PH stocks down on foreign selling

The local stock barometer declined sharply on Thursday as foreign investors heavily sold down large cap stocks.

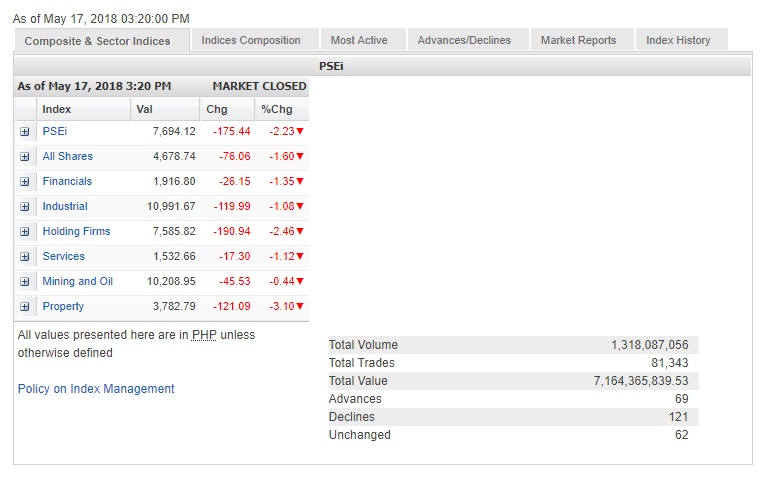

The Philippine Stock Exchange index (PSEi) shed 175.44 points or 2.23 percent to close at 7,694.12.

The index was weighed down most by the property counter, which fell by 3.1 percent, and the holding firm counter, which declined by 2.46 percent.

The financial, industrial and services counters all fell by over 1 percent. The mining/oil counter also declined.

Total value turnover for the day amounted to P7.16 billion. There was a hefty net foreign selling of P1.32 billion for the day.

Article continues after this advertisementThere were 121 decliners that overwhelmed 69 advancers, while 62 companies were unchanged.

Article continues after this advertisementEagle Equities president Joseph Roxas said the market had reflected concerns on the exchange rate and overseas Filipino remittances.

It was recently reported that remittance inflows in March dropped by 10 percent year-on-year, the steepest decline seen in 15 years.

The PSEi was dragged down most by Ayala Corp., which declined by 5.05 percent.

Property giant SM Prime, the day’s most actively traded stock, fell by 3.67 percent.

Ayala Land also lost 3.7 percent while BDO fell by 3.94 percent.

URC and AEV both fell by over 2 percent, while SM Investments, ICTSI, Megaworld and GT Capital all declined by over 1 percent.

Security Bank, Metrobank and Jollibee also slipped.

On the other hand, LTG gained 0.7 percent.

While paring their holdings of large cap stocks, some investors focused on nonPSEi stocks.

Third telecommunications aspirant MRC Allied surged by 12.5 percent, while Century Peak and Bloomberry both rose by over 2 percent.