Globalizing corporate Philippines

For the longest time, the Philippines has been stereotyped as a principal source of cheap labor. Indeed, we have exported many of our people to greener pastures abroad.

But as the country shed its “sick man of Asia” status in recent years, the Philippines is now much better appreciated as a vibrant consumer market given a steadily growing economy and a sizeable population of more than 100 million, mostly young people.

It’s the same economy that has nurtured enterprises that have grown big enough, and confident enough, to compete in a regional, if not global, marketplace. Over the last three decades, we have seen more of these Filipino conglomerates and companies spread their wings. Thus, we are becoming an exporter of capital as well.

Gone are the colonial days of the East. These days, it’s not surprising to hear about an Asian company taking over long-standing companies in the West. Or building a new business from scratch. Or bagging a much-sought big-ticket contract. Sure, most of them are Chinese, but some may just involve Philippine companies.

It’s not exactly like landing on the moon for the first time but it’s a big deal because in an increasingly borderless world—even as protectionism is on the rise in some places at this time—these local companies have set the bar higher. They gain valuable experience in running businesses across multiple markets, in dealing with regulators in various jurisdictions and collaborating with their foreign counterparts. So while they are fiercely guarding their home turf in emerging markets, they are also expanding their overseas footprint and blazing the trail for other local companies who aspire to go global.

Based on a 2017 survey conducted by PwC/Isla Lipana for the Management Association of the Philippines, 45 percent of chief executive officers in the Philippines said they were keen on expanding to overseas markets, particularly in Southeast Asia. Most tend to expand to neighboring emerging markets first but some have gained a foothold even in the most challenging places.

As we celebrate the Inquirer’s 33rd anniversary, we feature 33 Philippine companies that are making inroads into the global stage.

1. SM PRIME HOLDINGS

It was in the Philippines that tycoon Henry Sy found his fortune, but he never forgot about the land of his birth. Perhaps it’s both for sentimental and practical reasons, but after building a shopping mall empire in the Philippines, SM Prime found an opportunity to set up shops in mainland China as well.

When the SM group started investing in mainland China at the turn of the millennium, the strategy was to be there for the long haul. If China is 10 times bigger than the Philippines in terms of consumer base, then there’s big room to set up new malls, but the group’s strategy has been to target third-tier cities rather than slug it out in the biggest ones.

The first SM mall in China opened in Xiamen in 2001, then privately owned by the Sy family, with a gross floor area of 128,000 square meters, almost similar in size to SM City Sta. Mesa. By 2007, there were three malls in China—Xiamen, Jinjiang and Chengdu—and the China business has become mature enough for the Sy family to fold the business into SM Prime.

These days, SM Prime has 72 shopping malls in the Philippines and seven shopping malls in China. The malls in China are located in the cities of Xiamen, Jinjiang, Chengdu, Zibo, Chongqing, Tianjin and Suzhou.

SM pioneered shopping mall development in Jinjiang. Not coincidentally, the home city of the founder of SM or Shoemart group has become a major global supplier of shoes—sometimes referred to as the “shoe capital” due to a yearly international shoe expo that has successfully attracted a lot of international attention.

“We don’t do things six months, one year ahead. We always look at where will be and what can we be five years from now,” SM Prime chair Jose Sio said.

Andrew Tan’s Emperador, with Fundador in its portfolio, now the biggest brandy maker in the world —CONTRIBUTED PHOTO

2. EMPERADOR INC.

When real estate tycoon Andrew Tan goes to Europe for shopping, he shops for companies and assets. He has a special affinity for Spain, whose Fundador brandy inspired him to set up his own brandy business, Emperador. Decades later, Emperador would end up buying Fundador to become the biggest brandy maker in the world.

Emperador debuted in Europe in 2013 with the acquisition of Bodega San Bruno S.A., a brandy company based in Jerez, Spain, from González Byass S.A., one of the largest and oldest liquor and wine conglomerates in Spain. The deal includes the acquisition of the San Bruno trademark, which has been registered since 1942, as well as vineyards, alongside a sizeable inventory of high-quality and well-matured brandy, now being stored and aged in sherry casks in the bodegas, or wineries. Afterwards, Emperador acquired 409 hectares of additional vineyard land in Madrid, then bringing close to 1,000 ha its vineyard land bank in Spain.

Emperador also invested P3.7 billion in acquiring a 50-percent stake in integrated brandy producer Bodega Las Copas S.L., a unit of Spain’s popular sherry bodega González Byass (same group that sold San Bruno) in early 2014. Las Copas’ operations in brandy-making run the full scale with its vineyard near Toledo, its distillery plant in Tomelloso, Ciudad Real, and its Las Copas brandy production premises all in Jerez. The 275-ha specialized vineyard project of Bodega Las Copas near Toledo is the first of its kind in Spain to grow the finest grapes dedicated exclusively for brandy distillation and production.

These initial deals boosted Emperador’s profile and prepared it for even bigger deals in the beverage space. In 2014, it outbid a number of global consumer powerhouses to bag a 430-million pound deal to take over iconic Scottish whisky-maker Whyte &Mackay, the fifth largest maker of Scotch whisky in the world with a history of more than 160 years. It owns some of the most iconic Scotch brands in the industry, including the British luxury brand The Dalmore Single Highland Malt, Jura Premium Single Malt and Whyte & Mackay Blended Scotch whiskies. It holds one of the world’s largest stock of aged whisky.

