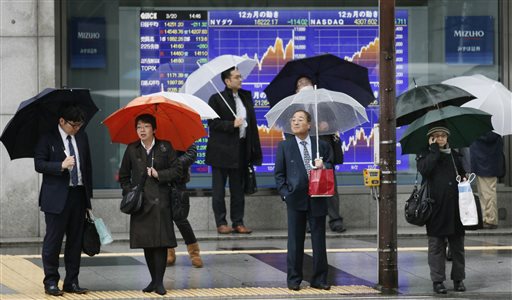

People stand in front of an electronic stock board of a securities firm in Tokyo on March 20, 2014. Asian markets were mostly down Tuesday, March 25, as traders booked profits after the previous day’s rally, while Wall Street provided another negative lead in response to anemic US and Chinese manufacturing data. AP PHOTO/KOJI SASAHARA

HONG KONG—Asian markets were mostly down Tuesday as traders booked profits after the previous day’s rally, while Wall Street provided another negative lead in response to anemic US and Chinese manufacturing data.

But the euro held on to the gains it made against the dollar after an upbeat survey of European factory activity raised hopes for the eurozone, while the Indian rupee hit a seven-month high.

Tokyo slipped 0.36 percent, or 52.11 points, to finish at 14,423.19; Seoul lost 0.22 percent, or 4.30 points, to end at 1,941.25 and Sydney shed 0.19 percent, or 10.3 points, to 5,336.6.

Hong Kong fell 0.51 percent, or 114.13 points, to 21,732.32 but Shanghai closed flat, edging up 1.03 points to 2,067.31.

European and US shares were unable to match Monday’s strong performance from stocks in Asia, where traders saw a fall in Chinese manufacturing activity as possibly pressing Beijing into announcing monetary easing measures.

Regional markets surged despite HSBC’s preliminary purchasing managers index (PMI) for March contracting further and hitting an eight-month low.

In the United States, Markit Economics said an early PMI reading slid to 55.5 in March from 57.1 in February.

A figure above 50 points to growth while anything below suggests contraction.

While the data still suggests expansion, investors were spooked as recent disappointing economic numbers had been blamed on severe winter weather at the start of the year.

The Dow ended 0.16 percent lower, the S&P 500 lost 0.49 percent and the Nasdaq tumbled 1.20 percent.

Earlier, the eurozone composite PMI from Markit Economics came in at 53.2 in March, from 53.3 in February, although traders took heart from a pick-up in output and new orders from France, which had previously been holding back the index.

The figures lifted the euro, helping it to $1.3835 in late New York trade from $1.3800 earlier in the day. In Tokyo on Tuesday the single currency fetched $1.3838.

The euro was also at 141.41 yen against 141.48 yen on Wall Street, while the dollar bought 102.18 yen compared with 102.26 yen.

India’s rupee touched 60.51 to the dollar—its highest since August as hopes grew that a stable and business-friendly government will win upcoming elections, boosting foreign fund inflows.

The unit sank as low as 68.85 later in August owing to a fiscal deficit crisis, waning market confidence and expectations the US Federal Reserve would wind down its stimulus that had been credited with an investment boom in emerging markets.

Oil prices edged up. New York’s main contract, West Texas Intermediate for May delivery, rose 15 cents to $99.75 a barrel in afternoon trade, and Brent North Sea crude for May gained five cents to $106.86.

Gold fetched $1,313.10 an ounce at 0810 GMT compared with $1,322.65 late Monday.

In other markets:

— Taipei rose 0.98 percent, or 83.92 points, to 8,689.30.

Taiwan Semiconductor Manufacturing Co. was 0.89 percent higher at Tw$113.5 while Cathay Financial Holdings added 1.49 percent to Tw$44.3.

— Wellington advanced 0.24 percent, or 12.08 points, to 5,130.69.

Telecom eased 0.62 percent to NZ$2.39 while Contact Energy rose 1.34 percent to NZ$5.29.

— Manila fell 1.00 percent, or 64.33 points, to 6,336.34.

BDO Unibank was unchanged at 83.10 pesos while Philippine Long Distance Telephone eased 0.15 percent to 2,704 pesos.

— Mumbai ended nearly unchanged at 22,055.21 points.

Dish TV India rose 6.24 percent or 3.05 rupees to 51.95 rupees, and Apollo Tyres gained 5.87 percent or 8.70 rupees to 156.80 rupees.

— Bangkok added 0.30 percent, or 4.11 points, to 1,354.01.

Oil company PTT gained 2.79 percent to 295 baht, while telecoms company True Corporation rose 2.22 percent to 6.90 baht.

— Jakarta ended down 0.37 percent, or 17.33 points, at 4,703.09.

Palmoil producer Astra Agro Lestari fell 5.32 percent to 24,925 rupiah, while food manufacturer Indofood Sukses Makmur lost 0.35 to 7,025 rupiah.

— Singapore closed down 0.25 percent, or 7.66 points, at 3,104.17.

United Overseas Bank eased 0.53 percent to Sg$20.76 while oil rig maker Keppel Corp. gained 0.47 percent to Sg$10.66.

— Kuala Lumpur’s main stock index gained 0.18 percent, or 3.32 points, to 1,837.17.

Plantation giant Sime Darby added 0.4 percent to 9.27 ringgit, while Telekom Malaysia rose 2.4 percent to 6.11. RHB Capital lost 0.1 percent to 8.29 ringgit.