Banks buy star power to reach consumers

Christopher Lao was just a normal law student in 2011. One day, he tried and failed to drive his car though a flooded street and, after complaining on the news that he “was not informed,” became an instant celebrity.

Now a lawyer, Lao said dealing with the online vitriol he received was difficult, but it wasn’t all bad.

In October of the same year, Lao went from cyberbullying victim to commercial model after being hired by Bank of the Philippine Islands (BPI) to endorse the company’s car insurance products.

“Let’s face it, not everybody can say that at one point in his life he has been a commercial model,” said Lao, who admits to still struggling with the trauma to this day.

BPI’s deal with Lao was just the start of a trend in the country’s competitive banking sector, with players starting to discover what dish-soap salesmen and multinational fast food joints have known for decades. In the competitive world of marketing, merely having the best product is no guarantee for success. To get bigger market shares, companies need star power.

Celebrities, big and small, have been cashing in on heightened competition in the banking sector, where players are eager for dominance in the long-neglected retail segment.

“Celebrity endorsers allow a brand to connect better to consumers because they already have a connection with the public,” said EastWest Bank vice president Allan Tumaga, who heads the firm’s marketing and public relations.

EastWest’s current endorser may be impossible to top. Emblazoned on walls and promotional materials in mid-sized lender’s branches is none other than the most popular Filipino on earth, Manny Pacquiao.

“The awareness cuts through because a star immediately gets attention,” Tumbaga, former president and current director of the Bank Marketing Association of the Philippines, said in a recent interview.

Pacquiao—the world’s second-highest-paid athlete—makes a significant part of his income from endorsements deals like the one with EastWest. Globally, he’s one of the faces of Foot Locker and Nike. Struggling computer giant Hewlett Packard (HP) also tried to boost gadget sales using commercials starring Pacquiao. The Filipino boxer collected his checks, but HP’s tablet business was scrapped soon after.

Locally, Pacquiao has endorsement deals with car battery maker Motolite and telecommunication firm Smart Communications. The EastWest deal is his newest one, announced just weeks before his fight with Floyd Mayweather Jr. last May.

EastWest started using celebrity endorsers in 2012, with actor Derek Ramsay signing on as the company’s new face. “This, together with disruptive pricing and compelling product benefits, helped make us No. 4 in auto loans, No. 5 in credit cards and our deposits have been growing by 27 percent since, well above industry average,” Tumbaga said.

The shift toward the retail segment is driven by volatile conditions in financial markets, which have driven down treasury earnings of many banks. Firms intend to offset this decline by extending more car loans, issuing more credit cards and approving more mortgages.

Industry profits rose to a record high in 2013, the banks’ return on equity reached 13.65 percent—a banner year for many local lenders. The year after, yields shrunk, with returns declining to 10.96 percent.

Tumbaga said celebrity endorsements could provide a quick boost in broad awareness to a degree few other marketing tricks can ever hope to match.

Pacquiao isn’t the first Filipino with international clout to help in selling car loans, credit cards, and mortgages. In 2014, another mid-sized lender, Security Bank, named as its first ever endorser 2013 Miss World Megan Young.

Young, whose endorsement deal was recently renewed, started in TV commercials, showcasing what Security Bank said was a superior experience for retail clients. Today, her commercials market a wider range of products for Security Bank—from cash-back credit cards to unified investment trust funds (UITF).

This was part of the bank’s recent shift in focus. Security was known in the past for its strong securities trading business. But with financial markets in turmoil, the bank turned more aggressive in growing its consumer business.

As part of these efforts, Security Bank’s board pirated BPI executive and retail banking veteran Alfonso “Yogi” Salcedo Jr. as its new president and CEO, replacing Alberto Villarosa, who moved up as chair. Last year, Security Bank’s earnings rose by 43 percent, bucking the rest of the industry which posted some 10-percent drop in profit.

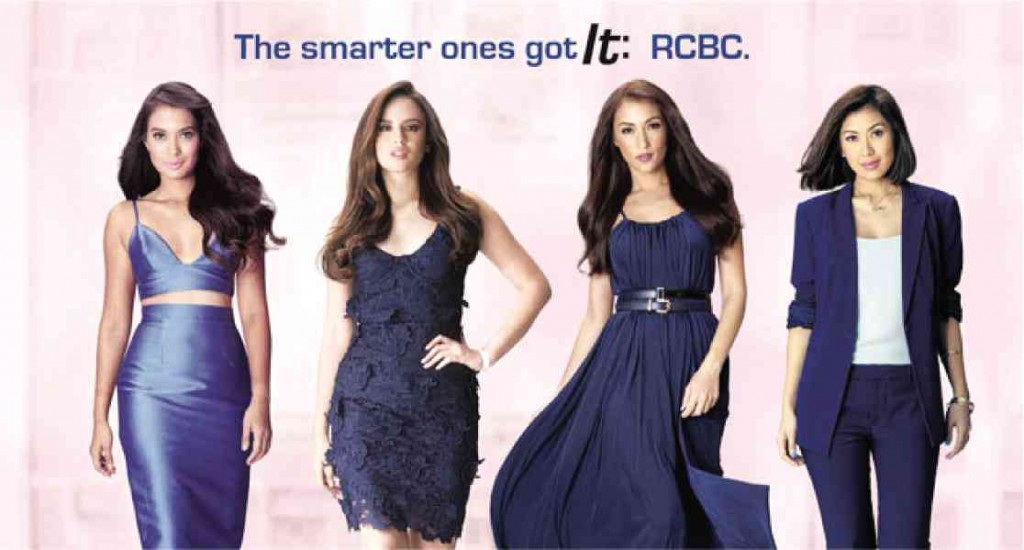

Rizal Commercial Bank Corp. (RCBC) took a more local approach late last year when it recruited Manila’s so-called “It Girls” in efforts to reach a wider audience.

Celebrities’ Solenn Heussaff, Georgina Wilson, Isabelle Daza and Liz Uy—the “It Girls”—had a combined 8.28 million Twitter followers as of July 28th, and RCBC is banking on this fan base to promote its growing list of services for consumers.

RCBC vice president for corporate communications Joee Guilas declined to be interviewed for this story, but in a statement in August 2014, he said the move aimed to “show through the It Girls that customers can rely on us for their major life decisions.”

Among RCBC’s main consumer products, which are offered by subsidiary RCBC Savings, are MyWheels-Auto Loan, MyHome-Housing Loan, MyBiz–SME Loan and MyCash-Personal Loan.

EastWest’s Tumbaga said celebrity endorsements should continue in the years to come. “With the focus on retail banking, the use of celebrities help in quick saliency, quick connection, quick differentiation and providing the efficient communication of our brand values,” he said.