But Emperador’s purchase of Bodegas Fundador, Spain’s most iconic, largest and oldest Spanish brandy maker, was the one most memorable to Tan. With Fundador now under its wings, Emperador controls almost 1,500 ha of vineyard land, around 1 million sqm of cellar and bottling facilities and four distilleries in Spain.

Emperador portfolio of beverages can now be found in over a hundred countries around the world.

3. JOLLIBEE FOODS CORP.

The joy of eating is something that Tony Tan Caktiong and his siblings enjoyed growing up as their father was a chef. Together with Grace, the classmate who became his better half, he started two Magnolia ice cream houses after they graduated in 1975 and founded Jollibee in 1978. Capturing the Filipino preference for tasty meat and sweet spaghetti, Jollibee Foods Corp. (JFC) has become a multibrand multinational company.

Jollibee is now the most valuable Asian restaurant chain. Tony Tan Caktiong’s dream is to become one of the five most valuable restaurant chains in the world. Before, Jollibee’s offshore expansion followed where the overseas Filipinos were, but these days, Jollibee is a company that can go local by acquiring homegrown chains—as what it did in China, Vietnam and the United States.

As of end-September 2018, Jollibee operates the biggest food service network in the Philippines with 3,003 restaurant outlets, close to a third of which are Jollibee stores while the rest are Chowking, Greenwich, Red Ribbon, Mang Inasal, Burger King and Pho24.

Overseas, it was operating 1,350 stores. Its largest markets are mainland China, Vietnam and the United States.

In China, it has 314 stores of Yonghe King and 42 stores of Hong Zhuang Yuan and 14 Dunkin Donut branches. In Vietnam, it operates 253 Highlands Coffee shops, 107 Jollibee restaurants, two Hard Rock Cafes and 17 Pho24. In the United States, it has 347 stores under the Smashburger brand plus 37 Jollibee stores, 32 Red Ribbon stores and 15 Chowking outlets.

The Jollibee brand is also present in Brunei (with 16 stores), Hong Kong (8), Singapore (6), Macau (1), Canada (4), Saudi Arabia (13), UAE (14), Qatar (7), Kuwait (6), Bahrain (1), Oman (1) and Italy (1).

Jollibee entered Macau and Italy earlier this year and likewise debuted in London in October. It plans to enter Malaysia and Guam. Jollibee has a total of 222 stores overseas. The JFC group’s worldwide store network reached 4,353 stores. To date, Jollibee is one of the most recognizable Filipino brands.

Most recently, Jollibee entered the Mexican restaurant space in the United States by investing in the Tortas Frontera business founded by Chef Rick Bayless. This partnership was formalized through an investment by JFC of $12.4 million in Tortas Frontera LLC, in exchange for a 47-percent stake. The remaining 53 percent will be held by Bayless and other shareholders.

Mexican food is a rapidly growing and very popular segment in the US restaurant industry with estimated sales of as much as $45 billion in 2017.

4. LIWAYWAY MARKETING CORP.

Business tycoon Carlos Chan, who leads the company that produces the “Oishi” snack food brand, anticipated the opening of China to the global economy decades ago. Being an early mover, Liwayway has thus become one of the most successful Philippine companies to do business in China, where it has 15 factories. It is among the top five snackfood producers in China in the sweet and savory category.

Currently, Liwayway operates a total of 29 production facilities across nine countries: the Philippines, China, Vietnam, Indonesia, Thailand, Myanmar, Cambodia, India and South Africa.

Next to China, Liwayway’s large overseas markets are Vietnam, where it has four factories, and populous Indonesia, where it has one factory.

Liwayway currently derives about 70 percent of its business from its overseas sites.

“Our South Africa operation has begun and we are eyeing a possible entry into Bangladesh, provided opportunities and conditions are right,” said Heinrich Cochien, assistant vice president for corporate affairs.

5. UNIVERSAL ROBINA CORP.

Not content with being one of the largest agro-industrial and commodity foods in the Philippines, the group of tycoon John Gokongwei Jr. had long envisioned to grow the business empire across the region. The group started sowing its seeds across the region even before the creation of the Asean Economic Community became a reality. In recent years, the group widened its horizon to Oceania by acquiring market-leading players in Australia and New Zealand.

In 2014, it acquired Griffin, New Zealand’s leading biscuits company with a 150-year baking heritage, producing over 300 products from its two manufacturing sites in Auckland. This was followed by its acquisition in 2016 of Snackbrands Australia, the second largest player in salty snacks in Australia.

In Asia, Universal Robina Corp. (URC) is present in 13 markets. It has production sites in China, Myanmar, Thailand, Vietnam, Malaysia and Indonesia, exclusive distributor presence in Laos and Cambodia, as well as sales offices in Hong Kong and Singapore. In the Philippines, it has 19 production sites, two of which are for packaging and 17 are for branded consumer foods.

URC is the No. 1 player in the Philippines in snacks, candies, chocolates, ready to drink tea, noodles and sugar, while it’s No. 3 in coffee, biscuits and pasta categories.

In Thailand, it is the No. 1 producer of biscuits and wafer, while in Vietnam, it’s the third biggest player in the ready-to-drink business.

It’s the No. 1 player in sweet biscuits in New Zealand and No. 2 in crackers and salty snacks.

6. SAN MIGUEL FOOD AND BEVERAGE

The newly consolidated consumer powerhouse of storied conglomerate San Miguel Corp. has long been expanding its traditional businesses outside the Philippines long before the parent firm decided to diversify into new businesses.

