Volatile 2015 ends stock market’s 6-year bull run

The local stock market closed 2015 on a bearish note, ending a six-year run-up, as investors braced for global headwinds and greater domestic political noise in the coming year.

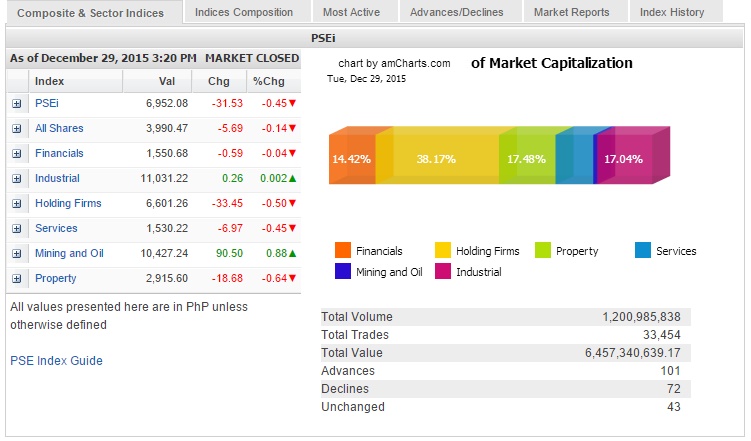

For the full year, the Philippine Stock Exchange index lost a total of 278.49 points or 3.85 percent to close at 6,952.08 on Tuesday, the last trading day. Last year, the PSEi closed at 7,230.57, gaining 22.8 percent.

“We [can] argue that we are in a bear market—a period of sustained declines in share prices,” said Jose Mari Lacson, head of research at local stock brokerage Campos Lanuza & Co.

“We expect this bear market to test the patience of most investors. The bull market of the past five years has been capped with a few large corrections that eventually reversed and gave sustained high returns to investors,” Lacson said.

Apart from external headwinds arising from China’s economic woes and the start of the interest rate liftoff in the US, many investors point to the 2016 presidential election as a domestic source of uncertainties in the coming year.

For its part, the PSE cited key milestones as it held yearend market closing festivities at the trading floor on Tuesday. “All our initiatives in 2015, from the shift in trading engine to our corporate governance projects, are all geared toward the vision of the PSE to be a premiere exchange with world-class standards,” said PSE chief operating officer Roel Refran.

Amid the Wall Street-epicentered global financial crisis, the PSEi bottomed out in 2008 and started to climb in 2009.

On Tuesday, the last trading day of 2015, the PSEi lost 31.53 points or 0.45 percent to close at 6,952.08. The day’s decline was led by the financial, holding firm, services and property counters.

Value turnover stood at P6.46 billion. There were 101 advancers that outnumbered 72 decliners, while 43 stocks were unchanged.

Globe Telecom fell by 4.29 percent as investors priced in the entry of a new telecom challenger in 2016—a prospective team-up by Australian telecom firm Telstra and San Miguel Corp.

GTCAP fell by 2.87 percent while SM Prime, Jollibee and Metrobank all slipped by over 1 percent. PLDT, ALI, SMIC and MPI all declined.

Outside of the PSEi, 2GO slumped by 2.41 percent. It was the day’s most heavily traded stock.

URC, which has a pan-ASEAN (Association of Southeast Asian Nation) footprint, bucked the day’s downturn, gaining by 1.53 percent. BDO, Ayala Corp. and ICTSI both gained modestly.

Investors also scouted for opportunities outside of the PSEi roster. Gaming stock Travellers surged by 10.55 percent while Security Bank, Cirtek and Metro Retail all advanced by over 2 percent.

RELATED STORY