Investors, big or small, split on their views on PH

This was one of the key findings of the sentiment survey conducted by financial services firm Credit Suisse during the 18th Credit Suisse Asian Investment Conference held from March 23 to 27. Around 2,800 participants attended the conference, representing a combined $18 trillion in assets under management.

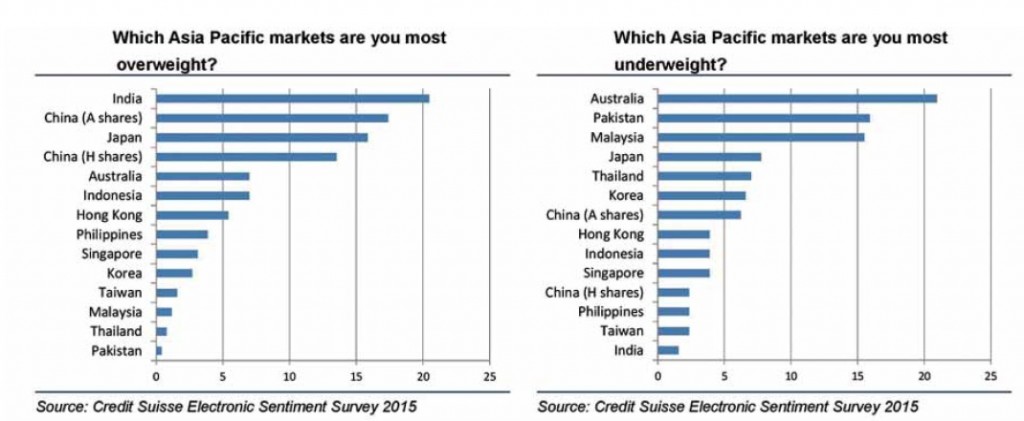

Survey participants were asked to choose their most overweight and underweight country picks in the Asia Pacific. The results showed that Hong Kong, the Philippines, Singapore and Taiwan saw “similar overweight and underweight scores,” which the company said highlighted “the difference in opinion investors have on these countries.”

An “overweight” rating means that the analyst expected the sector’s or the country’s fundamentals to be favorable over the next 12 months. An “underweight” rating, on the other hand, means that the analyst was “cautious” over the sector’s fundamentals or valuation over the same period.

The three countries chosen as the most overweight country picks of the survey participants were China, India and Japan. The three countries accounted for over half of the total votes, same as in 2014.

As for the most underweight, the three countries that received the highest votes were Australia, Pakistan and Malaysia, each receiving over 15 percent of the total votes, according to the Credit Suisse sentiment survey.

Article continues after this advertisementAsia Pacific as a whole is expected to be up by as much as 20 percent this year. More than two-thirds of the conference attendees were upbeat about the region.

Article continues after this advertisementLike last year, the participants of the Asia Investment Conference 2015 were most bullish about Europe, with 45 percent believing that Europe will be the best performing equity market in 2015, followed by 23 percent for Asia outside Japan and 16 percent for the United States.

“Time will tell if they are right, and if this is finally Europe’s year to shine … Europe has indeed had a very strong start to this year,” the report said.

Meanwhile, global geopolitical issues were deemed the biggest risk to the equity markets this year, followed by tightening monetary policy and China’s growth and credit-related risks. Last year, China-related risks were listed as the most prominent concern.

“[This concern] seemed to have tapered off somewhat this year,” the Credit Suisse report said.

The financial services giant added that, perhaps because of these views on geopolitics, just over half of the survey participants expected crude oil to trade between $50 and $80 a barrel by the end of the year, while 45 percent expected the commodity to sell between $25 and $50 by the end-2015.

“Continued supply growth in the United States and instability in the Middle East inevitably render the oil price a difficult and volatile one to forecast,” the report said.

When the participants were asked about the sector in Asia which they feel would perform better than the rest this year, technology emerged as the most liked sector, same as last year.

“Consumer discretionary is the next favorite with consumer staples falling back considerably this year. Unsurprisingly, given the points alluded to earlier on oil, energy is the most underweighted sector. Only 6 percent of those polled chose it as their most overweight sector while a significant 22 percent chose it as their most underweight sector,” the report said.

“Materials was the second least liked sector this year. Gaming was the third most underweighted category, no doubt partly due to the significant pressures Macau faced in the past year.”