Bulls take a break as PH stocks get repriced

After outperforming all expectations this year, the law of gravity has finally caught up with high-flying local equities. AFP FILE PHOTO

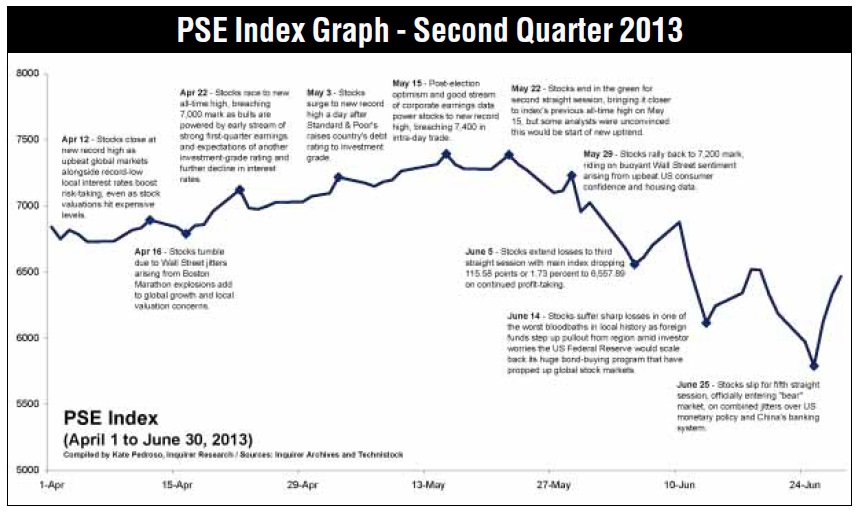

MANILA, Philippines—After outperforming all expectations this year, the law of gravity has finally caught up with high-flying local equities. All it took was for US Federal Reserve chair Ben Bernanke to signal the tapering of an aggressive monetary stimulus that had inflated emerging market assets to temper the bulls that have lorded it over the local market in the last four years.

The good news is that nothing has changed in the country’s rosy underlying fundamentals and these, in turn, support a bright local corporate earnings outlook. In fact, many institutions—local and foreign—see the Philippines standing out if and when the US Fed finally ends its liquidity-inducing, bond-buying activities often referred to as quantitative easing (QE).

Experts agreed that with valuations now off dizzying heights, conventional wisdom suggested that the recent shakeout in the Philippine stock market could only be good because it eliminated the weak hands and offered investors a chance to enter the market at a cheaper level—opening up a new window of opportunity especially to those who were not able to ride the earlier run-up.

But in the painful process of taking out the froth, volatility is seen remaining. Most of the good news have been priced in, including the play on the Philippine government’s newly minted investment grade status and fastest economic growth posted in Asia in the first quarter, while concerns on valuations have escalated. In the recent past, a surge in both liquidity and confidence made valuation metrics less reliable in predicting market movements especially as the main index became bolder in conquering uncharted territory. Now, being more discerning is the name of the game.

In end-June when the main index ventured into bear territory alongside the slump in other asset classes, Bangko Sentral ng Pilipinas Governor Amando Tetangco Jr. said it best when he described such price action was a good thing. “It is good because it helps put a brake somehow on the exuberance, and thereby help reduce some of the risks from bubble formation in certain asset classes that could lead to more financial market imbalances,” Tetangco said.

Article continues after this advertisement“Have the movements been excessive? Well, rather than answering that question, I would say, the recent market movement can help separate the ‘wheat’ from the ‘chaff’—or to those who enjoy a good glass of beer, help raise the ‘head’ to the top of the glass. When these separations are completed, the process could actually create opportunities for those who keep their eye on the ball,” the BSP chief said.

Article continues after this advertisementTetangco said that Philippine fundamentals were intact with the positive convergence of high growth and low inflation. Besides, the banking system is sound, external position is robust, liquidity conditions are adequate and credit growth is healthy.

One major factor seen by market players as favoring equities is the tightening of rules on the BSP’s special deposit accounts (SDAs), which will free up additional domestic liquidity that may find its way into the stock market in the same way as the US Fed’s three phases of QE earlier trickled into emerging market assets.

Trend reversal?

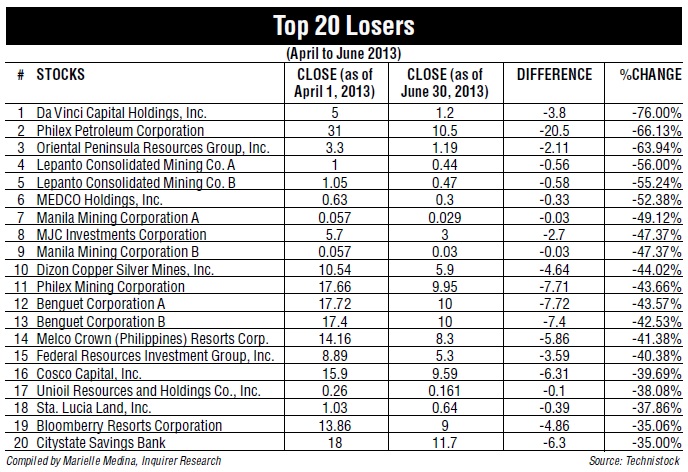

On June 25, the local stock market technically slipped into “bear” territory after falling by more than 20 percent from the peak of about 7,400 in mid-May. Although the index briefly touched that fragile territory, trading volume has declined since then, thereby making subsequent rebounds—including those after President Aquino’s State-of-the-Nation address—lacking in conviction.

