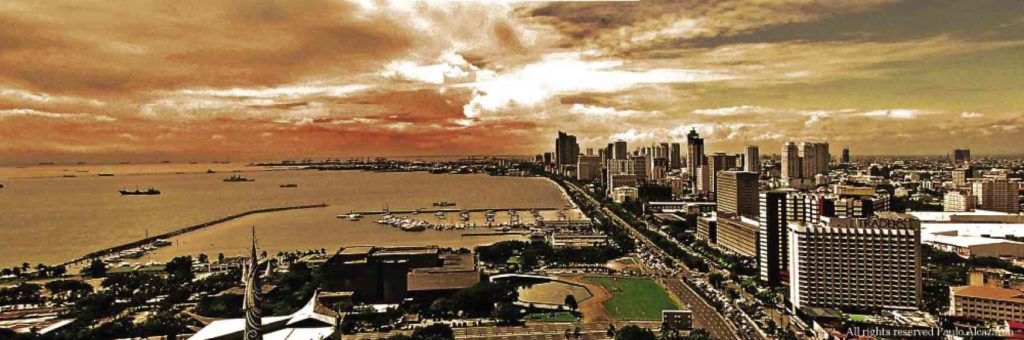

A country to watch

(PHOTO BY PAULO ALCAZAREN / INQUIRER FILE )

The Philippines is expected to remain a stellar performer in the Asia Pacific, and a country to watch for.

In the latest report of commercial real estate services firm Cushman & Wakefield, the Philippines was identified as one of the region’s emerging markets, which means that the country can offer new investment opportunities that would provide the desired yields.

“The Philippines is still projected to be a stellar performer in the Asia Pacific region for the coming years, despite concerns over a recent shift in foreign policy direction away from the United States and towards other Asian countries,” the firm said in its report entitled, Betting on Asia Pacific’s Next Core Cities.

“This is due in large part to the economy being heavily driven by local demand and consumption. Investments are playing a bigger role in the country’s development as the administration hopes to lift the country higher from the status quo,” the report stated.

On the real estate front, high end and prime office spaces still benefit from stable demand, largely driven by the Information Technology-Business Process Outsourcing (IT-BPO) industry, the report added.

“Rental yields are projected to be stable at around 7 percent over the next few years, making strata-title offerings appealing,” it further noted.

Apart from Manila, Bangkok, Jakarta, Kuala Lumpur, Ho Chi Minh, and Mumbai were also named as emerging markets.

“The region’s emerging markets will also offer investors the opportunity to tap into its long-term growth fundamentals, which will become increasingly viable due to sustained reforms and economic initiatives,” the real estate services firm said.

The report further identified Asia Pacific’s next core markets namely Australia, Tokyo, Hong Kong, Shanghai and Seoul, which are reportedly “poised to maintain their relevance and predominance (in the region) over the next five to 10 years.”

Investment climate

For this year, Cushman & Wakefield said it expects the investment climate in the Asia Pacific region to stand out.

This was on the back of a steady economic growth in Asia Pacific, continued job creation, and liquidity in the region, all of which are expected to provide impetus for strong office asset performance, the firm said.

“Indeed, the dynamics point to another vibrant year of investment activity,” it stressed. “A wide range of buyers and sellers are also repositioning portfolios as they recalibrate their strategies in light of continuing economic and office market momentum in the region and generally accommodative financial conditions.”

Meanwhile, Cushman & Wakefield also noted five important transitions that could help fuel the favorable investment climate in the region. These are as follows:

Real estate going public

Real estate in Asia Pacific has become an established investment asset class as institutional investors, including financial intermediaries, Real Estate Investment Trusts (REITs) and public developers, have dominated investment activity over the last two years.

Policy trumps politics

Economic policy uncertainty is on the rise given changes in leadership and protectionist trade policies. It is expected that political developments will only pose a “slight downside risk to the outlook… as leaders increasingly focus on stability and growth in Asia Pacific.”

Asia’s great wall of capital

Chinese capital has increasingly shown its heft, especially as outbound investments continually set records over the last five years. Such flow of capital is not likely to change over the long term as investors are keen to put their capital to work.

Follow the infrastructure

Investments in infrastructure will be a key economic stimulus tool in many markets across the region. Improvements should spur more rapid economic growth and urban development, and improve the emerging markets’ standing.

Alternative assets are hot

Data centers remain lucrative in the region, as more consumers turn online for shopping and data needs for cloud-based systems. Student housing, retirement living, and healthcare are increasingly popular alternative property types.