PH stocks surge to a new high

The local stock barometer surged to a new high on Tuesday, even flirting with the 8,400 level in intra-day trade, as investors loaded up on local equities ahead of the third quarter corporate earnings reporting season.

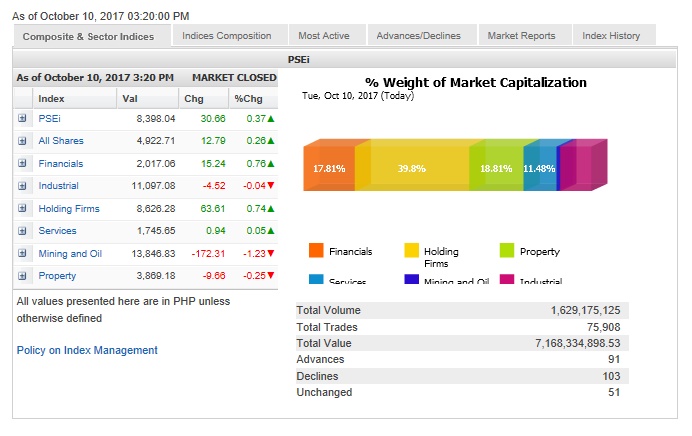

The main-share Philippine Stock Exchange index gained 30.66 points or 0.37 percent to end at its best-ever finish of 8,398.04.

A new intra-day peak of 8,409.92 was likewise hit.

“It’s really difficult to doubt the strength of the market nowadays. Investors remain positive despite the weakness in New York and unfavorable news in the country. Most investors preferred to ignore the political bickering and reports of lower economic forecast by several institutions,” said Astro del Castillo, managing director at fund management firm First Grade Finance.

Del Castillo said the PSEi could still breach the 8,400 level in the next next sessions.

“But there are already signs of weakness in the surge of the index given the low value turnover and more stocks declined than advanced today,” he noted.

Selective buying of large-cap stocks perked up the main-share index.

On the other hand, market breadth was negative, as 103 decliners outnumbered 91 advancers.

The PSEi was led higher by the financial, holding firm and services counters.

On the other hand, the industrial, mining/oil and property counters slipped.

Value turnover for the day amounted to P7.2 billion. Foreign investors were net buyers to the tune of P496.23 million.

The PSEi was propelled higher by conglomerates. SM Investments gained 2.34 percent, while Ayala Corp. added 1.06 percent.

BDO Unibank and PLDT also advanced by over 1 percent while GT Capital, Security Bank, Meralco and Puregold also contributed to the day’s gains.

Outside the PSEi, notable gainers included MacroAsia (+9.15 percent) alongside RFM (+3.3 percent) and EDC (-1.06 percent).

On the other hand, RRHI fell by 2.92 percent while AGI fell by 1.1 percent. URC, BPI, SM Prime and ICTSI also slipped.