PSEi follows Asian pack looking to gain on US stimulus

The local stock barometer firmed up for the second straight day yesterday, tracking regional markets which were mostly upbeat on US corporate and economic data.

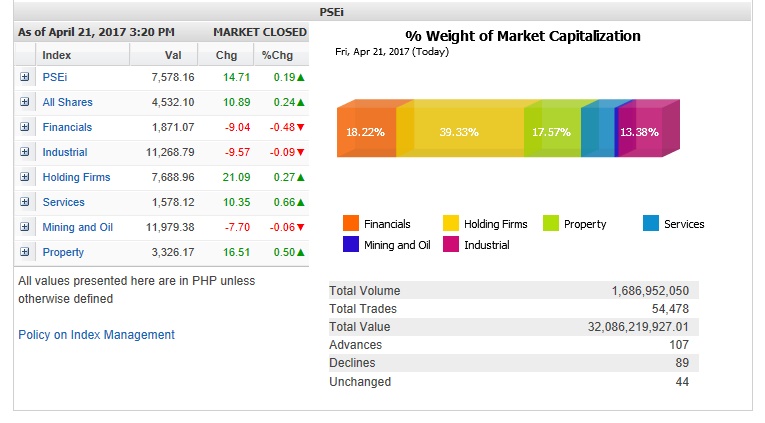

The mainshare Philippine Stock Exchange index (PSEi) added 14.71 points or 0.19 percent to close at 7,578.16 on Friday.

“The Philippine markets tried to replicate the positive performance of the United States as overnight, financials and industrials led the rally with the S&P 500 climbing 17.67 points, or 0.8 percent, to 2,355.84. US stocks finished higher on Thursday as strong economic data and corporate earnings lifted the main benchmarks,” added Luis Gerardo Limlingan, managing director at Regina Capital Development.

Value turnover was heavy at P32 billion as this included the P24.7-billion block of Metrobank shares acquired by GT Capital. It also included a P1.32-billion block sale of COL shares to Daiwa.

There was also net foreign selling of P237.67 million for the day.

Article continues after this advertisementThe day’s modest gain was led by the holding firm, services and property counters; while the financial, industrial and mining/oil counters slipped.

Article continues after this advertisementThere were 107 advancers that edged out 89 decliners. Meanwhile, 44 stocks were unchanged.

The PSEi was led higher by DMCI, which racked up 4.24 percent, while GT Capital rebounded by 2.81 percent.

JG Summit, ALI, Jollibee and Globe Telecom all gained over 1 percent.

SM Prime, Megaworld, Metro Pacific and Ayala Corp. also contributed to the PSEi’s gains.

Outside of the PSEi, MRC Allied surged by 11.76 percent, while Cebu Air went up by 3.7 percent.

Meanwhile, SMIC and URC both tumbled by over 1 percent, while BDO and Security Bank also slipped.