Despite short-term market volatility, long-term outlook remains positive

Having completed its tapering of its liquidity-inducing bond buyback operations, the next step is for the US Fed to actually raise interest rates—currently at near zero levels—to more “normal” levels. While this is seen imminent, the guessing game on the timing has only escalated.

There is also debt-strapped Greece. Although this southeastern European nation is some six thousand miles away from Manila, its inability to pay back last June 30 a $1.73-billion debt to the International Monetary Fund—the same bailout package that had kept it afloat for five years—spooked global financial markets. After all, it was the first developed country to default on an IMF debt and this was the single biggest unsettled repayment in the IMF’s history.

Will it end up exiting the European Union? Amid the uncertainties, the natural reaction would be for investors to seek safer haven by dumping emerging market assets. Investment-grade or not, the Philippines is still part of that basket of emerging markets whose asset classes international investors tend to unload at the slightest excuse.

Whether it’s a risk of an asset bubble bursting in China, a liberalization of China’s external accounts or a recovery seen in the world’s wealthiest economies—US, Japan and Europe—it has become more difficult to compete for funds in an environment where global interest rates are bottoming out.

Internally, the slower-than-expected first-quarter economic growth did not make it any more compelling for investors to look at Philippine equities, which are now trading at very expensive levels compared to regional peers. Philippine stocks are trading at price-to-earnings ratio of 18 to 20 times, which means investors are paying 18 to 20 times the money they expect to make from the market. In the past, investors were willing to buy local stocks at only 14 to 15 times what they expect to make.

Sluggish government spending and weak export earnings curbed first quarter gross domestic product (GDP) growth to 5.2 percent versus the 6.6-percent market consensus. This was the slowest quarterly growth rate seen in the Philippines since 2012. The sustainability of the good-governance-is-good-economics agenda that has been successful in boosting investor confidence since 2010 when President Aquino took office is also a big question mark ahead of the national election next year.

Indeed, a lot of easy money has been made in the last six years. The Philippine Stock Exchange index (PSEi) has been rising since 2009. An investor who was bold enough to pick up PSEi stocks in 2008 when global markets were bludgeoned by the US-epicentered financial crisis would have quadrupled his money by this time.

