Is Europe ready for Greek Crisis 2.0?

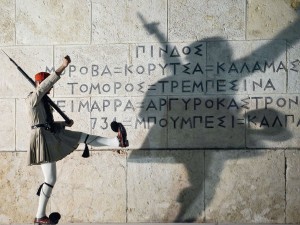

CHANGING OF GUARD A night before election day, a Greek Presidential Evzoni guard prepares for a changing of the guard in front of the Greek parliament in Athens. As Greece heads for a momentous electoral battle that could decide whether it stays in the euro zone, party leaders are scrambling to reassure angry voters they can bank on the single currency. AFP

FRANKFURT, Germany — Talk of Greece crashing out of the euro is back.

And the question of whether Europe can handle another crisis in Greece is heightening financial uncertainty for the currency union just as it is struggling to grow and create jobs.

Some analysts and politicians say Greece 2.0 wouldn’t be as rough on the eurozone as the original Greek crisis and default in 2010-2012. They claim the currency bloc has new safeguards. Most investors seem to agree for now.

Others argue that’s dangerous complacency.

They say the eurozone’s newly installed defenses against financial turmoil aren’t as tough as some think. That means Greek problems could spread to other countries — so that the potential fallout from a Greek debt default or even a euro exit shouldn’t be downplayed. The eurozone’s troubles are big news for the global economy, since it’s a major trade partner for the U.S., Eastern Europe and Asia.

Speculation of a Greek exit intensified Monday after Der Spiegel magazine reported that Germany, the eurozone’s biggest power, was willing to let Greece leave the bloc if the troubled country decides to renege on the terms of its bailout loans. Greece’s left-wing Syriza party is leading in polls ahead of early elections scheduled for Jan. 25. The party has proposed tearing up the agreement under which Greece got bailout loans worth 240 billion euros (currently $286 billion) from other eurozone governments and the International Monetary Fund.

Syriza is riding a wave of popular discontent over the tax increases and cuts to public spending, wages and pensions that were demanded in the bailout deal. Yet Greece still needs financial support to pay its debts. German government spokesman Steffen Seibert said that Germany’s policy “has been to strengthen the eurozone including Greece. This has not changed. ”

Here is a look at the risks involved and what might happen.

Ring fenced

Some experts argue the eurozone has set up new defenses against any financial trouble in Greece.

Those include the European Stability Mechanism, a taxpayer-backed bailout fund that can loan to troubled countries if bond investors won’t. Another is the European Central Bank’s offer to buy the government bonds of countries that get into trouble, a move that would aim to ensure their borrowing rates are affordable.

Holger Schmieding at Berenberg Bank says Syriza and Greece’s creditors are likely to strike some sort of deal. He pegs the possibility of “a major accident,” such as Greece’s exit from the eurozone, at 30 percent.

Even if Greece were to default or leave the euro, the market impact could be contained, he says. “Greek politics pose a threat to Greece itself, but no longer to the stability of the eurozone as a whole.”

So far that’s been the case. Greek stocks and bonds have plunged, but borrowing costs for other heavily indebted countries such as Italy remain low, suggesting investors don’t believe Greece’s troubles will threaten other eurozone members.

Beware

Mujtaba Rahman at Eurasia Group says the eurozone isn’t as protected as some think.

The ECB’s offer to buy a country’s bonds is still facing a legal challenge at the European Court of Justice from opponents in Germany. Meanwhile, ESM money comes with painful conditions that governments may be unwilling to accept. And Europe is vulnerable because of slow growth and the threat of crippling deflation, or falling prices. Italy in particular remains heavily in debt and has passed only limited reforms to make its economy more competitive.

“If anything, Crisis 2.0 could be more severe, precisely because the larger countries that weren’t subject to reform programs in 2010, Italy and France, are much more vulnerable,” Rahman said. “Growth is bad, the inflation outlook is problematic, debt sustainability is an open question. ”

One concern is that one country leaving the euro will show that exit is possible, leading markets to be that others might, too.

Additionally, if Greece left it would earn tax revenues in a new currency that would probably devalue sharply against the euro. That could make it impossible to repay its bailout loans to taxpayers in other countries — not the outcome that eurozone leaders would like to explain at election time.

Exit this way

Polls show Greeks want to remain in the euro. Syriza’s leader Alexis Tsipras also says Greece should stay.

Annika Breidthardt, spokeswoman for the European Union’s executive commission, said Monday the EU treaty doesn’t make allowance for that.

Greece could find itself falling out of the euro by miscalculation. For example, the bailout creditors or Syriza could push too forcefully in their negotiations, leading to loss of financing and a default. Financial market turbulence could lead Greek banks collapse to collapse. Without financial help from outside, it would have to print a new national currency to bail them out.

Either way, Europe is facing a period of uncertainty.

“The political will is there” to keep the euro together, said Alessandro Leipold, chief economist at the Lisbon Council think tank. “But it may show itself in Europe, as usual, only when you’re at the crunch. I don’t think there’s grounds to be too alarmist, but there are certainly risks in saying everything’s in place. ”

“Markets are fickle… These things can change quite rapidly.

RELATED STORIES

Euro lowest in 9 years on eurozone worries, falling oil