Dow, S&P 500 close at record highs

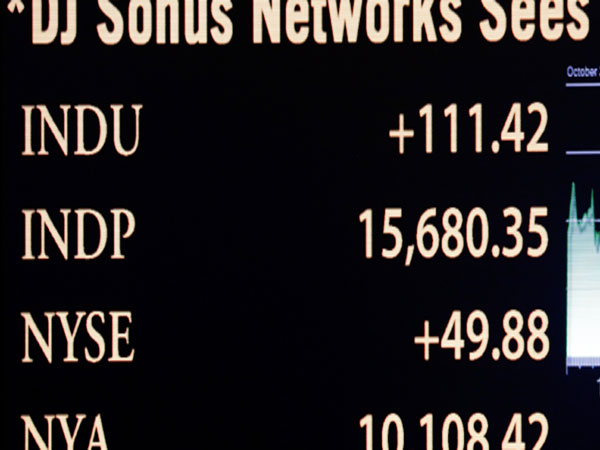

A board on the floor of the New York Stock Exchange shows the record closing number for the Dow Jones industrial average, Tuesday, Oct. 29, 2013. AP

NEW YORK CITY—The Dow and S&P 500 closed at fresh all-time highs Tuesday, a day before a US Federal Reserve decision that is expected to maintain its aggressive monetary stimulus.

The Dow Jones Industrial Average rose 111.42 points (0.72 percent) to 15,680.35, while the S&P 500-stock index jumped 9.84 (0.56 percent) to 1,771.95.

The Nasdaq Composite Index also closed higher, up 12.21 (0.31 percent) at 3,952.34.

The gains came on the heels of a trove of largely mediocre economic data that is seen as boosting the chances the Fed will wrap up a two-day meeting Wednesday announcing it will keep unchanged its $85 billion per month bond-buying program.

Economic data showed a 0.1 percent fall in retail sales and a 0.1 percent drop in producer prices, indicating weak inflation, in September. Home prices rose 12.8 percent year-on-year rise in August, but the monthly gains were slowing.

Article continues after this advertisementUS consumer confidence plummeted to 71.2 in October from 80.2 the previous month, reflecting worries about the Washington budget and debt ceiling battle that partially closed the federal government for 16 days.

Article continues after this advertisement“The Fed has been pretty clear about making decisions dependant on data and the data the Fed has received since the last meeting have certainly not been upbeat,” said Art Hogan, head of product strategy equity research at Lazard Capital Markets.

“So therefore making a move towards tapering would be difficult to explain.”

The Dow got a boost from solid earnings from Pfizer, up 1.7 percent, and IBM’s announcement of a $15 billion additional share buyback program that lifted the technology company’s shares by 2.7 percent.

Other big gains on the Dow were posted by AT&T (+2.0 percent), Home Depot (+1.9 percent) and Procter & Gamble (+1.4 percent). Within the Nasdaq, outperformers included Google (+ 2.1 percent) and eBay (+2.6 percent).

Tech giant Apple fell 2.5 percent. While fiscal fourth-quarter earnings exceeded expectations by 33 cents at $8.26 per share, the company’s gross margin narrowed to 37 percent from 40 percent a year ago. “Shares finished lower as the company’s 1Q gross margin guidance had a midpoint that was below expectations,” Charles Schwab & Co. said in a market note.

Bank of America declined 0.6 percent after Fitch fingered the banking giant as the most exposed to a large settlement with the Federal Housing Finance Agency after rival JPMorgan Chase last week agreed to a $5.1 billion settlement to resolve charges it overstated the quality of mortgages and mortgage-backed securities it sold to Freddie Mac and Fannie Mae.

Bank of America could end up paying $5-$8 billion, Fitch said.

The yield on the 10-year US Treasury held steady at 2.51 percent, the same level as Monday, while the 30-year rose to 3.62 percent from 3.60 percent. Bond prices and yields move inversely.