Asian stocks dip, Tokyo retreats as BoJ stands pat on policy

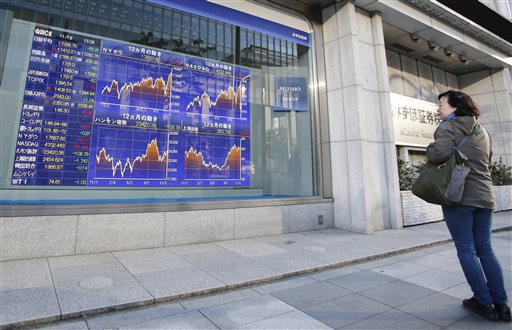

A woman looks at an electronic stock indicator of a securities firm in Tokyo, Wednesday, Nov. 19, 2014. Asian stock markets slipped Wednesday despite record closing highs on Wall Street, with Tokyo stocks retreating after the central bank stood pat on monetary policy even as Japan tipped back into recession. AP PHOTO/SHIZUO KAMBAYASHI

HONG KONG–Asian markets slipped Wednesday despite record closing highs on Wall Street, with Tokyo stocks retreating after the central bank stood pat on monetary policy even as Japan tipped back into recession.

Sydney dropped 0.57 percent, or 30.9 points, to 5,368.8, Shanghai lost 0.22 percent, or 5.38 points, to 2,450.99 and Hong Kong fell 0.66 percent, or 155.86 points, to 23,373.31.

Seoul ended flat, shedding 0.14 points to 1,966.87.

Tokyo shed 0.32 percent, or 55.31 points, to end at 17,288.75 after Bank of Japan policymakers trimmed their inflation expectations but held off fresh monetary easing.

On Tuesday Japanese Prime Minister Shinzo Abe called for early elections to seek a mandate for delaying next year’s sales tax increase, after data showed the Japanese economy was in recession–hammered by a sales tax rise in April.

“Abe’s actions were in line with market expectations, which had been building for several days,” said Eiji Kinouchi, chief technical strategist at Daiwa Securities.

“Historically, the market tends to rise between the time elections are declared and when the vote actually occurs, and foreign investors, importantly, appear to be embracing the decision,” Kinouchi told Dow Jones Newswires.

On Wall Street on Tuesday, the Dow Jones Industrial Average climbed 0.23 percent and the S&P 500 rose 0.51 percent to close at fresh records following solid economic data from Germany and the United States.

Investment sentiment in the eurozone’s biggest economy rebounded in November, a survey showed Tuesday.

After hitting a 22-month low in October, the widely watched investor confidence index calculated by the ZEW economic institute was back in positive territory in November, jumping to 11.5 points from minus 3.6 points the previous month.

The European single currency rose on the upbeat data, trading at $1.2516 and 146.94 yen in Asian afternoon trade from $1.2482 and 145.68 yen late Tuesday.

And in the United States, homebuilder confidence rose by four points to 58, according to the National Association of Home Builders/Wells Fargo Housing Market Index.

The dollar rose to 117.40 yen from 116.83 yen in New York Tuesday afternoon and 116.57 yen in Tokyo earlier Tuesday.

Oil prices were mixed in Asia as dealers predicted that leading producer Saudi Arabia would resist pressure from other OPEC members to cut output in order to prop up falling prices.

US benchmark West Texas Intermediate for December delivery fell 44 cents to $74.17, while Brent crude for January rose eight cents to $78.55 in afternoon trade.

Gold was at $1,200.30 an ounce, compared with $1,202 late Tuesday.

In other markets:

— Mumbai fell 0.46 percent, or 130.44 points, to end at 28,032.85.

Tata Steel dropped 3.08 percent to 471.45 rupees, while Dr. Reddy’s Laboratories rose 2.45 percent to 3,514.85 rupees.

— Bangkok fell 0.24 percent, or 3.72 points, to 1,577.55.

Kasikorn Bank added 2.09 percent to 244 baht, while Siam Cement fell 0.88 percent to 448 baht.

— Malaysia’s main stock index rose 6.01 points, or 0.33 percent, to close at 1,824.39.

Public Bank added 0.22 percent to 18.34 ringgit, Tenaga Nasional gained 0.73 percent to 13.74 while Airasia X lost 7.86 percent to 0.65 ringgit.

— Jakarta ended up 0.50 percent, or 25.46 points, at 5,127.93.

Cigarette maker Gudang Garam gained 2.04 percent to 63,700 rupiah, while retailer Hero Supermarket slipped 1.00 percent to 2,475 rupiah.

— Singapore rose 0.63 percent, or 20.83 points, to 3,334.56.

Agribusiness company Wilmar International gained 0.31 percent to Sg$3.24, while Oversea-Chinese Banking Corporation rose 2.34 percent to Sg$10.50.

— Taipei gained 1.18 percent, or 104.17 points, to 8,963.24.

TSMC rose 3.42 percent to Tw$136.0 while HTC was 1.14 percent higher at Tw$133.5.

— Manila ended flat, edging down 6.17 points to 7,269.49.

Top-traded Megaworld rose 1.61 percent to 5.05 pesos while Philippine Long Distance Telephone shed 0.07 percent to 2,992 pesos.