Manila seen attracting fair share of climate-related investments

East Asia Pacific, thanks to its growing urban population, has the highest potential to attract climate-related investments in six key sectors by 2030 compared to other regions, says a recent report by International Finance Corp. (IFC), a member of the World Bank Group.

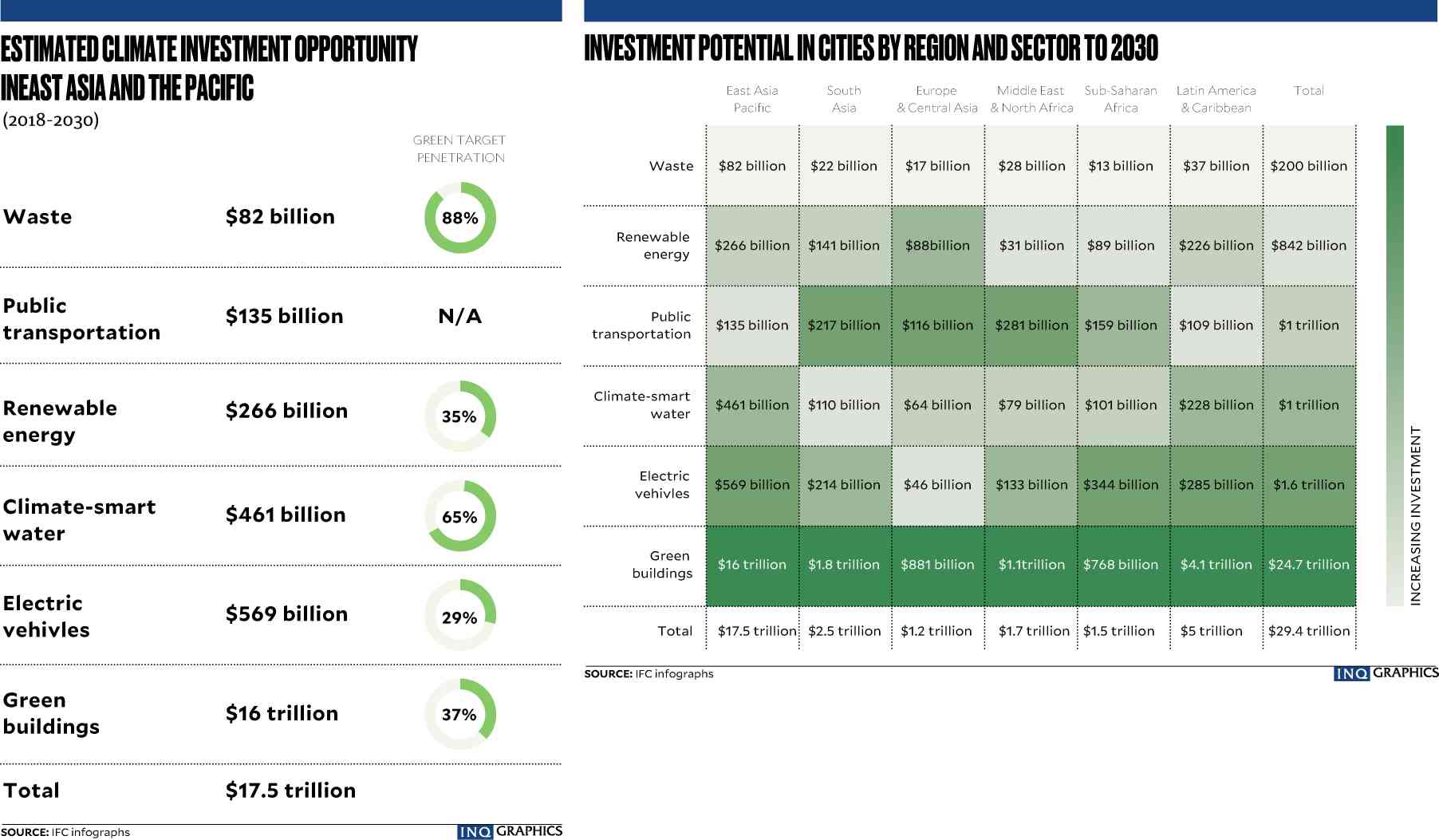

According to “Climate Investment Opportunities in Cities,” East Asia Pacific cities could attract a total of $17.5 trillion by 2030 in climate-related projects concerning waste ($82 billion), public transport ($135 billion), renewable energy ($266 billion), climate-smart water ($461 billion), electric vehicles ($569 billion) and green buildings ($16 trillion).