San Miguel, to date, is still among the most well-known Philippine brands.

For the beer business under San Miguel Brewery, the group has six breweries in the Philippines and six overseas: Two in China, one in Hong Kong, one in Thailand, one in Vietnam and another in Indonesia. Plans are underway to invest up to $150 million in setting up a new beer brewery in Los Angeles, California, to cater to growing demand for its beer products in North America.

For the food group, San Miguel has 22 production facilities, 20 of which are located in the Philippines and two are overseas—in Vietnam and in Indonesia, along with 15 company-owned farms in the Philippines. It also uses more than 60 tolled production facilities.

For the hard liquor business under Ginebra San Miguel, the group has a bottling and distillery plant in Kanchanaburi, Thailand, on top of five bottling plants and one distillery in the Philippines.

Outside the food and beverage business, San Miguel’s packaging business has likewise gone regional. In China, this business operates in three sites, one for glass, another for plastics and one for paper packaging. In Vietnam, the group has one glass and one metal packaging site. In Australia, the group has grown through a series of acquisitions and now operates a plastic packaging site, a trading site and a wine closure and bottling hub. The group also has a plastics and trading hub in New Zealand and a flexible packaging hub in Malaysia.

7. INTERNATIONAL CONTAINER TERMINAL SERVICES INC.

In the early 2000s, tycoon Enrique Razon Jr. sold the overseas business of International Container Terminal Services Inc.

(ICTSI) Hutchison Whampoa of Hong Kong to pare down debt in the aftermath of the Asian currency crisis. Since then, he has rebuilt the overseas portfolio of ICTSI and has entered the most number of foreign markets among globalizing Philippine companies.

As of Nov. 7, 2018, ICTSI has a footprint in 18 countries worldwide, operating 31 terminal concessions. It also has the most exotic markets in its overseas portfolio. It operates in two sites in Indonesia and one each in China, Ecuador, Brazil, Poland, Georgia, Madagascar, Croatia, Pakistan, Mexico, Honduras, Iraq, Argentina, Colombia, Democratic Republic of Congo, Australia and, recently, Lae and Motukea in Papua New Guinea.

It also has an existing concession to construct and operate a port in Tuxpan, Mexico.

It previously operated the Muara Container Terminal in Brunei Darussalam and likewise operated in Oregon, Portland, but the respective contracts on these facilities ended.

Suffice to say, ICTSI knows its way around global markets.

8. DEL MONTE PACIFIC LTD.

It’s not often that a company gets to buy another company bigger than itself. Even rarer is a company that buys its American parent brand. The Campos family-led Del Monte Pacific Ltd. (DMPL) did just that in 2014 when it acquired the US consumer food business of Del Monte Foods Inc. (DMFI), which has since become its subsidiary.

Its subsidiaries are principally engaged in growing, processing and selling canned and fresh pineapples, pineapple juice concentrate, tropical mixed fruit, canned peaches and pears, canned vegetables, tomato-based products and other food and beverage products mainly under the brand names of “Del Monte,” “S&W,” “Today’s,” “Contadina” and “College Inn,” among others. The group also produces and distributes private label food products.

DMFI generated sales of $1.7 billion or 75.3 percent of group sales in the fiscal year ended April 2018. This US subsidiary has been focused on strengthening its leading share positions amid canned vegetable and fruit industry contraction.

Sales at FieldFresh Foods, DMPL’s Indian joint venture (where equity is accounted and not consolidated) amounted to $72.9 million in the last fiscal year.

Apart from its main manufacturing sites in India, the United States and the Philippines, the group has manufacturing presence in selected Latin American countries such as Venezuela, Colombia and Mexico, alongside distribution units in Peru and Ecuador.

9. UNITED LABORATORIES

Unknown to many, homegrown pharmaceutical giant United Laboratories (Unilab) has grown to be the biggest pharmaceutical company in Southeast Asia. Whether wholly owned or through affiliates, the Unilab group now has six factories in the Philippines, two in Indonesia and one each in Vietnam and Thailand. Some of its manufacturing facilities overseas are operated by affiliates. It had acquired a local company to gain a foothold in Indonesia but for the rest of its overseas markets, it has built its business from scratch. Products made in Vietnam are now being exported to other countries such as Myanmar and Singapore.

The group also manufactures medicine in Shanghai, China, and has been working to make inroads into the Middle East in recent years.

10. MONDE NISSIN

“Noodle” queen Betty Ang-led Monde Nissin is best known in the Philippines for the “Lucky Me!” instant noodles. In recent years, it has been expanding its overseas production capability through a string of acquisitions. In recent years, it has acquired three companies in Australia and one in the United Kingdom as part of its goal to build a global branded food business.

In 2015, Monde Nissin bought Quorn Foods from Exponent Private Equity and Intermediate Capital Group for the amount of 550 million pounds. Quorn is an international meat alternatives business, with market leading position in 15 countries. It has around 620 employees in three UK sites, in Germany, and in the United States. This acquisition marked Monde Nissin’s diversification into healthy food production.

In 2014, Monde Nissin acquired Black Swan, the leading brand of chilled dips in Australia. Aside from chilled dips, Black Swan is also a manufacturer of Greek yogurt. The following year, it acquired Nudie, a manufacturer, marketer and distributor of pure premium juices in Australia. Nudie has a line of fruit juices without preservatives, without colorings, without additives, without concentrates or added sugar. Nudie also owns one of the leading coconut water brands in Australia. More recently, the company launched a range of carbonated beverages made with 50-percent real fruit, and likewise without preservatives, colors, concentrates or artificial flavors added.

