PH to be affected by US default

The global economy faces dire consequences rivaling the effects of the 2007 global financial crisis if the US government fails to raise its debt ceiling and default on some of its loans by the Oct. 17 deadline.

While the Philippine economy remains structurally strong compared to other emerging markets around the world, no one will be spared from a possible meltdown if the United States, the world’s most reliable borrower, misses a loan payment.

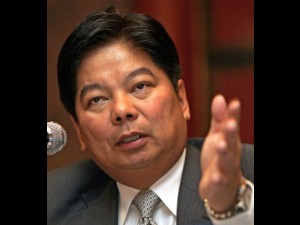

“Both policymakers and business leaders are getting more concerned about the possibility of a failure of the US Congress to reach a consensus,” Bangko Sentral ng Pilipinas Governor Amando M. Tetangco Jr. said Monday.

“The implications can be serious and can lead to dire consequences,” he said.

The possibility of the US defaulting on its loans seems more likely now due to the ongoing shutdown of the federal government, which stemmed from the failure of the US government to pass legislation that would have funded various state services.

The US Senate controlled by allies of President Obama and the House of Representatives—dominated by the chief executive’s opponents—have been at odds over the government’s budget since last week.

On Oct. 17, the US government will reach its legal borrowing limit, known as its “debt ceiling.” Should the US Congress fail to raise that ceiling, the world’s largest economy will not be able to service maturing obligations.

Bert Hofman, World Bank chief economist for East Asia and the Pacific, said a US default would be unprecedented and “and it would be hard to predict what would happen.”

Since the US enjoys the privilege of having the dollar, the world’s most liquid unit and therefore the default reserve currency for most countries, the US government’s debt is considered risk-free. A default would undermine the creditworthiness of the US.

“It’s possible that credit markets could freeze, the US dollar can plummet and interest rates could skyrocket,” BSP’s Tetangco said. “It will have negative spillover effects on the rest of the world, but we are still hopeful that this will be resolved soon.”

Tetangco said higher interest rates could send the global economy back into recession, “just like what happened in 2007” following the burst of the US subprime housing bubble that started the global financial crisis.

Tetangco stressed that the Philippines has sources of strength that would allow it to ride out any global crisis better than most of its neighbors.

For instance, the country’s external debt stock went down to 22.8 percent of gross domestic product (GDP) at the end of the first quarter from 26.9 percent last year. The country’s external debt service ratio, or the ratio of debt payments to income from exports and services, improved to 7.8 percent as of March from 9.4 percent a year ago, BSP data showed. The BSP said this was well below the international benchmark of 20 percent, reflecting the “sufficiency of foreign exchange (income) to meet maturing obligations.”