The report cites these reasons for such investment opportunities:

In most East Asia Pacific countries, cities account for 80 percent of gross domestic product (GDP).

Economic opportunities in these places attract more people, and in 35 years, Asian cities’ population is expected to balloon to a total of 1.2 billion. With many urban centers located in typhoon- and flood-prone areas—Bangkok, Guangzhou, Ho Chi Minh, Manila, Shanghai and Yangon—leaders, along with businesses, are developing climate resiliency solutions while remaining at the forefront of economic growth.

Article continues after this advertisementCities are also setting their own climate agendas that will invite investment into key climate-smart sectors and projects, such as Kuala Lumpur’s commitment to reduce emissions by 20 percent by 2022 through energy-efficient buildings, and Ho Chi Minh’s city climate change action plan, which also focuses on reducing emissions by 19 percent by 2020.

Article continues after this advertisementClimate resilience and mitigation is being embedded into East Asia Pacific cities’ social, economic and development policies. Locally, the Manila Bay Integrated Flood Control, Coastal Defense and Expressway Project is one example, as it seeks to mitigate the climate impact of typhoons while improving road access.

Lastly, Chinese cities are leading in the electrification of the transport sector, with the projection that by 2030, three out of 100 people in the country will own a private electric vehicle.

“With the expected dramatic increase in urban population centers in Asia, there’s even more of an opportunity for a low-carbon transition in cities, which already account for much of the GDP in this region,” says IFC regional director for East Asia and the Pacific, Vivek Pathak. “In Jakarta, there’s a $30- billion investment opportunity, particularly in green buildings, electric vehicles and renewable energy. The report shows megacities in Asia also have significant potential for investments that yield emission reductions.”

The report analyzes cities’ climate-related targets and action plans in five other regions—South Asia, Europe and Central Asia, Middle East and North Africa, Sub-Saharan Africa, and Latin America and the Carribean—identifying opportunities in priority sectors such as green buildings, public transportation, electric vehicles, waste, water and renewable energy.

According to the report, globally, green buildings will account for $24.7 trillion of cities’ climate investment opportunities. There is also significant investment potential in low-carbon transportation solutions such as energy-efficient public transport ($1 trillion) and electric vehicles ($1.6 trillion). Clean energy ($842 billion), water ($1 trillion) and waste ($200 billion) remain essential components of sustainable urban development.

The report also highlights innovative approaches that cities are already using—such as green bonds and public-private partnerships (PPPs)—to attract private capital and build urban resilience.

IFC, the largest global development institution focused on the private sector in emerging markets, has invested, since 2005, $22.2 billion in long-term financing from its own account and mobilized another $15.7 billion through partnerships with investors for climate-related projects.

One such project here in Manila is the Light Rail Transit, a PPP which the IFC supported through the then Department of Transportation and Communications.

According to the report, IFC helped in the selection of a private concessionaire to operate the existing system, as well as develop and operate the Cavite extension.

The project has so far yielded $512 million in fiscal benefits and will reduce CO2 emissions by 40,000 tons per year—equivalent to eliminating 8,500 cars—by providing public transport to hundreds of thousands of commuters every day.

“There’s a great urgency to address climate change—we must take meaningful action now,” says IFC CEO Philippe Le Houérou. “Cities are the next frontier for climate investments, with trillions of dollars in untapped opportunities. To deliver on the promise of climate-smart cities, the public sector needs to enact reforms that are aimed at attracting more private sector financing.”

The report, which is part of the “Climate Investment Opportunities” series started by IFC in 2016, is available at https://www.ifc.org/wps/wcm/connect/Topics_Ext_Content/IFC_External_Corporate_Site/Climate+Business/Resources/climate+investment+opportunities+report+series.