Furthermore, Monde Nissin acquired Menora Foods, one of Australia’s biggest and most innovative food marketers and distributors. It sells dips, condiments, pasta, beverages, confectionery, cakes, snack foods, and general merchandise, among others. The company also carries homegrown brands Wattle Valley dips and Peckish rice crackers, which are leaders in their respective product categories, alongside international consumer brands including Phillips, Chobani, Bonne Maman and Maille.

11. INTEGRATED MICRO-ELECTRONICS INC.

One of the world’s largest electronic manufacturing service providers (EMS) is domiciled in the Philippines. We’re talking about Ayala-led Integrated Micro-Electronics Inc. (IMI), which specializes in highly reliable and quality electronics for long product life cycle segments such as automotive, industrial electronics and more recently, the aerospace market.

Only recently, IMI opened in Serbia’s City of Niš the 21st factory in its growing global network. This newest hub in Serbia is seen to complement IMI’s production facilities elsewhere in the world—in the Philippines, China, Bulgaria, Czech Republic, Germany, Japan, Mexico, the United Kingdom, and the United States. These are on top of the production facilities of other AC Industrials companies in Germany, Thailand, United States, and the Philippines.

IMI ranks 18th in the list of top 50 EMS providers in the world, based on the research of Manufacturing Market Insider (March 2018 edition). In the automotive market, it is now the fifth largest EMS provider in the world per New Venture Research.

12. METRO PACIFIC INVESTMENTS CORP.

With its growing investments in toll roads across the region, the infrastructure holding firm led by businessman Manuel Pangilinan now operates the road network with the biggest vehicular traffic volume in the region.

Locally, Metro Pacific Investments Corp.’s (MPIC) toll road business through subsidiary Metro Pacific Tollways Corp. (MPTC) includes operation and maintenance of the North Luzon Expressway, Cavite Expressway and Subic-Clark-Tarlac Expressway.

Average daily vehicle entries for all three of MPTC’s domestic tollways system rose by 7 percent to 471,634 compared with 438,861 in the first nine months of 2017. Including its overseas toll roads, system-wide vehicle entries rose by 55 percent year-on-year to an average of 916,169 a day in the first nine months due mainly to the traffic contribution from its investment in PT Nusantara Infrastructure Tbk in Indonesia.

“Our presence in the Philippines, Thailand, Vietnam and Indonesia means we are well on the way to establishing the first-ever Pan-Asean (Association of Southeast Asian Nations) tollways group,” parent conglomerate MPIC said in its latest quarterly report.

Apart from PT Nusantara, MPTC’s foreign investees include CII Bridges and Roads Investment Joint Stock Co. (CII B&R) in Vietnam and Don Muang Tollway Public Ltd. in Thailand.

PT Nusantara has become subsidiary in July 2018 as MPTC increased its interest in the company from 48.3 percent to 53.3 percent. This step-up acquisition triggered the need for a tender offer, which further increased MPTC’s ownership to 77.94 percent.

Meanwhile, MPIC acquired 49 percent of Tuan Loc Water Resources Investment Joint Stock Co. (TLW), one of the largest water companies in Vietnam, for P1.99 billion. The deal was done through wholly owned subsidiary MetroPac Water Investments Corp. TLW is one of the leading water companies in Vietnam, with 310 million liters per day (MLD) of installed capacity and a billed volume of around 87 MLD as of year-end 2017. Majority of TLW’s operating capacity targets industrial parks.

13. MANILA WATER CO.

Manila Water Co.’s (MWC) overseas expansion started in Vietnam 10 years ago, and has since then invested $120 million in this market. It has also invested $170 million in Thailand with the acquisition of 18 percent of East Water. It also debuted in Indonesia with a 20-percent stake in bulk water supply company PT Sarana Tirta Ungaran.

It all started when MWC was contracted in Vietnam’s Ho Chi Minh City in the mid 2000s to plug pipeline leaks. This was followed by investments in a couple of water treatment plants and water distribution business in that country.

This company is now the largest foreign direct investor in Vietnam’s water space with over $120 million in investments. In 2012, it spent $21 million to acquire 49 percent of CII Water while its parent, Ayala Corp., invested $14 million for a 10-percent direct equity in CII.

MWC is now scouting for new bulk water projects in Indonesia and Vietnam, in line with plans to expand its footprint across Southeast Asia and grow its overseas business to account for 10 percent of total business.

14. PETRON CORP.

Petron Corp., the country’s largest oil refiner and distributor, took a big step toward regionalization in 2011 with the acquisition of the downstream petroleum businesses of American multinational oil and gas company Exxon Mobil Corp. in Malaysia for about $600 million.

Exxon, through subsidiary Esso Malaysia Berhad, had at that time a refinery in Port Dickson that processed an average of 45,000 barrels of crude oil per day. It also managed a major portion of ExxonMobil’s network of 560 Esso and Mobil service stations in Malaysia.

These days, Petron operates over 2,400 service stations in the Philippines and 600 in Malaysia. ExxonMobil’s network had been rebranded as Petron Malaysia.

The refinery at Port Dickson had likewise been expanded since then and now has a refining capacity of 88,000 barrels per day. This complements the 180,000-barrel-per-day capacity of Petron’s integrated refining capacity in Bataan, the largest and most advanced petroleum refinery complex in the Philippines.

