Ty family-led Metropolitan Bank & Trust Co. (MBTC) has priced its stock rights offering at P75 per share, finalizing a P60-billion capital-raising intended to sustain brisk lending activities against the backdrop of a fast-growing domestic economy in the coming years.

The offer price is based on a 22-percent discount to the 10-day volume-weighted average price of Metrobank common shares listed on the Philippine Stock Exchange.

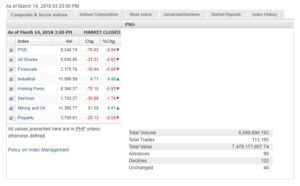

Shares of Metrobank fell by 0.52% to close at P96.50 per share on the local bourse following the discounted pricing of the rights offer yesterday.

Eligible shareholders are entitled to subscribe to one share for every 3.976 Metrobank common shares held as of the record date March 21.

The stock rights offer will commence at 9 a.m. on March 22 and end at 12 p.m. on April 4.

Metrobank previously disclosed it would raise up to P60 billion through this stock rights offering, proceeds from which would enable the bank to sustain a strong growth trajectory.

Part of the proceeds will also be used to fund its acquisition of an additional 40 percent stake in Metrobank Card Corp., to increase its ownership to 100 percent. This is in line with plans to beef up high-margin lending activities.

The bank believes the robust growth of the Philippines will continue to support prospects for faster loan growth across the various segments of the economy.

GT Capital Holdings Inc., Metrobank’s controlling shareholder, committed to subscribe to its full rights entitlement in the bank’s stock rights offer.