domestic product (GDP) growth over the next decade. These are:

1) Leaders, or cities where both population and GDP growth are above the global average;

2) Low productivity growth, where population growth is driving GDP gains, which are below the global average;

3) High productivity growth, where population growth is below the global average, but innovation in productivity is driving GDP growth above the global average;

4) and Laggards, where both population growth and GDP growth are below the global average.

The Leaders, according to the report, are dominated by Indian and Southeast Asian cities—including Manila. The forecast for these cities is a demographic windfall, with particularly high population growth of millennials and Gen Zs, and a low aging rate. Companies looking to outsource work will most likely head to these cities.

High productivity growth cities, which are mostly from China, are expected to attract greater institutional investment, and have strong economic growth. As for those that fall under Low productivity growth and Laggards, these cities need to address the issue of population aging, especially in North Asia where Boomers leaving the workforce are not being replaced by younger generations.

“While we recognize the importance of distinguishing between the differing demographics, we believe that understanding how we can all work together is critical,” the report says. “These changes won’t occur overnight; there will continue to be a mix of different age groups and expectations that have particularly different influences on real estate over the coming decade.”