Furthermore, Petron has about 10 product terminals in Malaysia alongside its 30 depot terminals in the Philippines.

15. AC ENERGY

After building a critical mass of energy portfolio in the Philippines, AC Energy sees a lot of opportunity to invest in regional markets given strong demand for energy in selected markets.

Of the first $1 billion of AC Energy’s committed capital, 20 percent had been invested overseas, particularly Vietnam and Indonesia. Of the next $1 billion that AC Energy will invest, more than half will likely go to overseas projects, EC Energy president Eric Francia had estimated.

In Indonesia, AC Energy is part of a group that operates Salak & Darajat in West Java. This 637-megawatt project is the largest geothermal energy asset registered under the CDM program in 2007. AC Energy has a 20-percent stake and an attributable capacity of 126 MW. This is operated by Star Energy Geothermal, a joint venture of AC Energy, Star Energy Group and Electricity Generating Public Co. The project cost is $170 million.

Another operating asset in Indonesia is the 75-MW Sidrap Wind project in Sulawesi, where AC Energy has an economic stake of 75 percent and an attributable capacity of 56 MW. This is the first utility-scale wind farm project in Indonesia and the first offshore greenfield investment of AC Energy. This wind farm, operated by a joint venture firm set up by AC Energy and UPC Renewables, started operations in March 2018.

AC Energy has likewise provided funding for the development of UPC Renewables’ power generation projects with generation capacity of less than 50 MW.

In Vietnam, AC Energy has taken a 50-percent stake in the 80-MW solar farm of AMI/AC Renewables in Khan Hoa and Dak Lak. To be built at an estimated cost of $83 million, it is expected to start operations in time for the June 2019 solar feed-in tariff deadline.

Through AMI/AC Renewables, the group also holds a 50-percent stake in the 250-MW wind farm project at Quang Binh Province in Vietnam. This $463-million project is targeted to be completed by the second half of 2021.

In Australia, AC Energy invested $30 million for a 50-percent stake in UPC Renewables’ Australian business. It also earmarked $200 million to fund project equity. UPC is developing the 1,000-MW Robbins Island and Jims Plain projects in northwest Tasmania and the 600-MW New England Solar Farm located near Uralla in New South Wales (NSW). UPC and AC Renewables have also mapped out a development portfolio of another 3,000 MW in NSW, Tasmania and Victoria.

AC Energy has also acquired a 25-percent stake in The Blue Circle (TBC) alongside coinvestment rights in TBC projects. AC Energy and TBC will jointly develop, construct, own and operate TBC’s pipeline of around 1,500 MW of wind projects across Southeast Asia, including 700 MW in Vietnam. TBC pioneered wind farm development in Vietnam. The joint venture with TBC is expected to start construction of around 200 MW of wind farms in Vietnam in 2019.

16. ABOITIZ EQUITY VENTURES

The Aboitiz Group is fairly newer in overseas investing compared to other big local conglomerates, but it is moving quite fast. Its first platform into the regional markets is Pilmico Foods Corp., which is into commodities and food business.

In 2014, Pilmico set up its first Southeast Asian representative office in Jakarta, followed by the creation of another representative office in Ho Chi Minh City in March 2015. Pilmico was thus able to build its export market, successfully distributing its flour products to Hong Kong, Vietnam, Myanmar, Thailand, Malaysia and Indonesia.

In 2014, Aboitiz Equity Ventures (AEV) also created Pilmico International Pte. Ltd., marking its foray into the overseas feeds business. This unit acquired a 70-percent equity interest in Pilmico VHF Joint Stock Co. (Pilmico VHF), operator of an aqua feed mill at Dong Thap province in Vietnam.

That same year, Pilmico International also acquired a 70- percent equity stake in feed mill operator, VIN Hoan 1 Feed JSC (VHF), from its parent company, Vinh-Hoan Corp. (VHC) and is set to purchase the remaining shares within five years.

VHF has since then been officially renamed Pilmico VHF Joint Stock Co. It is the fourth largest “pangasius” aqua feeds producer in Vietnam, with a capacity of 165,000 metric tons per year. Pilmico VHF’s capacity was ramped up to 270,000 MT in April 2016.

Recently, Pilmico International acquired a 70-percent stake in feeds company Eurofeed for $3.2 million.

The investment in Pilmico VHF is expected to pave the way for investments in other Southeast Asian countries like Thailand, Laos and Cambodia.

In July 2018, AEV signed a $334-million deal to acquire a 75-percent stake in Singapore-based Gold Coin Management Holdings Ltd., a major producer of animal feeds and operator of 20 livestock and aqua feed mills across 11 countries in Asia. This is the largest investment made by AEV’s Pilmico International in Asia Pacific to date.

Established in Singapore in 1953, Gold Coin is a pioneer in animal nutrition and the manufacturing of scientifically balanced animal feed within Asia. It is one of the largest privately owned agribusinesses in the region, employing over 3,000 people throughout 20 production facilities. Gold Coin serves both the livestock and the aqua industries, including young animals and hatchery feed, premixes, concentrates and compound feed. Through its alliance partner, the group is also in the distribution of pharmaceutical products. In 2017, it generated net revenues of $751 million.

Indonesia is next on the Aboitiz Group’s expansion program, particularly for its flagship business of power generation.

