PH shares hit new record high on bright growth prospects

The local stock barometer ended at a new record high on Friday as investors focused on the country’s favorable macroeconomic prospects while global credit watcher Moody’s said local political risks would not adversely affect the government’s creditworthiness.

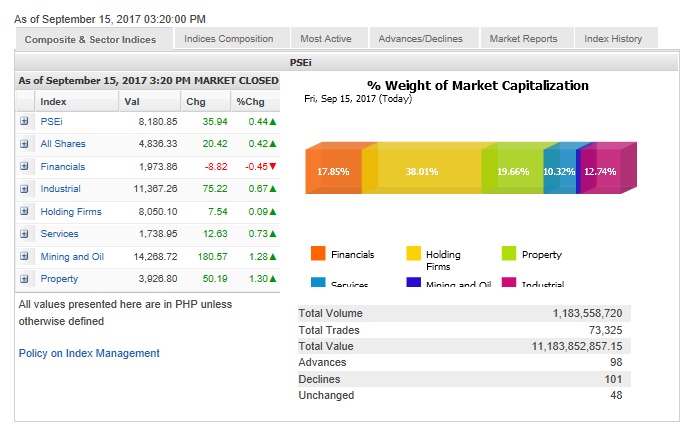

Reversing sluggish trading in early trade, the main-share Philippine Stock Exchange index (PSEi) gained 35.94 points or 0.44 percent to close at the intraday high of 8,180.85. This marked the PSEi’s best finish in history.

“Philippine equities closed mostly higher as the country was perceived as a less risky asset class. The perception that we have entered bull market has become stronger [even] after strong US inflation data raised the possibility of tighter monetary policy from the Federal Reserve,” said Luis Gerardo Limlingan, managing director at local stock brokerage Regina Capital Development Corp.

Meanwhile, global credit watchdog Moody’s said on Friday that the Philippine sovereign’s credit profile “balances sound economic and fiscal fundamentals against structural challenges to competitiveness and rising political risks.”

Moody’s expects robust economic growth to be sustained over the next few years, aided by the government’s focus on infrastructure development, buoyant private sector investment, and the recovery in external demand.

“The reemergence of conflict in the southern Philippines, and the administration’s focus on the eradication of illegal drugs, represents a rising but unlikely risk to economic performance and institutional strength,” Moody’s said.

Except for the financial sub-sector, all counters gained at the local market. The biggest gainers were the property and mining/oil counters which both advanced by over 1 percent.

Total value turnover for the day amounted to P11.18 billion. Foreign investors were net buyers amounting to P473.68 million.

Investors gobbled up shares of Semirara and ICTSI, which both gained over 2 percent, while Ayala Land and SM Investments both rose by over 1 percent.

SM Prime, Ayala Corp., PLDT, Megaworld, Metrobank, Metro Pacific and AEV also contributed gains.

On the other hand, GT Capital slipped by 2.09 percent while AGI fell by 1.88 percent.

Shares of BDO, Security Bank, BPI, Jollibee and JG Summit also faltered.