PSBank to phase out non-EMV cards by Sept.1, 2017

Philippine Savings Bank (PSBank), the thrift arm bank of the Metrobank Group, is set to deactivate all non-EMV PSBank cards by Sept. 1, citing the need to provide clients with more secured products and services.

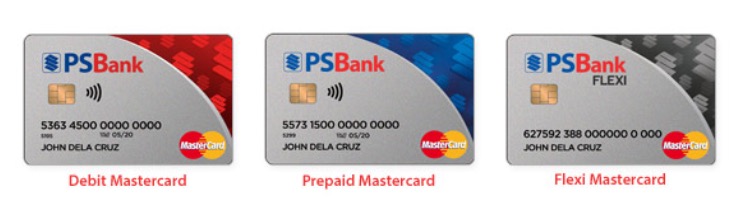

The planned phaseout of the non-EMV automated teller machine (ATM), debit and prepaid cards by September is ahead of the June 2018 ultimatum set by the Bangko Sentral ng Pilipinas for all banks to migrate to EMV chip-enabled cards.

PSBank’s EMV (Europay, Mastercard and Visa) chip-enabled cards have enhanced features that verify transactions made on card which limit the cases of care-present fraud incidents and identity theft. This replaces non-EMV PSBank cards that are originally magnetic swipe cards.

“(This will give) cardholders the peace of mind whenever they do card transactions,” PSBank said in a press statement.

PSBank thus asked all its clients to replace their non-EMV cards at any PSBank branch. Replacement is free of charge if it’s the client’s first time to have their cards replaced.

“(Clients) will simply need to bring their old non-EMV PSBank cards and one government-issued valid ID,” the bank said.

For PSBank Flexi accountholders, cards will be delivered via courier to their office address while their PIN will be delivered via another courier to their home address.

The issuance of EMV chip-enabled cards that started in January 3 is in line with the BSP Circular No. 859 or the EMV Implementation Guidelines. This requires all banks to issue all customers with EMV chip-enabled cards until June 30, 2018 to further strengthen consumer protection.

Failure to comply with the EMV requirement will subject BSP-supervised financial institutions to monetary sanctions provided under relevant provisions in the Manual of Regulations for Banks and Manual for Non-Bank Financial Institutions.

Banks which will be delayed in migrating to EMV will have to estimate possible losses due to fraud because of not being compliant.

For cardholders who are victims of fraud incidents and identity theft, BSP advises cardholders to file their complaints and/or requests for charge back within the 10-day resolution timeline. This is prescribed under BSP Circular No. 936 dated December 28, 2016.

PSBank is a key player in the Philippine consumer banking industry. It has a network of 250 branches and has more than 600 ATMs nationwide, all of which are EMV-ready, according to the thrift bank.