17. AYALA LAND

Property giant Ayala Land Inc. (ALI) has dabbled in various overseas investments in previous years, but recently, it decided to focus its offshore activities closer to home in Southeast Asia.

ALI had invested in Tianjin Eco-City in China, a 3,000-hectare collaboration between the Chinese and Singaporean governments to showcase advanced urban planning and sustainable development. It decided to unwind this investment.

Meanwhile, ALI’s-66.25 percent investment in MCT Bhd, a Malaysian development and construction firm, is seen to become its vehicle to expand across the region. MCT recently invested P2 billion to acquire a 9.8-ha land bank in Klang Valley in Malaysia where its investment is expected to double in the next two to three years.

18. ENERGY DEVELOPMENT CORP.

Energy Development Corp. (EDC), which recently went back to public hands, is the Philippines’ largest vertically integrated geothermal developer, delivering 1,457.8 MW of clean and renewable energy to the country. It is also diversifying its renewable energy portfolio through investments in solar, hydropower and wind power projects in the Philippines. With almost 40 years of geothermal mastery, EDC now seeks to export its geothermal expertise to communities around the world. It has set up offices in Indonesia, Chile and Peru because it has early-stage geothermal projects in these countries.

With EDC’s portfolio, the Philippines is the third largest geothermal producer globally. Only the United States and Indonesia have more installed capacity.

19. ROBINSONS LAND CORP.

The Gokongwei group is no stranger to property development in mainland China. Its property development arm Robinsons Land Corp. (RLC), however, has just debuted in this market through its ongoing 8.5-ha project in southwest Chengdu.

Chengdu, the capital of Sichuan Province, or the “Heavenly State,” is well-known as the natural habitat of the adorable giant pandas.

The project brings 1.8 billion Chinese renminbi (P13.2 billion) worth of new residential property inventory to Chengdu. The entire condominium project will create around 315,000 sqm of living space for “upper middle-class” homebuyers.

The project in Chengdu has drawn strong momentum from the Gokongwei group’s earlier real estate projects in the city outside RLC. The group is familiar with the environment and regulations and has a team that can hit the ground running.

20. ETON/LUCIO TAN GROUP

Tycoon Lucio Tan’s privately held Eton Property Group, which is incorporated in Hong Kong, has millions of square meters of land bank in Hong Kong and China. In the mainland, it has created new urban landmarks in Hong Kong, Shanghai, Xiamen, Dalian, Shengyang, Beijing and Shenzhen.

In Hong Kong, among Eton’s projects are Queen’s Garden, Carmen’s Garden, Dragon Centre, King’s Court and Eton Tower. It has become one of the largest unlisted private real estate businesses in Hong Kong with a value of HK$20 billion.

The tycoon has also been investing in shopping malls in Guam and was at one time recognized as the biggest investor in this territory.

21. MAX’S GROUP INC.

The country’s leading casual dining chain started out as a Filipino restaurant chain operating Max’s but the group’s acquisition of Pancake House Inc. in 2014 not only gave it a backdoor listing platform but also widened its restaurant offerings. And some of these brands—such as pizza-maker Yellow Cab and Pancake House—are easy to pitch to a broader audience.

As of end-November, Max’s Group Inc. (MGI) was operating a total of 58 restaurants overseas in addition to its network of over 600 stores in the Philippines. Of its overseas stores, 13 are in Asia, 29 in the Middle East and 16 in North America.

In Asia, MGI operates in five overseas markets—Brunei, China, Singapore, Vietnam and Malaysia. Except for Malaysia, which has four Pancake House outlets to date, Yellow Cab serves the rest of the Asian markets. There are three Yellow Cab outlets each in Vietnam and China, two in Brunei and one in Singapore.

In the Middle East, the biggest market is the United Arab Emirates, where there are seven Max’s restaurants, three Yellow Cab and Pancake House outlets each, one Teriyaki Boy and one Sizzlin’ Steak. The brand Max’s has one outlet in Kuwait and two in Qatar. Yellow Cab has eight outlets in Qatar, one in Jordan and two in Saudi Arabia.

In North America, there are 11 Max’s outlets in mainland United States and five in Canada.

22. BENCH

Fashion retailer Bench started in 1987 as a small retailer of men’s T-shirts. Over the years, the business has expanded to include a ladies’ line, underwear, fragrances, housewares, snacks, and a wide array of other lifestyle products. The brand has likewise expanded to overseas territories, setting up shops in the United States, the Middle East and China.

Based on its website, Bench has set up shops in 34 locations in China, including some of the SM malls. Outside of China, it has one shop in Myanmar and two each in Singapore and the United States.

23. FIGARO

Businessman Jerry Liu’s food retailing business under Figaro Systems operates 68 Figaro coffee shops in the Philippines. The group has started to bring this coffee shop brand to other markets. Figaro now has one store in Qatar, three in Saudi Arabia and more overseas stores in the pipeline.

The Figaro outlet in Dubai, for instance, has become a favorite meeting place of overseas Filipino workers.

In Asia, Figaro has attracted potential franchisees who want to set up shops in Malaysia, China and Singapore. Moving forward, Figaro Systems expects to grow through acquisition and fast-track expansion by bringing in institutional investors.

The listing of Figaro Systems on the local stock exchange is also a possibility in the next three years.