Last call

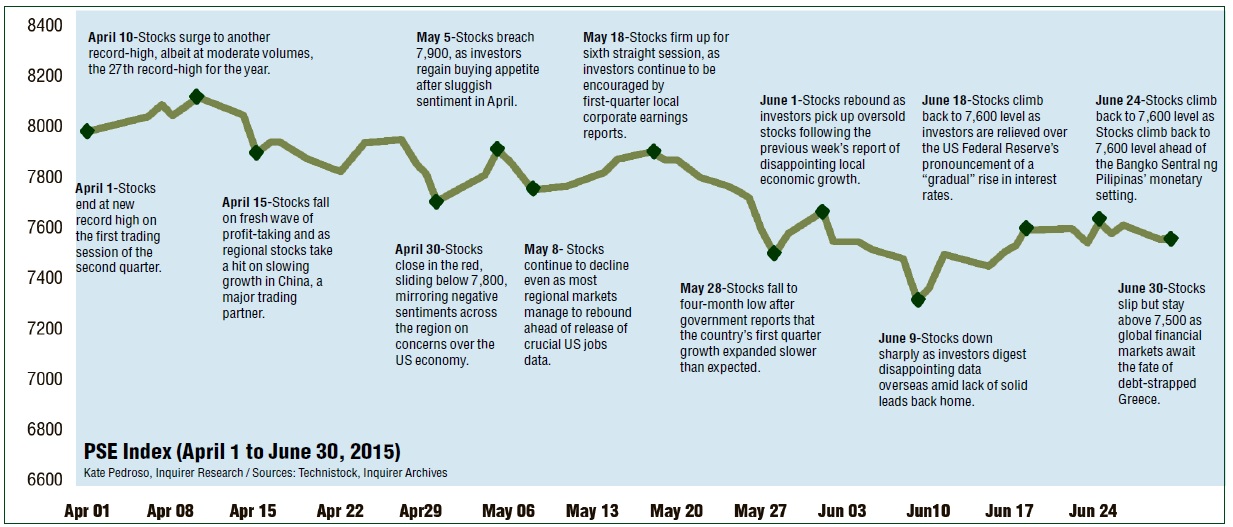

Despite the wave of foreign selling seen by the local market in recent months, stock experts agree that the PSEi will sustain its upswing for the seventh straight year this 2015. It has been a volatile year for the PSEi but in the first semester, the local stock barometer was still ahead by 333.93 points or 4.6 percent from the end-2014 level. The PSEi ended the second quarter at 7,564.50, down by 534.18 points or 6.5 percent from a record finish of 8,089.68 seen last April 7. The highest level hit by the PSEi in intra-day trade in history was 8,136.97 likewise seen on April 7.

If you think of the bull run as one big party, BPI Securities managing director Michaelangelo Oyson estimated that the market was now at 11 to 12 pm, adding though that the party could last to the wee hours. “I’m still of the view that we’re in the last call for happy hour and the elections in 2016 will determine whether we move the happy hour to the main party or we will say that the party is over.”

Oyson said the PSEi was fairly valued at 7,800 but would have the potential to end the year at 8,600. He noted that valuation of corporate earnings were still below their historical peak and the Philippine growth story was still intact.

What the market was seeing now, Oyson said, was a rotation of funds from smaller emerging markets like Indonesia, Thailand and the Philippines into larger markets in North Asia like Japan and China.

Another potential headwind this 2015, Oyson said, would be the potential inclusion of the Chinese markets in the MSCI index. Once markets start factoring in the greater weight for China, this is seen to suck more portfolio flows outside of emerging markets. Recently, however, fears of an asset bubble have bludgeoned Chinese stock markets.

Recurring volatility

In the latest joint research note of First Metro Investment Corp. and the University of Asia and the Pacific, it was predicted that the market turbulence since May this year would likely become a regular occurrence in the interim or until there was an improvement in investors’ confidence improve.

“We argue that the loss in investors’ confidence can be ascribed to the GDP miss, lackluster earnings, and increasing risk of Federal Reserve (Fed) rate hike. Upcoming second quarter 2015 data (GDP and earnings) will be paramount to investors on whether rich valuations can be sustained,” FMIC-UA&P said.

PSE-listed companies grew their net profit by an average 13.9 percent in the first quarter of 2015, led by earnings chalked up by the property and services sectors. Companies in the local stock stock barometer PSEi accounted for 70.4 percent of the net income generated by the overall market. Its 30 constituent blue chips posted a combined profit of P111.41 billion in the first quarter, up by 9.2 percent from the same period a year ago. On the other hand, the consolidated revenues of all listed firms for the January to March 2015 period were marginally higher by 1.6 percent to P1.58 trillion from P1.55 trillion in the same period last year.

Five out of six sectors posted net income growths in the first quarter of 2015, led by the property sector, whose combined profits soared 52.4 percent year-on-year to P27.42 billion. On a revenue basis, four of the six sectors recorded higher revenues, again led by the property sector with a 22.4 percent year-on-year increase.

“Nevertheless, we are strategically constructive on Philippine equities amid the volatile backdrop,” the research note said.

FMIC-UA&P’s yearend index target is 8,300-8,500, which is still seen as viable on the back of sound macroeconomic fundamentals, in turn indicated by low inflation, stable peso and resilient remittances. The research note said that important drivers of growth — particularly household consumption and investments — remained intact, suggesting that full year 2015 GDP growth would be unlikely to deviate from the 6-percent level.

“The recent drop presents an opportunity to increase exposure, but we prefer to wait for tactically more attractive entry points as we see no significant catalysts that can boost the market in the interim. Low liquidity and fragile investors’ confidence may lead to steeper declines,” it warned.

