Asian stocks mostly higher following US lead

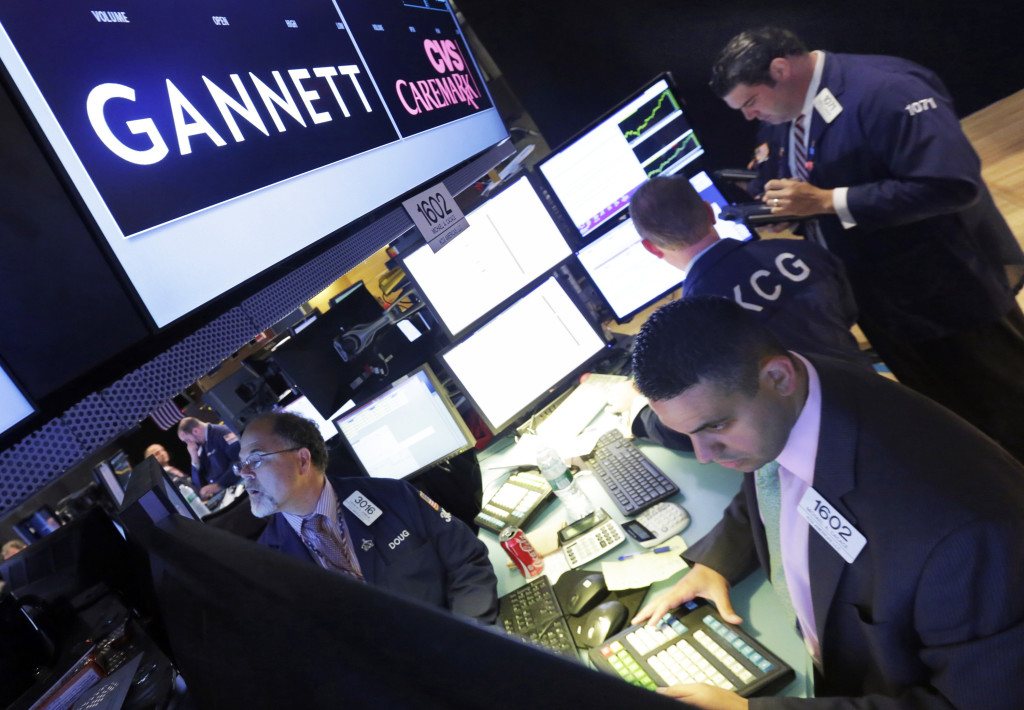

In this Tuesday, Aug. 5, 2014, file photo, specialist Michael Cacace, foreground right, works at the post that handles Gannett, on the floor of the New York Stock Exchange. Gannett reports financial results on Wednesday, April 27, 2016. AP FILE PHOTO

MANILA, Philippines — Asian stocks were mostly up Tuesday, with Australia’s S&P ASX 200 index making solid gains after the Australian central bank cut interest rates and following the rise in U.S. stock indexes, recovering some of last week’s steep declines.

KEEPING SCORE: Australia’s S&P/ASX 200 rose 2.1 percent to 5,353.80 after the Reserve Bank of Australia lowered the official interest rate by 25 basis points to 1.75 percent effective Wednesday, with RBA Governor Glenn Stevens pointing to lower than expected inflationary pressures, slow but continued global economic growth, and Australia’s trade remaining much lower than in recent years. The Shanghai Composite index was up 1.4 percent at 2,979.54. Hong Kong’s Hang Seng shed 1.1 percent to 20,830.11. South Korea’s KOSPI gained 0.5 percent to 1,987.83. Japan’s stock market is closed for the Golden Week holidays. Southeast Asian markets were mostly higher.

WALL STREET: U.S. stock indexes moved solidly higher Monday afternoon, recovering some of last week’s steep declines. Recently battered technology stocks such as Amazon.com and Microsoft all posted gains, helping end a seven-day losing streak in the Nasdaq composite. The Dow Jones industrial average rose 117.52 points, or 0.7 percent, to 17,891.16. The Standard & Poor’s 500 index added 16.13 points, or 0.8 percent, to 2,081.43 and the Nasdaq rose 42.24 points, or 0.9 percent, to 4,817.59.

THE QUOTE: “The question now is whether the RBA will back this with a further cut this year,” said Chris Weston, chief market strategist of IG in Melbourne, Australia. “Certainly the statement leaves the door open to further easing although it is not sufficiently dovish enough to feel they are going to cut below 1.5 percent anytime soon.”

CHINA’S MANUFACTURING SLOWS: Chinese manufacturing activity weakened further in April despite government stimulus, a survey showed Tuesday, indicating the economy has yet to rebound from a downturn. The Caixin magazine purchasing managers’ index declined to 49.4 from March’s 49.7 on a 100-point scale on which numbers below 50 show activity contracting. It said conditions have worsened in each of the past 14 months. Beijing has tried to shore up slowing economic growth by boosting spending on public works projects, expanding credit and easing policies on real estate to encourage purchases. Some indicators improved in March but analysts warned that was unlikely to last.

Article continues after this advertisementENERGY: Benchmark U.S. crude oil rose 44 cents to $45.22 a barrel in electronic trading on the New York Mercantile Exchange. It fell $1.14 to close at $44.78 per barrel on Monday. Brent crude, the international standard, gained 46 cents to $46.29.

Article continues after this advertisementCURRENCIES: The euro rose to $1.1560 from $1.1525 on Monday. The dollar fell to 105.78 yen from 106.45 yen.

RELATED STORIES

How to deal with losses in the stock market

How do presidential elections affect the stock market?