24. SHAKEY’S PIZZA ASIA VENTURES INC.

While Shakey’s is an American brand, the Philippine-listed Shakey’s Pizza Asia Ventures Inc. (Spavi), which is now led by the Po family, is completely independent from its US “mother” entity. Spavi earlier acquired the trademark and the intellectual property and does not pay royalty or licensing fees to the US counterpart, resulting in good margins.

Apart from the Philippines, Spavi owns perpetual rights to use the Shakey’s brand for the Middle East, Asia excluding Japan and Malaysia, China, India, Australia and New Zealand.

As such, Spavi has now started to bring Shakey’s to new markets, starting in the Middle East. Shakey’s has so far entered Kuwait and Dubai.

Spavi expects to sign up development deals in two more countries in the next few weeks. It is targeting to open five new overseas stores next year.

Everything on the menu is halal-certified, in line with Islamic culture. However, the key features and flavors that make for a Shakey’s trademark experience are meticulously kept intact. Marinade, breading, dough blends and spice mix for the pizzas, chicken and spaghetti are all flown in from the Philippines.

25. GOLDILOCKS

The country’s leading bakeshop chain Goldilocks operates 673 stores in the Philippines. Led by the Yee family, this food retailer also operates a network of 11 stores in the United States.

Conglomerate SM Investments Corp. recently revived a deal to invest in Goldilocks but instead of taking the majority control as earlier expected, it is now willing to buy just 34 percent of the company.

26. GOLDEN ABC INC.

Fashion house Golden ABC Inc., led by businessman Bernie Liu, is the company behind proprietary brands Penshoppe, Oxygen, ForMe, Memo, Regatta and Tyler. It also operates Red Logo, a wholly owned direct selling subsidiary. The group has a network of more than 900 stores, which are complemented by its online platform.

The group has also brought its brand Penshoppe to overseas markets. The clothing brand is now present in 13 territories outside the Philippines: Indonesia, Brunei, Hong Kong, Malaysia, Bahrain, Myanmar, Taiwan, Singapore, Macau, Thailand, Cambodia, Vietnam and Kingdom of Saudi Arabia.

The top three biggest overseas markets for Penshoppe are: Myanmar, Vietnam and Cambodia.

27. PHINMA EDUCATION

Phinma Education, which operates a network of universities in the Philippines, teamed up with Victoria Hospital, one of Myanmar’s leading private medical facilities, to open Phinma Training Center in Yangon. The center—which offers courses on child caregiving, elderly caregiving and special care assistance—was in response to the shortage of healthcare professionals. It is expected to create more job opportunities for Myanmar’s young people.

The Phinma Group now plans to scale up its footprint in Southeast Asia’s education space by transforming this pilot nursing and healthcare training center in Myanmar into a full college. It is also scouting for expansion opportunities in Vietnam and Indonesia.

The Yangon center started offering short nursing and healthcare programs for nursing assistants in 2017. Although enrollment was initially modest at around 160 students, the program provided Phinma with valuable insights into the Yangon market, bringing it closer to its goal of eventually offering full-degree programs. Phinma, however, still has to wait for Myanmar to enact a law to open up education to foreign investment.

Once Phinma is able to upgrade the training center in Yangon into a full college, nursing will still be a focus given strong demand for nurses. “But we want it to be a general college, offering things like Business, Education, Engineering, similar to our model here. We think we’ll be successful doing it in other countries,” Phinma president Ramon del Rosario Jr. said.

28. CIRTEK HOLDINGS PHILIPPINES CORP.

This Laguna-based electronics manufacturer debuted into Silicon Valley in 2017 and moved up the value chain with a $77-million deal to acquire US-based Quintel, a leading supplier of antenna solutions to North America’s telecom carriers.

While already strong in the United States with a market share of 15 percent, Quintel is expanding to Latin America. The existing marketing office in the United Kingdom is likewise used as a jumping board to promote and market products to Europe.

Quintel is a leading innovator of spectrum and space-efficient base station antennas for wireless networks. Among its major customers include two of the top five telecom carriers in North America. It is a company with rich intellectual property and strong R&D (research and development) capabilities.

The transaction gave Cirtek a significant presence in the large and rapidly growing base station antenna market, estimated to be more than $14 billion by 2020.

29. BOUNTY FRESH

Bounty Fresh is one of the largest poultry companies in the Philippines. It is engaged in breeding, raising, processing and retailing, both locally and via export to other parts of Asia.

The company recently announced that it had built a chicken farm in Indonesia.

Its takeover bid for Tegel Group, New Zealand’s largest poultry processor, has likewise been approved by the Overseas Investment Office of New Zealand.

Tegel, which operates out of Auckland, Christchurch and New Plymouth, processes 58 million birds a year destined for food service outlets and retailers. Apart from the Tegel brand, its portfolio includes other brands like Top Hat and Rangitikei.

30. BLOOMBERRY RESORTS

If tycoon Enrique Razon Jr. had been able to globalize ICTSI, there’s no stopping him from bringing his integrated gaming operations to new territories.

