Stock barometer reaches new high for 2017 on strong foreign buying

The local stock barometer regained momentum on Wednesday, climbing back to the 8,000 level and marking a new high for this year on strong risk appetite among foreign funds across regional markets.

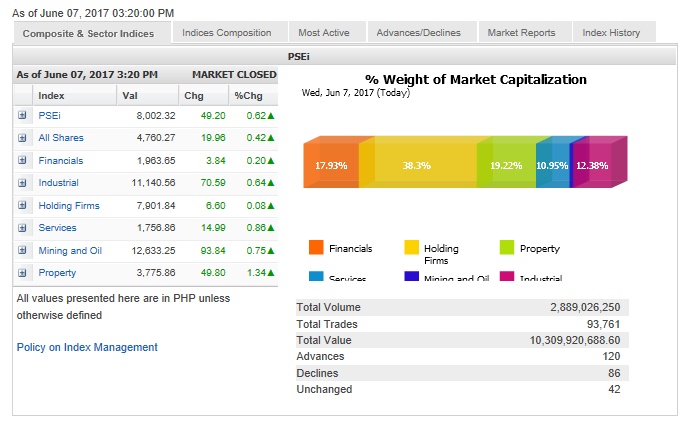

The main-share Philippine Stock Exchange index advanced by 49.2 points or 0.62 percent to close at a new 10-month high of 8,002.32.

The local bourse has now risen by 17 percent since the start of the year.

All counters ended higher but the biggest gainer was the property counter, which surged by 1.34 percent.

“As the PSEi approaches its 8,130 resistance a third time, we look to the market’s foreign flows and equity risk premium (ERP) to gauge the possibility of a breakout,” Papa Securities said in a research note on Wednesday.

ERP refers to the excess return that investing in the stock market provides over a risk-free rate, such as the return from government bonds.

This excess return compensates investors for taking on the relatively higher risk of equity investing.

To date, Papa Securities said the PSEi’s ERP was slightly depressed at 4.75 percent versus its average of 5.37 percent.

However, it noted that this was still above the 4.55 percent ERP level when the market achieved its peaks in March 2015 and July 2016.

It likewise noted that monthly foreign flows as of May amounting to P8.6 billion were below the level during previous peaks, when such foreign flows peaked at over P20 billion, concluding that there’s room for an upside as “both indicators suggest a good chance of a breakout.”

“Looking at both metrics, we think there is room for more upside in the PSEi, likely enough to fuel the market above its two-year resistance level of 8,130. The current macroeconomic landscape seems supportive of this scenario as well, as the market just started riding the tax reform euphoria. We recommend a buy on the PSEi,” Papa Securities said.

The market was buoyed by about P849.99 million in net foreign buying. Value turnover for the day amounted to P10.31 billion. There were 120 advancers that edged out 86 decliners while 42 stocks were unchanged.

“Across the region, there’s a lot of buying by foreign sources,” said Manny Cruz, chief strategist at Asiasec Equities Inc.

Cruz said the Philippines was even “behind the curve” as far as the share of foreign inflows was concerned, which meant that these inflows could further improve.

“For the Philippine side, what’s keeping the market upbeat is the tax reform program which is expected to be signed before the end of the year,” Cruz said.

Before going into its session break, the House of Representatives passed the tax reform program earlier certified urgent by President Duterte.

All eyes are now on the Senate, which will begin deliberations on the package on July 24.

Economists are optimistic that the upper house will further finetune the package to be closer to the package supported by the Department of Finance.

Cruz said the PSEi would need to break 8,050, after which it would likely muster enough strength to breach 8,100.

The PSEi’s all-time high is 8,127.48, recorded on April 10, 2015.

Investors loaded up on shares of Ayala Land, SM Investments Corp. and AGI, which all advanced by over 3 percent while PLDT, Globe and BPI all went up by over 1 percent.

SM Prime, Semirara, URC and BDO also gained during the day.

Outside of the PSEi, the notable gainers were CLI (+4.04 percent) and IMI (+5.14 percent).

On the other hand, GT Capital, AEV and JG Summit all declined by over 2 percent while Ayala Corp. and MPI fell by 2.36 percent and 0.97 percent, respectively.