PSEi firms up on “cautious” bargain-hunting

PSEi July 3, 2017

The local stock barometer firmed up on Monday as investors took heart from mostly upbeat regional markets.

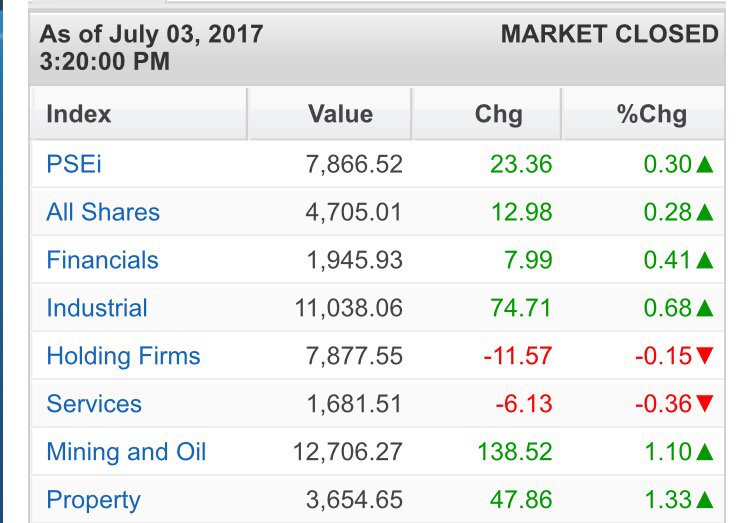

Reversing the weakness in early trade, the main-share Philippine Stock Exchange index gained 23.36 points or 0.3 percent to close at 7,866.52.

Rising for the second straight session, the PSEi was led higher by the mining/oil and property counters which both went up by over 1 percent. The financial and industrial counters also firmed up.

On the other hand, the holding firm and services counters both declined.

“Philippine markets continued the cautious bargain-hunting despite the low value turnover after the expected first half 2017 window-dressing, and depressed value turnover, and the lack of market- moving data because of the 4th of July holiday in the US,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

On Friday, he noted that Wall Street ended on a firmer footing, except for stocks in the technology space.

Value turnover for the day was thin at P4.88 billion. There were 118 advancers that edged out 74 decliners while 53 stocks were unchanged.

The PSEi was led higher by Megaworld, which surged by 4.65 percent, while DMCI, Ayala Land, Jollibee and Security Bank all rose by over 1 percent.

SM Prime, Metrobank, Meralco, BPI, Ayala Corp., JG Summit, Globe and Metro Pacific also firmed up.

Outside of PSEi stocks, notable gainers included Nickel Asia and RRHI which respectively gained 5.16 percent and 1.03 percent.

On the other hand, SM Investments and PLDT both declined by over 1 percent while shares of ICTSI also slipped.

The Philippine stock market attracted P22.04 billion in net foreign buying in the first semester of the year on the back of an improved global outlook and optimism on the government’s tax reform agenda.

Trading activity was also brisk during the first half of 2017, with daily average value turnover rising by 7.5 percent to P8.08 billion from the level in the same period last year.

Before going on a session break, the Philippine House of Representatives passed the first phase of tax reform package certified by Pres. Rodrigo Duterte as an urgent piece of legislation. This package simplifies and lowers personal income tax rates while broadening value added tax coverage, rationalizing estate and donor’s tax and adjusting oil and automobile excise taxes.

The Congress will be on break from June 3 to July 23. All eyes are now on the upcoming Senate deliberations on this bill.

Based on PSE data, market capitalization in the PSE ended the semester at P16.27 trillion. Capital raised in the first half of the year amounted to P106.74 billion, with the likes of retailer Wilcon Depot, Eagle Cement Corp. and Cebu Landmasters Inc. going public during the period.