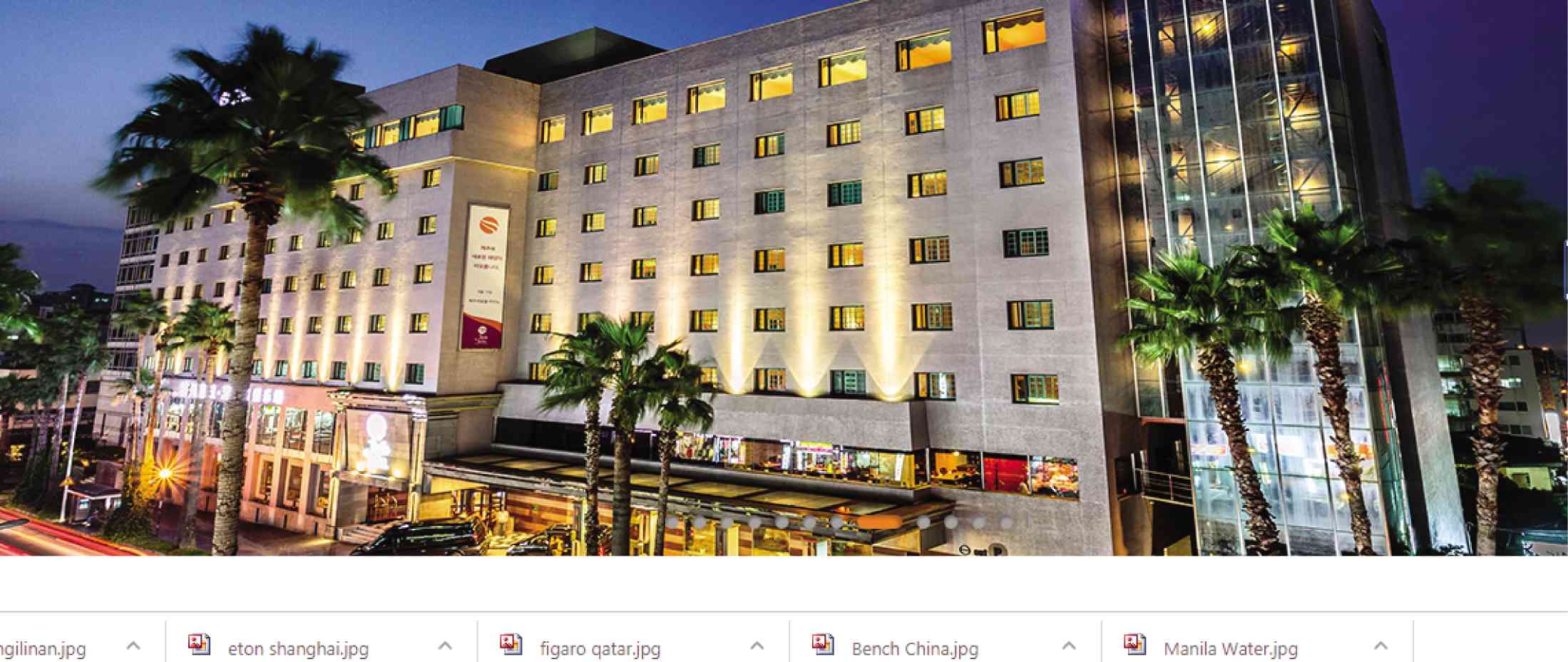

Bloomberry is the owner and operator of Solaire Resort & Casino (Solaire), the first integrated resort at the Entertainment City in Parañaque City, Metro Manila. It also owns and operates the Jeju Sun Hotel & Casino in Jeju Island, Korea.

The company has marketing presence in Korea, Macau, Hong Kong, Singapore, Malaysia, Indonesia, Thailand, Taiwan and Japan.

Aside from the Jeju casino, Bloomberry has also acquired land bank in Korea’s Muui and Silmi islands for future developments.

31. POTATO CORNER

Potato Corner, which began operations in 1992, is a food retailer that has grown rapidly through franchising. From operating small carts to in-line stores, Potato Corner can be found anywhere from shopping malls, schools, hospitals, bus stations, amusement parks and tourist destinations. The brand has also forayed to overseas locations such as Indonesia, Thailand, Cambodia, Vietnam, Singapore, Kuwait, Hong Kong, Australia, the United States and Panama.

32. PHILIPPINE NATIONAL BANK

Philippine National Bank was once the country’s largest bank. But while other banks have grown bigger, it has remained to be the Philippine bank with the most extensive international footprint with more than 70 overseas branches, representative offices, remittance centers, and subsidiaries across Asia, Europe, the Middle East and North America. In the Philippines, it has 707 branches.

The bank has a 100-percent owned subsidiary in China called Allied Commercial Bank (ACB). This unit has a license from China’s banking regulators to do local currency business. This unit is seen to benefit from the growing trade between the Philippines and China.

Founded in 1993 and based in Xiamen, ACB has a branch in Chongjin.

33. XURPAS INC.

Since going public in 2014, Xurpas Inc. has been investing in a number of ventures that would benefit its consumer and enterprise businesses.

In 2016, Xurpas took over Singapore-based Art of Click Pte. Ltd., a fast-growing mobile advertising network in Asia-Pacific.

Art of Click has created a proprietary, next generation ad optimization platform for advertisers. Its platform supports both client brands and global and regional communication agencies in the development and execution of mobile strategies in markets such as South Korea, Japan, Hong Kong, Taiwan, Southeast Asia, North America and Europe.

Xurpas also gained access to populous China by buying 23 percent of Micro Benefits Ltd., a Hong Kong-based company providing innovative human resources solutions to topnotch companies in the mainland.

Xurpas also incorporated in Singapore a new subsidiary, ODX Pte Ltd., which is now raising as much as $100 million from a token sale that will fund the rollout of free internet service in emerging markets.

ODX, which stands for the Open Data Exchange, intends to allow consumers in emerging markets to access the internet for free through sponsored data packages.