Villar plans to amend Agri-Agra Law to genuinely help more farmers, fishermen

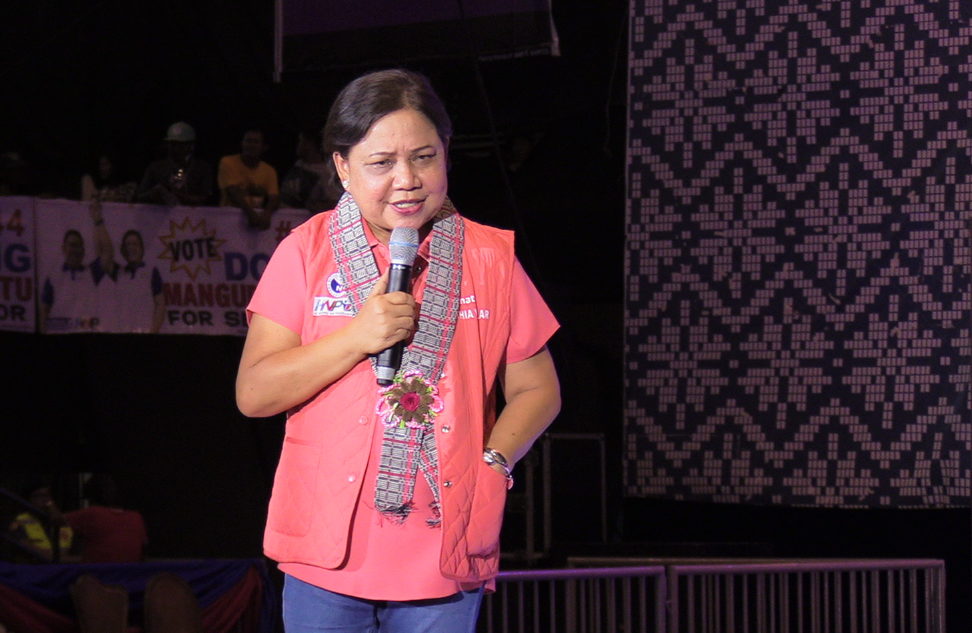

Sen. Cynthia Villar. INQUIRER.net file photo / CATHY MIRANDA

MANILA, Philippines–Senator Cynthia Villar said she is looking to pass amendments in the Agri-Agra Law this year after President Rodrigo Duterte threatened to abolish state-owned lender Landbank of the Philippines for allegedly failing to extend enough credit for farmers and fisherfolk.

During the sidelines of the 2019 Sustainable Agriculture Forum in Pasay City on Wednesday, the lawmaker said she plans to amend the 44-year-old law to ensure that enough funds are being funneled to the agriculture industry which has been lagging behind in terms of growth.

These amendments, however, have yet to be determined.

“We don’t know [the amendments] yet but we are failing there because instead of lending to farmers, banks are paying penalty… We have to find what’s wrong with the law,” she said.

The measure, which was passed during the regime of the late strongman Ferdinand Marcos, requires banks to set aside 25 percent of their loanable funds for agricultural and agrarian reform financing.

Article continues after this advertisementAlthough at present, banks hardly lend to the farm sector due to the perceived risk in investing in the industry. To comply, financial institutions simply invest in government securities that are eligible as substitutes for agricultural loans or pay the penalties imposed.

Article continues after this advertisementVillar was especially alarmed with the banks’ low compliance rate in terms of giving out loans for land reform programs. On average, banks have only extended 2 percent of their loan funds for land reform projects. Under the law, they are mandated to loan 10 percent.

“The problem is with DAR (Department of Agrarian Reform) because for agricultural loans, banks are supposed to give 15 percent of their loan portfolio and they have given around 12 percent. But in agrarian reform programs it’s so small.. it should be 10 percent but they have only used 2 percent so there’s something wrong. Maybe it’s not feasible, we have to review,” she added.

Bankers Association of the Philippines executive director Benjamin Castillo said in an interview with Inquirer that their low direct compliance rate is due to the high-risk tendencies of lending to farmers which may send jitters to their clients.

Compared to other industries, investments in agriculture could easily be compromised by occurrences of typhoons, drought, and other natural disasters.

The Bangko Sentral ng Pilipinas has also been pushing for reforms in the Agri-Agra Law that could expand the projects that banks can fund in order to comply with their lending obligations.

Last year, banks were able to extend P707.4 billion of total loanable funds for agriculture and agrarian reform credit, or about 14.25 percent of their entire portfolio.

This is way below the 25-percent minimum threshold set by the law, although higher against the industry’s compliance in 2017 at 12.38 percent. /jpv