The local stock barometer slipped back to the 8,300 level yesterday as White House politics cast gloom on US and regional markets.

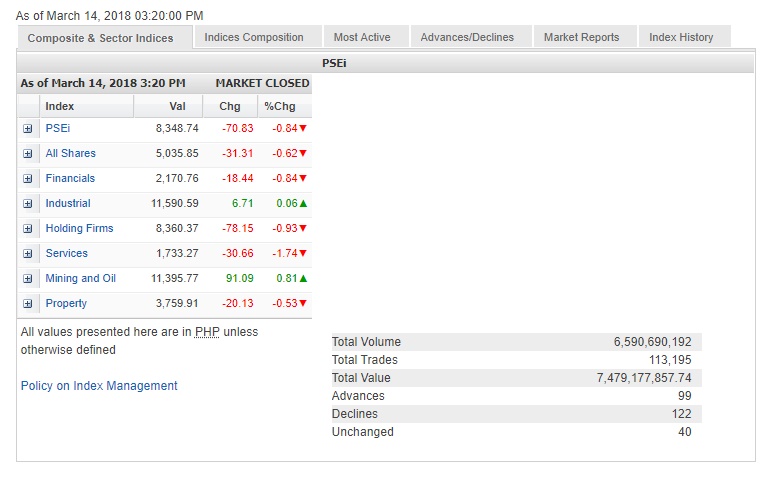

The main-share Philippine Stock Exchange index (PSEi) lost 70.83 points or 0.84 percent to close at 8,348.74, tracking sluggish regional markets.

Asian stock markets mostly tracked the overnight slump in Wall Street, after US President Donald Trump suddenly fired Secretary of State Rex Tillerson. This escalated concerns on global trade.

Local stocks continued to be weighed down by foreign selling. On Wednesday, net outflows were heavy at P1.43 billion.

The index was weighed down most by the services counter, which fell by 1.74 percent, while the financial, holding firm and property counters also declined.

On the other hand, the industrial and mining/oil counters firmed up.

Value turnover for the day amounted to around P7.5 billion. There were 122 decliners that edged out 99 advancers while 40 stocks were unchanged.

JG Summit was a big drag to the index as the Gokongwei-led conglomerate declined by 4.48 percent.

BPI also lost 2.95 percent while Security Bank and RRHI both slipped by over 2 percent.

SM Investments, ICTSI, Jollibee and PLDT all slipped by over 1 percent.

Outside of the PSEi, there was also heavy selling on MRC Allied, which pulled back by 8.24 percent. Bloomberry also lost 5.29 percent.

On the other hand, Metro Pacific rose by 1.27 percent, while Metrobank, Ayala Corp. and BDO all gained.

Notable gainers outside the PSEi included Ionics, which surged by 17.65 percent, while Pilipinas Shell gained 7.41 percent.

Pilipinas Shell declared a cash dividend of P5.14 per share, or a total payout of P8.29 billion, out of its unrestricted retained earnings in 2017.

East West Bank also rose by 1.32 percent after securing regulatory approval to hike authorized capital to P50 billion from P20 billion.