IEA: World oil market ‘close to balance’ despite OPEC cuts

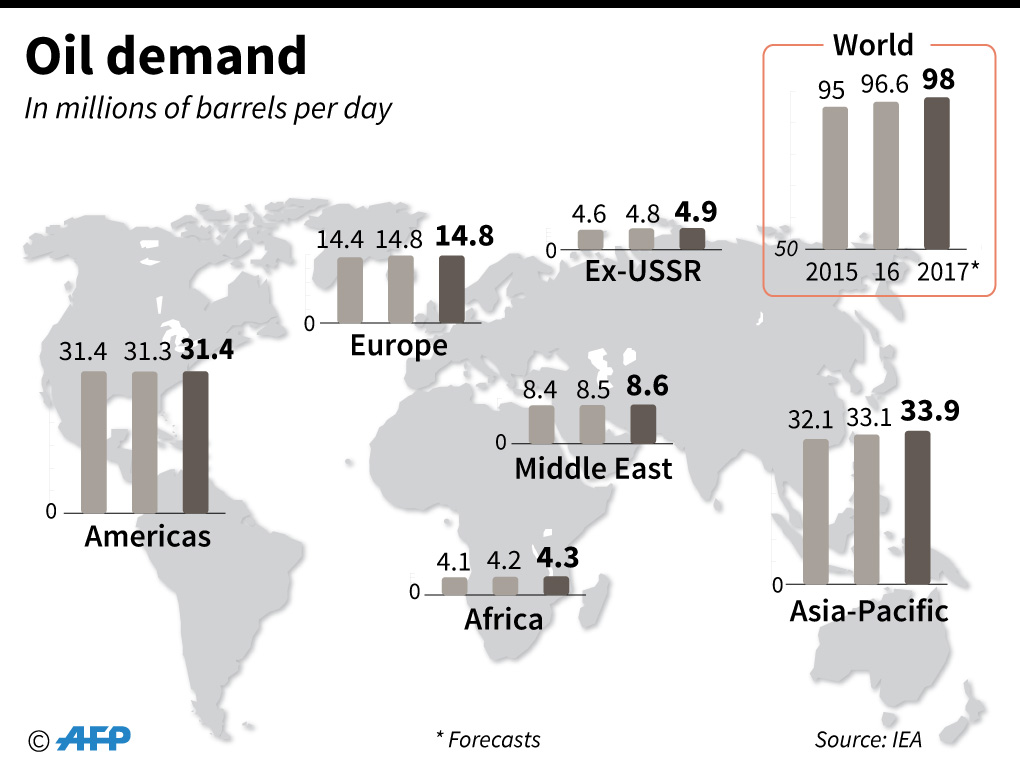

The graph shows demand for oil is expected to rise in 2017 but oil producers are talking about extending production cuts as output is seen to outpace consumption (Graphic from AFP )

PARIS, France — Supply and demand in the oil market are close to matching up, the IEA said Thursday, as landmark OPEC-led production cuts are mitigated by rising US supply and slipping worldwide demand growth.

The compliance rate with the agreement among OPEC members and some non-members, including Russia, “has been impressive,” the International Energy Agency (IEA) said in its monthly oil market report, giving a lift to oil prices.

But oil at above $50 a barrel has, in turn, attracted higher-cost producers in the United States back to the market, and frantic American drilling will push non-OPEC supply to surprisingly high levels throughout the year, the IEA predicted.

“It can be argued confidently that the market is already very close to balance, and as more data becomes available this will become clearer,” it said in the report.

“Although the oil market will likely tighten throughout the year, overall non-OPEC production, not just in the US, will soon be on the rise again,” it said.

At the end of November, the Organization of Petroleum Exporting Countries (OPEC) agreed to cut output by 1.2 million barrels per day (mb/d) from Jan. 1, initially for a period of six months.

Then in December, non-OPEC producers led by Russia agreed to cut their own output to 558,000 barrels per day.

The aim was to reduce a glut in global oil supply that had depressed prices.

Reports this week said that OPEC kingpin Saudi Arabia is pushing the cartel’s producers to extend the agreement by another six months at their meeting in May.

A less oil-thirsty world

The IEA made no prediction about such a likelihood, but said that a consequence of OPEC “hypothetically” renewing the deal would be to support prices more and give further encouragement to US shale oil producers.

This means that non-OPEC oil production will soon be on the rise again.

“Even after taking into account production cut pledges from the eleven non-OPEC countries, unplanned outages in Canada as well as in the North Sea, we expect (non-OPEC) production will grow again on a year-on-year basis by May,” the report said.

Oil inventories fell in March but probably showed a rise in the first quarter of this year overall because oil consumers stockpiled crude before the OPEC-led cuts took effect properly, the IEA said.

“The net result is that global stocks might have marginally increased in 1Q17,” it said.

On the demand side, the IEA revised down its estimates for the worldwide thirst for oil, meaning there will be more oil available than previously thought.

“New data shows weaker-than-expected growth in a number of countries including Russia, India, several Middle Eastern countries, Korea and the US, where demand has stalled in recent months,” it said.

Demand growth for 2017 is now expected to be 1.3 million barrels per day, down from the IEA’s previous forecast of 1.4 million.

Interesting times ahead

Oil prices declined on Thursday, with US benchmark WTI futures down 10 cents at $53.01 per barrel, and Europe’s Brent contracts four cents lower at $55.82.

Analysts cited the IEA report and also OPEC’s warning Wednesday that the cartel’s efforts to fight a global glut are threatened by American firms pumping oil with gusto.

Commodities analysts at Commerzbank said the question was now “whether the OPEC production cuts really have translated into a reduction in supplies.”

Oil prices are still around 25 percent higher than they were a year ago, and roughly stable over the past three months, despite frequent day-to-day volatility.

Analysts struggling to distill conflicting developments into a credible oil price prediction for the rest of the year appeared to have the IEA’s sympathy.

“We have an interesting second half to come,” it said.