Ecozones as a catalyst for growth

RA 7916 provided the legal framework and mechanisms for the creation, operation, administration and coordination of the special economic zones in the Philippines and created the Philippine Economic Zone Authority (Peza), tasked to regulate and supervise the enterprises in the ecozone.

The law grants special tax incentives and tax holidays to business establishments operating in the ecozones, such as the 5-percent gross income earned (GIE) tax which many companies in ecozones pay in lieu of local and national taxes.

Business activities eligible for Peza registration and incentives include export manufacturing, information technology, tourism, medical tourism, agro-industrial export manufacturing, agro-industrial bio-fuel manufacturing and logsitics and warehousing services.

Contribution to economy

A year before the law was enacted, pledges under the then Export Processing Zone Authority only reached P9.6 billion. When the enabling law was amended the following year to make way for today’s Peza, the figure surged to P52.5 billion, previous reports said.

Peza-registered companies, which according to the agency had poured into the economy more than P10 trillion in recent years, are required by law to export most of their output, making them a critical part of the country’s export industry. Their exports reportedly accounted for 70 percent of the P10.05 trillion contribution of Peza firms to the economy from 2015 to 2017.

Exports made by Peza-registered firms account for the bulk of the country’s exports.

In 2015, Peza said these companies were responsible for 59 percent of total merchandise exports, 65 percent in 2016, and 64 percent in 2017.

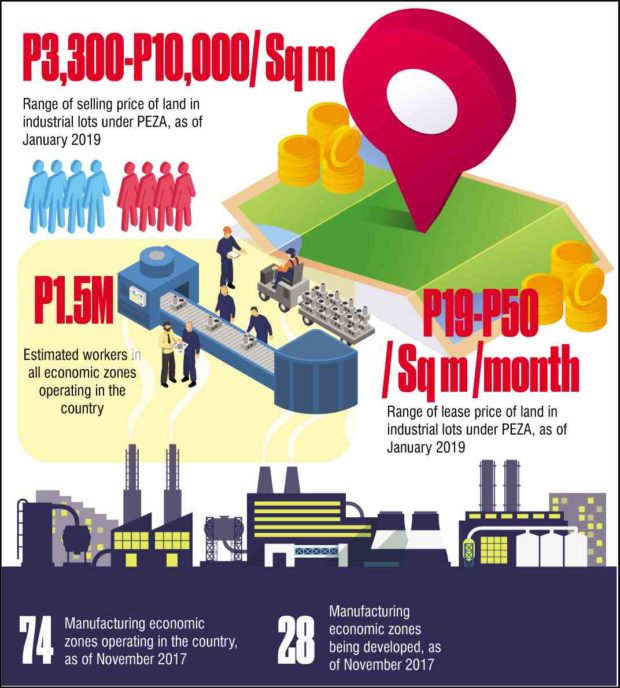

As of November 2017, there are nearly 400 operating economic zones across the country either classified as manufacturing, information technology park or center, agro-industrial, tourism or medical tourism park or center while 139 economic zones were being developed.

Industrial powerhouse

The Calabarzon Region, the industrial powerhouse of the country, is home to 35 of the country’s 74 manufacturing special economic zones, making the region as a hub providing a big supply base of semi-processed industrial raw materials and industrial components.

Located in the adjacent south of Metro Manila, Calabarzon registered an economic growth of 7.3 percent in 2018, its fastest in six years, as industry and services sector expanded.

Prime destination

Businesses consider Calabarzon a prime destination with investment opportunities in electronics and semiconductor products, housing construction, ICT services, boosting its economy as it seeks to become a more vibrant, progressive, resilient and competitive region.

Meanwhile, 155 of the country’s 262 IT parks and centers are located in Metro Manila where the business process outsourcing (BPO) industry continues to generate revenues and jobs for many Filipinos.

However, in an effort to boost countryside development, President Duterte issued Administrative Order 18, which slapped a moratorium on having new ecozones in Metro Manila starting June 22.

Source: Inquirer Archives, peza.gov.ph