PSEi slides to 7,200 on political, US Fed jitters

LOCAL stocks saw a bloodbath that dragged the main index to the 7,200 level on Friday as investors weigh the US Federal Reserve’s hawkish clues and incoming President Rodrigo Duterte’s choice of Cabinet members.

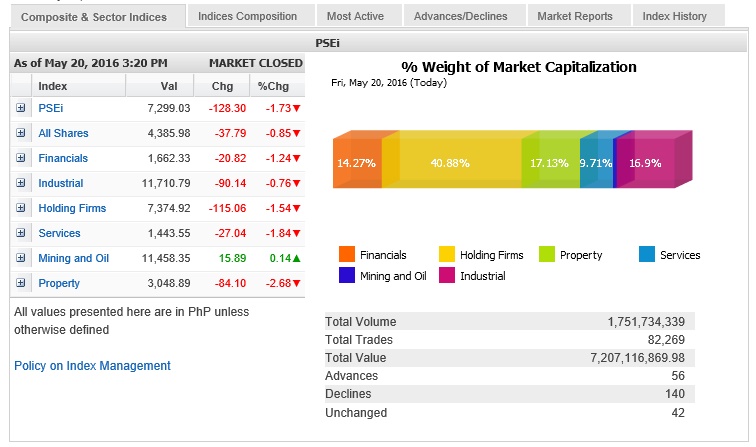

Sliding for the second straight session, the Philippine Stock Exchange index gave up 128.3 points or 1.73 percent to close at 7,299.03. It failed to ride on the rebound in most regional markets.

A veteran stock market dealer said investors were bracing for another interest rate hike by the US Fed, which hinted of such hawkish move coming by June or July. At the same time, the dealer said the market was jittery over Duterte’s choices of Cabinet members. It was reported that several seats were earmarked for the Communist Party while the Department of Public Works and Highways portfolio was given to a Villar scion – perceived to be part of a political horse-trading that for some, dashed hopes of any dramatic change under the incoming administration.

The day’s decline was led by the property counter which faltered by 2.68 percent while the financial, holding firms and services counters slipped 1 percent.

Only the mining/oil counter ended higher, albeit with only a marginal gain.

Total value turnover for the day amounted to P7.21 billion. There were 56 advancers which were overwhelmed by 140 decliners while 42 stocks were unchanged.

Investors sold down shares of SMIC, ALI, MPI, Megaworld and GTCAP which all slid by over 3 percent while SM Prime, PLDT and BDO all declined by over 2 percent.

AC, Metrobank and Meralco all slipped by over 1 percent while URC, JG Summit, Semirara and BPI also declined.

One notable decliner outside the PSEi was Alterra, which slid by 44.79 percent in heavy volume.

AEV bucked the day’s downturn along with Jollibee, which gained 0.6 percent. Non-PSE stock SECB, which is debuting on the MSCI Philippines index after month-end, gained 0.52 percent.