PSEi firms up over US economy forecast, upbeat China trade

MANILA, Philippines — The local stock market firmed up for the sixth session on Wednesday, albeit on a very modest pace, on a benign economic outlook by the US Federal Reserve’s new chief and an upbeat China trade data.

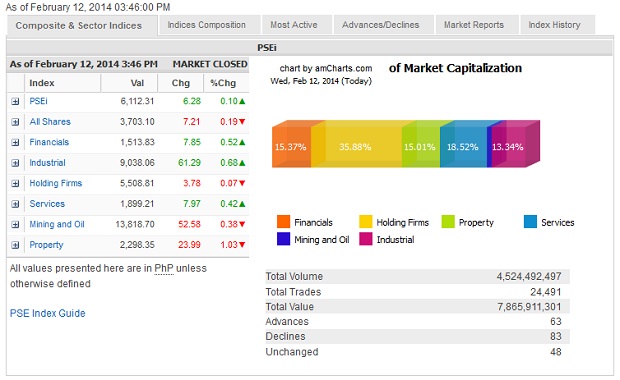

The local stock barometer added 6.28 points or 0.1 percent to close at 6,112.31.

Sentiment was mixed across counters, with the gains eked out by the financial, industrial and services counters making up for the slack in holding firms, mining/oil and property counters.

Across the region, risk appetite was boosted by US Federal Reserve chief Janet Yellen’s testimony before the US Congress, during which she reaffirmed a “measured” tapering of the Fed’s bond buying operations. Her benign outlook spurred a 1.22 percent or 192.98-basis point rally by the closely-tracked Dow Jones Industrial Index on Tuesday that in turn lifted regional markets on Wednesday.

Adding to the favorable backdrop in Asian trading was a surprise growth in China’s January imports to a six-month high. Chinese exports handily beat expectations in January, rising 10.6 percent from a year earlier, while imports jumped 10 percent, leaving the country with a trade surplus of $31.9 billion for the month.

The PSEi’s gains were led by Megaworld (+3.46 percent) and URC (+2.16 percent) while Metrobank, DMCI and GTCAP gained by over 1 percent. SMIC, PLDT, BDO, AEV, BPI and EDC also contributed to the day’s gains.

Outside of index stocks, Puregold (0.85 percent) and Emperador (+1.04 percent) rose in heavy volume on a consumer play.

On the other hand, the PSEi’s gains for the day were tempered by the decline by LTG (-3.57 percent) and SMPH (-2.21 percent). AC (-0.18 percent) was likewise modestly lower.

Robinsons Retail (-2.97 percent) also slipped on profit-taking.