Overweight

For American investment bank JP Morgan, Philippine corporations still offered one of the most attractive earnings in the region. JP Morgan has an “overweight” rating on the Philippines, a suggestion to increase allocation of stocks relative to a benchmark index like the MSCI Global indices. This is the only Southeast Asian country that JP Morgan has an “overweight” recommendation on.

Jakarta-based Aditya Srinath, executive director for equity research at JP Morgan, said Philippines corporate earnings would likely rise by 10-12 percent this year, which means in the given year, one could expect the equity market to rise by the same pace, assuming there wouldn’t be any expansion or compression of price-to-earnings (P/E) multiples.

In the first quarter, the basket of stocks monitored by JP Morgan, which included most of the companies in the PSEi and about 85 percent of listed companies, grew earnings by about 15 percent year-on-year. “So the idea is it could take earnings growth expectation higher rather than lower and that’s unique in the region,” Srinath said.

About 85 percent of Philippine corporations monitored by JP Morgan had either met or exceeded earnings expectations in the first quarter, much higher than the ratio of 60 percent in the fourth quarter. Of total monitored stocks, about a quarter had performed better than expected. But elsewhere in the region, Srinath noted that less than half either met or outperformed expectations. “It’s the worst [performance] you’ve seen in a long time,” he said.

JP Morgan’s upbeat view on Philippine equities also assumed that year-on-year gross domestic product growth would bounce back to 6.5 percent in the next three quarters of 2015 from a disappointing 5.2 percent in the first quarter. Along with expectations of a benign inflation, such macroeconomic growth trajectory is seen supporting an increase in corporate earnings of as much as 12 percent.

On the 2016 election risks, Srinath said: “Ultimately, election risks tend to be very overstated and markets tended to rally quite hard thereafter. Elections don’t have to be one big risk,” noting that there was more compelling reason to stay invested than not ahead of the upcoming elections.

From now until the end of the year, Srinath said there were other multiple headwinds the market should brace for. Aside from the Greek debt woes and the US Fed saga, the liberalization of Chinese external accounts is seen potentially diverting more foreign funds to China’s asset markets.

Onward to 10,000

Jonathan Ravelas, chief strategist at Banco de Oro Unibank said the PSEi might still recover to the 7,800 level by yearend provided that the support level at 7,000 would hold.

In the first quarter when macroeconomic growth turned out disappointing, he said average first-quarter earnings were still good. “Moving forward, the question is if growth in earnings will be sustainable? If you look at it from the perspective of inflation and interest rates, it looks subdued,” Ravelas said.

While some people are not yet convinced that the US Fed will raise rates this year, Ravelas said his team had factored in a 50-basis point increase in interest rate by the US central bank. The BDO research team had also assumed that local inflation rate would normalize at 2 to 2.5 percent.

Ravelas said a lot of people were moving funds to the stock market because low fixed-income returns would simply be eroded by inflation. He said the local inflation rate usually went up during an election year while loan growth slowed. He also cited the threat of another El Niño weather phenomenon (prolonged dry spell) that could threaten food prices.

While a number of key concerns in the horizon seem to be brewing up a “perfect storm” reminiscent of the 1997 crisis, Ravelas said a technical yearend bounce for the stock market coming from the 8,000 levels would still be possible.

The main engines of growth of the economy — business process outsourcing (BPO) and overseas Filipino remittances — were still there, Ravelas said. A likely depreciation of the peso against the dollar, he added, would help perk up consumption spending by overseas Filipino-assisted households.

Overall, Ravelas said there was risk that the PSEi might fall to as low as 6,500 but for the long-term investor, he said it would still be a good time to buy stocks from sectors that would continue to perform well even while the economy was still on the capacity-building stage. These sectors are retailing, food and real estate.

“Over the next one to two years, we’ll go to 10,000,” Ravelas said.