Technology helps ward off loan sharks in PH

About a year ago, Vilma Fortuna, a 50-year-old administrative aide at the city of Manila’s health department, found herself short of cash. At that time, she had a 21-year-old who was still in college and an 11-year-old in the 5th grade. Living on a P12,000 monthly government salary as a single parent, Vilma had no choice but to take out a loan to make ends meet.

Instead of going to the neighborhood loan shark, Vilma applied for an P85,000 salary loan from Land Bank of the Philippines (Landbank) by sending a text message from her Smart prepaid phone and completing the application online. There was no need to go to a Landbank branch to talk to a loan officer and fill out application papers. Within three working days, her loan application was approved and released through her ATM payroll account.

“Maayos at mabilis, wala pong problema, nakuha ko kaagad ‘yung pera. Gumaan na po ang pakiramdam ko, nabawas-bawasan din ang bigat ng problema dahil dito,” Vilma said. (It went well and fast, I did not encounter any problem and I got the money immediately. I felt better, it lessened my problems.)

Vilma’s story is the story of some 36,000 other borrowers who availed of the Landbank Mobile Loan Saver (LMLS), a service developed by leading tech company Voyager Innovations together with the country’s premier government financial institution. The LMLS borrowers were among the early beneficiaries of the next big thing in the Internet—financial technology or “fintech.”

What is fintech?

“Fintech” is the catch-all term for digitally-enabled financial services that allows faster, more convenient and less expensive options for consumers. “Fintech” is also democratizing financial services as these are being made more accessible and relevant to a broader population.

The reinvention of traditional banking and finance through technology is happening globally in services such as credit and lending (like the LMLS), payments, money transfers, investments, microfinance, insurance, and savings.

The prize for financial innovators can be huge. According to The Economist, investment bank Goldman Sachs has estimated potential revenues of $4.7 trillion that “fintech” companies can take away from traditional banking and finance. This kind of opportunity has spawned a slew of “fintech” startups that received $12 billion in investments in 2014, up from only $4 billion in 2013.

Jamie Dimon, JP Morgan Chase CEO and US star banker sounded the alarm in his latest annual letter to shareholders: “Silicon Valley is coming.”

But it is in emerging economies like the Philippines where “fintech” hits closest to home as it addresses day-to-day problems similar to what Vilma faces, like borrowing money for personal emergencies, children’s education, or micro business capital. Sending money to one’s relatives in the province is another emerging market practice that “fintech” is transforming.

Voyager’s affiliate company, PayMaya Philippines (formerly Smart eMoney, Inc.), is the leader in digital financial services, already cornering 30 percent of the more than P300 billion domestic remittance money flow. It also recently introduced PayMaya, an Over-The-Top (OTT) mobile app for digital payments that gives anyone who downloads and registers a virtual Visa for online shopping, money transfers and soon, bills payments. PayMaya is now the most popular app in Google Play Store Philippines, ahead of PayPal and other local services like GCash.

Voyager Innovations also enables cash distribution under the conditional cash transfer (CCT) program, accounting for 56 percent of the CCT flow to deserving poor families in partnership with the National Confederation of Cooperatives (Natcco) and Landbank. It also recently partnered with the International Red Cross and Oxfam to distribute humanitarian aid using the same distribution platform.

“Last year was a breakthrough year for ‘fintech’. In the Philippines, we are marrying the best of online and on ground resources. Rather than disrupting banks and other financial institutions, we are enabling them, resulting in better consumer experience,” said Orlando B. Vea, president and CEO of both Voyager Innovations and PayMaya Philippines.

In its “Global Marketplace Lending: Disruptive Innovation in Financials” report published last May, Morgan Stanley Research Global said “marketplace lending is in lift off” and could exceed $490 billion by 2020.

Philippine consumer lending is fast growing and is ripe for this opportunity. The Bangko Sentral ng Pilipinas (BSP) reported an almost 20 percent increase in consumer loans for the second quarter of 2015, reaching P959.2 billion as compared to the same period in 2014. This robust growth has been sustained since 2008. Salary loans, in particular, saw an 89.6 percent year-on-year increase to P84.6 billion for the second quarter of 2015.

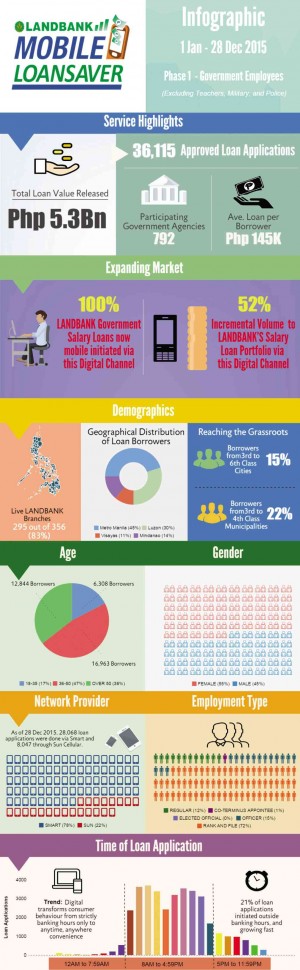

While “fintech”-enabled services still represent a small fraction of the country’s overall salary loan portfolio, the trend points to an acceleration. For 2015, based on data from Voyager Innovations and Landbank, LMLS has processed about P5.3-billion loan releases over a 12-month period. This volume represents 36,115 approved LMLS applications from 792 participating government agencies.

An overwhelming 72 percent of LMLS borrowers were rank-and-file employees. While majority of borrowers were still from Metro Manila (45 percent), LMLS is reaching out to the grassroots in the 3rd to 6th class cities (15 percent) and 3rd to 4th class municipalities (22 percent).

“LMLS is not just about loans; it is also about helping build a culture of good financial stewardship among borrowers. It is also facilitating financial inclusion as borrowers are encouraged to be part of the banking and finance ecosystem. Because it is enabled by ‘fintech’, it has the potential to be very pervasive,” said Lito Villanueva, vice president and head of financial innovations, digital inclusion and alliances at Voyager Innovations.

‘Uber’ of consumer loans

LMLS has attracted global recognition in less than a year of its implementation. It was cited as the Best Innovation in Retail Banking by the International Banker in ceremonies held at the London Stock Exchange. It was also adjudged by the Asian Banking and Finance in Singapore as the Best in Core Banking and the Best in Mobile Banking initiative.

With LMLS validating an acute market need, Voyager Innovations introduced Lendr, the country’s first online marketplace for consumer loans, last November. “It is your Uber of consumer loans,” said Vea.

Through the platform, banks are able to extend their reach while consumers like Vilma can benefit from a more transparent viewing of available loans among lenders. Application, processing and release of loans are made more efficient via mobile phone or other online devices. The service is expected to be available commercially by early 2016.

With encouragement from the BSP, the Rural Bankers Association of the Philippines and the Chamber of Thrift Banks have signed up to collaborate on expanding Lendr among member-banks nationwide. Lendr will also be piloted in key emerging countries in Africa and South Asia next year.

“We’re very excited to see ‘fintech’ innovations scale this new year. Silicon Valley may have their unicorns but it is in emerging economies like ours where it will gain massive traction because it’s where consumers need it most,” said Villanueva.

For consumers like Vilma, the value of “fintech” is as practical as her aspirations. “Ang gusto ko lang para umunlad ay patapusin ko ng pag-aaral ang mga anak ko kaya pagkatapos ng binabayaran ko, kukuha-kuha pa rin ako sa Landbank Mobile Loan Saver,” she said. (What I only want is for my children to graduate. Once I finish paying my current loans, I will continue to borrow under LMLS.)