“At the moment, the present rally from the recent low of 5,678 is best labelled as a technical rebound. This normally could be between a 20-25 percent rise or roughly between 6,800 and 7,000 levels,” said Banco de Oro Unibank chief strategist Jonathan Ravelas. “So if prices were to move above 7,000, the bulls are again in control.”

By year’s end, Ravelas said he expected the index closing at 6,500 to 6,800 levels, adding that the retesting of historical highs might have to wait until the first half of 2014.

Manny Cruz, chief strategist at Asiasec Equities Inc., said the nearing “ghost month” (Aug. 7 to Sept. 4) was resulting in meager value turnover. Cruz sees the local stock market bottoming out by September and consolidating in October before retesting 7,000 by yearend.

The “ghost month” refers to the seventh month of the Chinese lunar calendar, during which many Asian investors refrain from getting into big-ticket purchases, usually resulting in thinner trading volumes in the stock market. This also coincides with the peak of the summer holiday season in the West when many fund managers take a long vacation break.

Only when market rebounds on the back of bigger volumes—for instance, a daily value turnover of P9 billion to P10 billion, would be convincing that the bulls were back in play, Cruz said.

But for Ismael Cruz, president of IGC Securities, the Philippines was not in a bear market. “From a peak of 7,404 last May 15 we fell to 5,789 or 22 percent only for one day. Since then, we have rallied back to 6,800 or 17 percent,” Cruz said. “The bull run is intact and I forecast 7,200 by end-2013.”

Alex Pomento, head of research at Macquarie Philippines, is also upbeat on a recovery toward the 7,100 level by the year’s end.

“The Philippines is the sole Asean (Association of Southeast Asian Nations) country still on an economic upgrade cycle. The economy and corporate earnings should accelerate going to the second half of (President Aquino’s) term. We remain confident in our index target of 7,100 in the second half of 2013,” he said.

Pomento said corporate earnings would continue to be driven by sunrise industries—gaming, housing, infrastructure and tourism. “This will allow corporate earnings to grow at 15 percent CAGR (compounded annual growth rate) over three years on GDP (gross domestic product) growth of 7 percent a year,” he said.

Michael Gerard Enriquez, chief investment officer at the Philippine unit of global insurance giant Sun Life of Canada, said strong fundamentals should eventually regain focus as markets fully factor in the US Fed’s QE tapering.

Sun Life sees local corporate earnings rising an average 12-15 percent this year, but Enriquez said that if second-quarter results turned out better than expected, his firm could upgrade projected earnings growth to 16 percent.

At the recent bottom of close to 5,800, Enriquez estimated that investors were willing to tolerate a price-to-earnings (P/E) ratio of 15x compared to a high of 22x when the index peaked at about 7,400.

Philippine stocks have historically traded at a P/E ratio of 15x, but Enriquez said that given the current fundamentals, a higher valuation of 17x to 18x would be “justified.”

Standout

The emerging market backdrop does not bring good tidings but investors who are turning more selective are turning to the Philippines.

In a July 8 report, UBS global equities strategist Nicholas Smithie upgraded the Philippines to an overweight position, a recommendation to increase exposure relative to the benchmark index.

“Economic growth is strong, as are external balance sheets and, although still not cheap, valuations (18x P/E) look more compelling after the correction,” Smithie said, adding that this overweight position would be funded by taking some funds out of Indonesia, where he said fundamentals continued to deteriorate.

Smithie said he believed that the sharp selloff would prove short-lived and the strong momentum that has lifted the market in the last few years should resume.

“One of the reasons the Philippines has been such a strong market in recent years has been its solid economic growth profile. Against a backdrop of slowing emerging market growth and declining growth estimates, the Philippines is one country bucking the trend,” he said.

UBS expects the Philippine GDP to grow 7 percent for the full year, second only to China in the emerging markets.

Smithie was also positive on local earnings momentum, noting that corporate Philippines had beaten earnings estimates by 5 percent in the first quarter and likewise exceeded consensus estimates in three of the last four quarters.

“Debtopia” is seen as a potential wild card as Philippine interest rates are very low and the economy may be at risk from rising global interest rates. The UBS report said “this is something to watch but for now the Philippines stands in good stead,” noting that the Philippines’ loans-to-deposit ratio and bank credit-to-GDP were less than 100 percent and the economy still had a current account surplus.

If investors would revert to the practice of indiscriminately investing across Asia searching high yield, Asian policymakers would be too slow to normalize their accommodative monetary policies in the absence of market discipline, according to Japanese investment bank Nomura. But if investors would become more discerning, Nomura said they would go for sustainable growth over fast growth and favor countries that pursue structural reforms and unwind the loose macro policies that have fueled credit and property market booms. The Philippines and Taiwan stand out in this low-risk category, followed by Japan, the report said.